- Last year, EuroPacific Growth Fund celebrated its 40th anniversary.

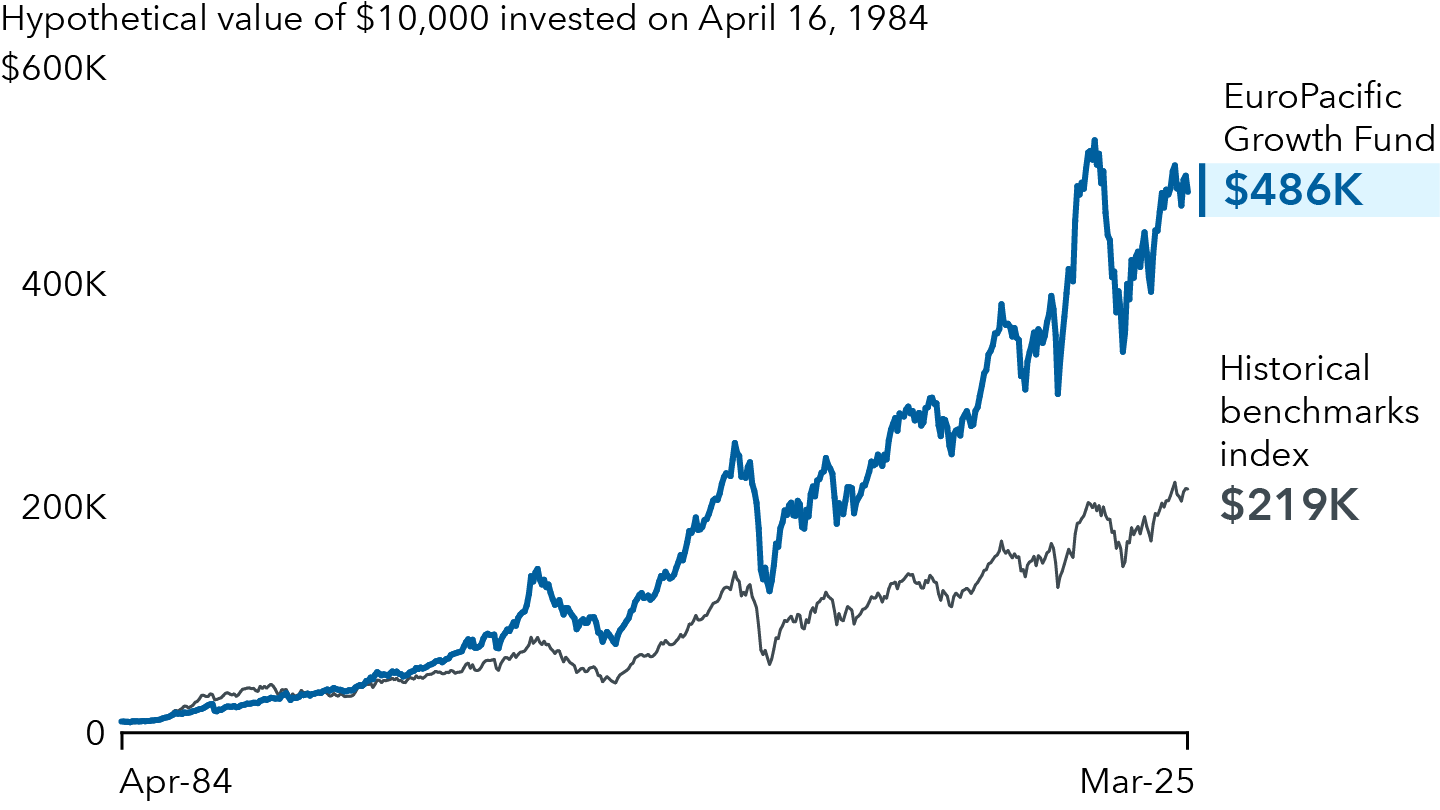

- Through 3/31/25, EuroPacific Growth Fund’s1 lifetime return has beaten both its historical benchmarks index and all funds in the Morningstar Foreign Large Blend, Foreign Large Growth and Foreign Large Value categories with enough history to compare (nine competing funds in total).

- The fund has seen a wide variety of market conditions in its 40+ years, including growth-led markets, value-led markets and a regional bubble in Japan.

- EuroPacific Growth Fund continues to offer a way to gain exposure to international markets that’s backed by deep research with a long-term perspective.

EuroPacific Growth Fund results based on F-2 share class

More than 40 years ago, Capital Group introduced the EuroPacific Growth Fund* with two theories in mind: first, that diversification across markets could help offset volatility in any one of those markets; and second, that U.S. investors could benefit in the long term by looking beyond our borders.

Investing abroad in 1984 wasn’t as convenient as it is today. Few fund managers had the extensive research capabilities to offer a fund built around global investment opportunities. But Capital Group has always prided itself on research capabilities, and in lifetime terms, EuroPacific Growth Fund has outpaced its historical benchmark and funds in Morningstar Foreign Large Blend, Foreign Large Growth and Foreign Large Value categories with enough history to compare (nine competing funds in total).

Here’s a look back at how flexibility and deep research over the past 40+ years has served EuroPacific Growth Fund’s investors.

*Effective June 1, 2025, this fund will be known as EUPAC Fund.

A 40+ year legacy of success

Source: Capital Group. As of 3/31/25. Investment results assume all distributions are reinvested and reflect applicable fees and expenses. Past results are not predictive of results in future periods. EuroPacific Growth Fund's inception date is April 16, 1984.

A history of adapting to changing market environments

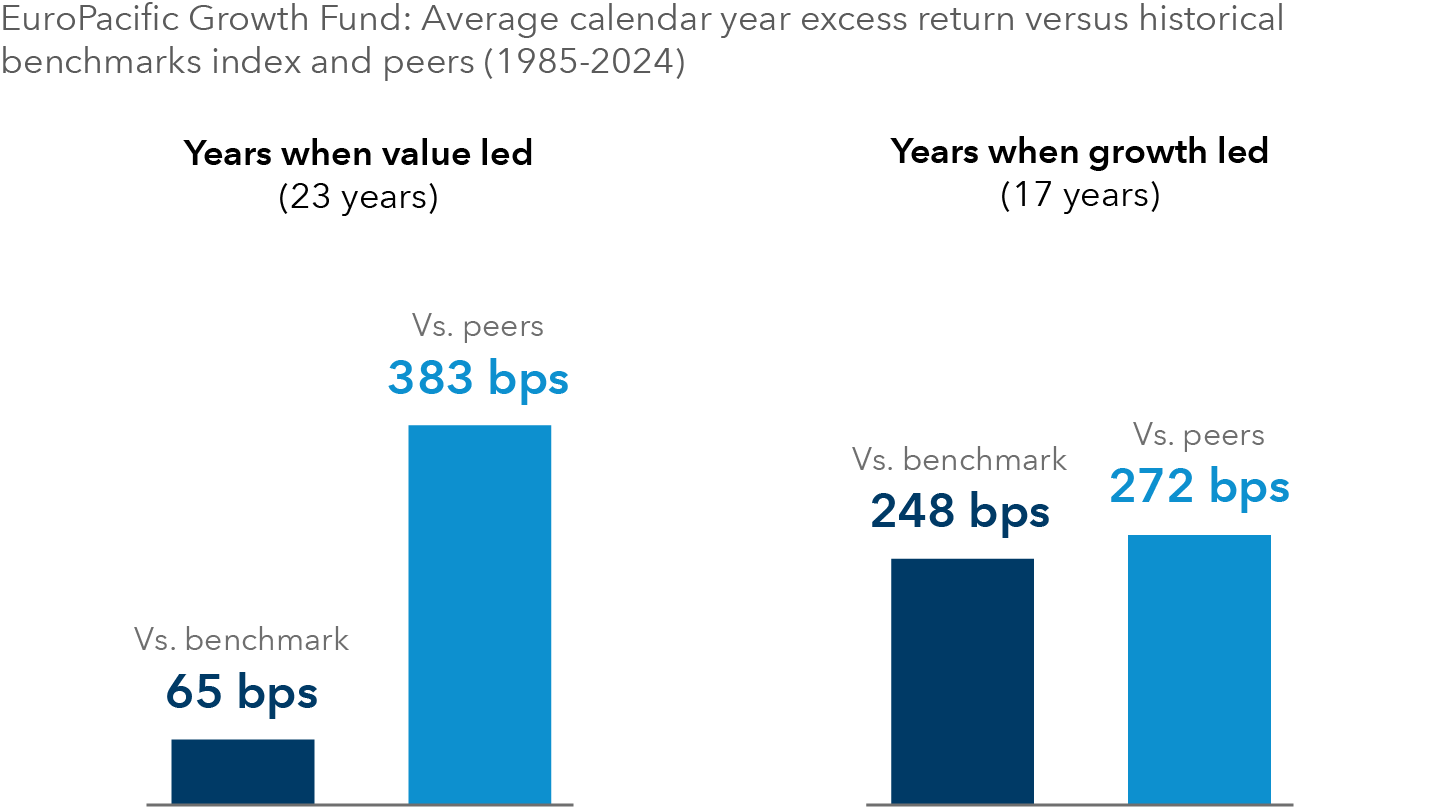

While we maintain a long-term outlook, EuroPacific Growth Fund has flexibility that has allowed us to adjust to changing market environments and, over many periods, stay ahead of EuroPacific Growth Fund Historical Peer Group averages.

For example, across growth-led markets, like during the onset of the internet era in the late 1990s, EuroPacific Growth Fund returned an average of 248 basis points (bps) in excess of the historical benchmarks index and 272 bps more than the EuroPacific Growth Fund Historical Peer Group average.

EuroPacific Growth Fund has held up roughly as well in value-led markets, such as years following the dot-com bubble bursting. Across value-led markets like these, EuroPacific Growth Fund returned an average of 65 bps more than the historical benchmarks index and 383 bps more than the EuroPacific Growth Fund Historical Peer Group average.

A flexible mandate has worked in many conditions

Sources: Capital Group, Morningstar. As of 12/31/24. Returns reflect EuroPacific Growth Fund’s average annual excess returns over the benchmark and peers from January 1, 1985 to December 31, 2024. Years when value led were those in which the MSCI EAFE Value Index’s cumulative return exceeded the MSCI EAFE Growth Index’s cumulative return. Years when growth led were those in which the MSCI EAFE Growth Index’s cumulative return exceeded the MSCI EAFE Value Index’s cumulative return. The peer average reflects the EuroPacific Growth Fund Historical Peer Group average. Class F-2 shares were first offered on August 1, 2008. Class F-2 share results prior to the date of first sale are hypothetical based on the results of the original share class of the fund without a sales charge, adjusted for typical estimated expenses. Refer to capitalgroup.com for more information on specific expense adjustments and the actual dates of first sale.

The fund has also thrived during changes in developed or emerging markets leadership, as determined by the MSCI World ex USA Index and MSCI Emerging Markets Index, respectively. In the 10-year period when emerging markets led developed markets by the widest margin (January 1, 2001 through December 31, 2010, as measured by rolling monthly 10-year periods from MSCI Emerging Market Index’s inception January 1, 1988, through March 31, 2025), EuroPacific Growth Fund outpaced the EuroPacific Growth Fund Historical Benchmarks Index by 210 bps. The EuroPacific Growth Fund Historical Peer Group average for this time was 3.05%, which was 374 bps less than EuroPacific Growth Fund’s return for the period. From January 1, 1994, through December 31, 2003, developed markets had their best 10 years relative to emerging markets, and the fund did even better, beating the EuroPacific Growth Fund Historical Benchmarks Index by 384 bps. The EuroPacific Growth Fund Historical Peer Group average for this time was 1.85%, which was 646 bps less than EuroPacific Growth Fund’s return for the period.

Some people have questioned the ability of large funds to remain successful. EuroPacific Growth Fund has been the largest active fund across Morningstar Foreign Large Blend, Foreign Large Growth and Foreign Large Value categories since July 1991 as measured by assets under management from all share classes on a monthly basis. For the one period measured between July 1, 1991, and March 31, 2025, the fund has beaten its historical benchmarks index and nearly every international fund in Morningstar Foreign Large Blend, Foreign Large Growth and Foreign Large Value categories with enough history to compare (32 competing funds in total).

Since inception through March 31, 2025, it has beaten its historical benchmarks index in 99% of all 10-year rolling monthly periods.

In the past 20 years through March 31, 2025, when the EuroPacific Growth Fund Historical Benchmarks Index has had a positive return, the fund has had a 100% up market capture ratio. When the EuroPacific Growth Fund Historical Benchmarks Index has posted negative returns over that same period, the fund has had a 94% down market capture ratio. In other words, the fund has historically kept up with the historical benchmarks index in good times and provided relative resilience in bad times.

These strong returns over long periods serve as a testament to the rigor of the fund’s investment process and the adaptability of its flexible mandate.

A durable, repeatable investment process

Strong results have benefited our existing shareholders, but new investors can’t buy past results. Instead, investors buy EuroPacific Growth Fund’s process, which we think has been the key to its enduring success.

The fund’s multi-manager structure, a key aspect of The Capital SystemTM, fosters a process that is stable in the near-term while being inherently scalable and repeatable in the long-term. By allowing each portfolio manager to invest in their highest-conviction ideas, the system cultivates a diverse base of experience and decision-making styles.

As portfolio managers come and go, that broad base of experience absorbs the loss of any one individual and smoothly incorporates the ideas of the next person joining the team. This promotes a robust and effective long-term investment process, preserving institutional knowledge and investment approaches that span market cycles.

EuroPacific Growth Fund has successfully replicated this formula for decades, providing a competitive advantage that has been difficult for others to match. The team may change over time, but the process remains consistent.

Short-term challenges don’t disrupt long-term research and outlooks

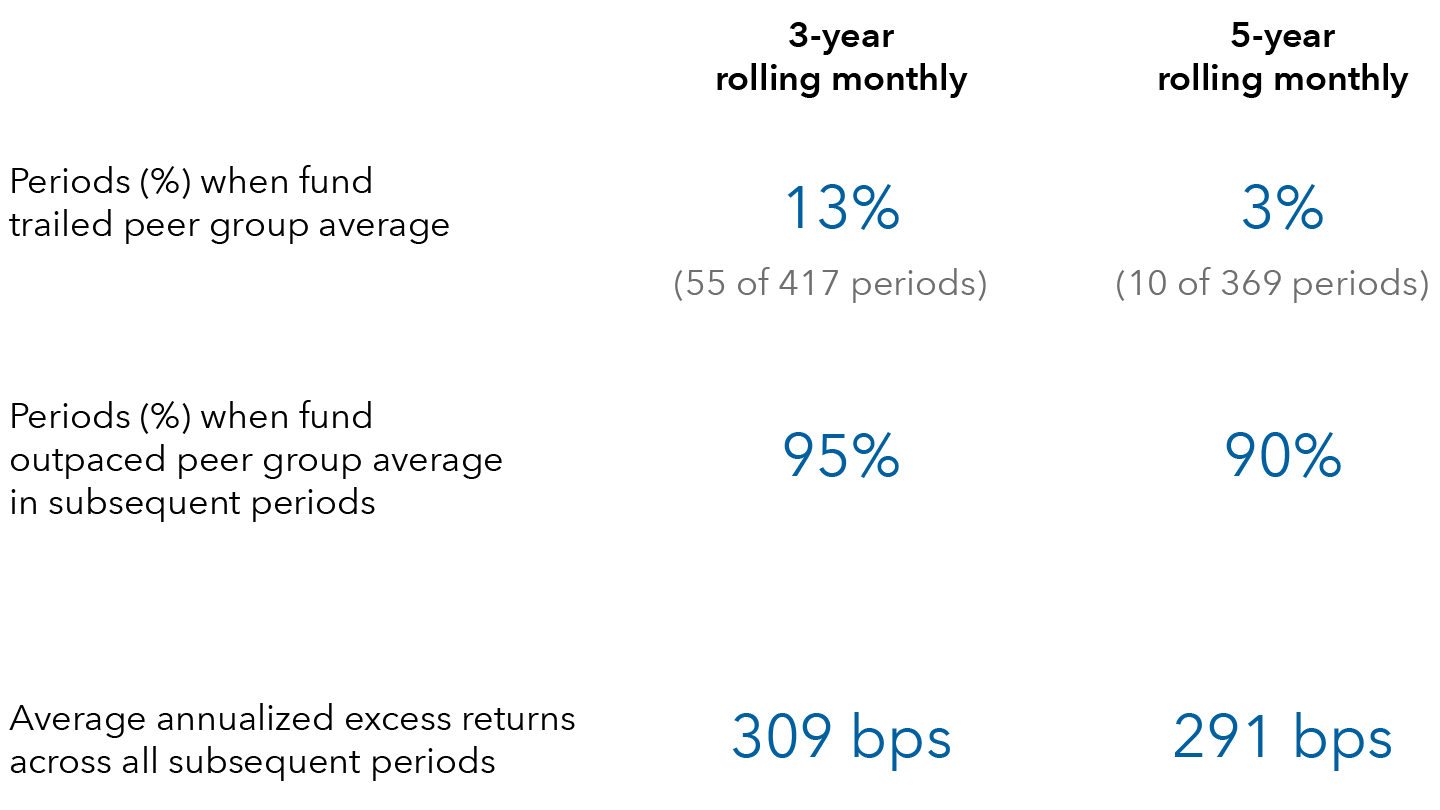

Despite the strength of long-term figures, recent years have presented challenges. The strong value rotation over the past three years has been a headwind to the fund’s results relative to its current benchmark index, the MSCI All Country World Index (ACWI) ex USA. Similarly, EuroPacific Growth Fund tends to avoid U.S. exposure and hold more emerging markets domiciled companies, and both of those factors have hurt results relative to the Foreign Large Growth peer group.

Thankfully, these kinds of lagging periods have historically been rare, brief and followed by much brighter days.

Out of all the fund’s five-year rolling monthly periods (369 periods in total as of 12/31/24), EuroPacific Growth Fund only trailed the EuroPacific Growth Fund Historical Peer Group average 3% of the time. In the periods that followed those 3% of trailing periods, EuroPacific Growth Fund outpaced the EuroPacific Growth Fund Historical Peer Group average 90% of the time. Across all subsequent periods that followed those 3% of trailing periods, including those in which the fund did not outpace the EuroPacific Growth Fund Historical Peer Group average, it still returned an average excess of 291 bps beyond the EuroPacific Growth Fund Historical Peer Group average.

Comparisons against the historical benchmarks index are similar. Since inception, the fund outpaced its historical benchmarks index 90% of the time across five-year rolling monthly periods and 95% of the time across three-year rolling monthly periods.

The fund rarely trailed its peer group and typically outpaced in subsequent periods

Sources: Capital Group, Morningstar. As of 12/31/24. The start date for the results shown is 4/16/84. Fund results are at F-2 shares. “Peer group” here refers to the EuroPacific Growth Fund Historical Morningstar Peer Group average.

The initial years after inception provided a great example of this dynamic in action. EuroPacific Growth Fund’s portfolio managers faced a tough decision in the late ‘80s: Should they invest in soaring Japanese equities at sky-high valuations? The growth of the Japanese equity bubble tempted fund managers with exciting growth, but at expensive prices (as determined by the price-to-earnings ratio).

EuroPacific Growth Fund’s portfolio managers and analysts decided to largely avoid these stocks. After a few years, the markets reflected what our research suggested; these equities were indeed a bubble bound to pop.

In 1989, Japan began to drag international markets while EuroPacific Growth Fund remained relatively steady. For the next five years, EuroPacific Growth Fund would outpace its benchmark by significant margins, including two years in which the fund was nearly flat or in positive territory while the benchmark fell by double-digit percentages.

EuroPacific Growth Fund outpaced MSCI EAFE Index in the years following the Japan bubble bursting

Source: Capital Group. Returns shown are annual total returns for EuroPacific Growth Fund and the MSCI EAFE Index from January 1, 1989, through December 31, 1993.

Looking ahead at the next 40 years

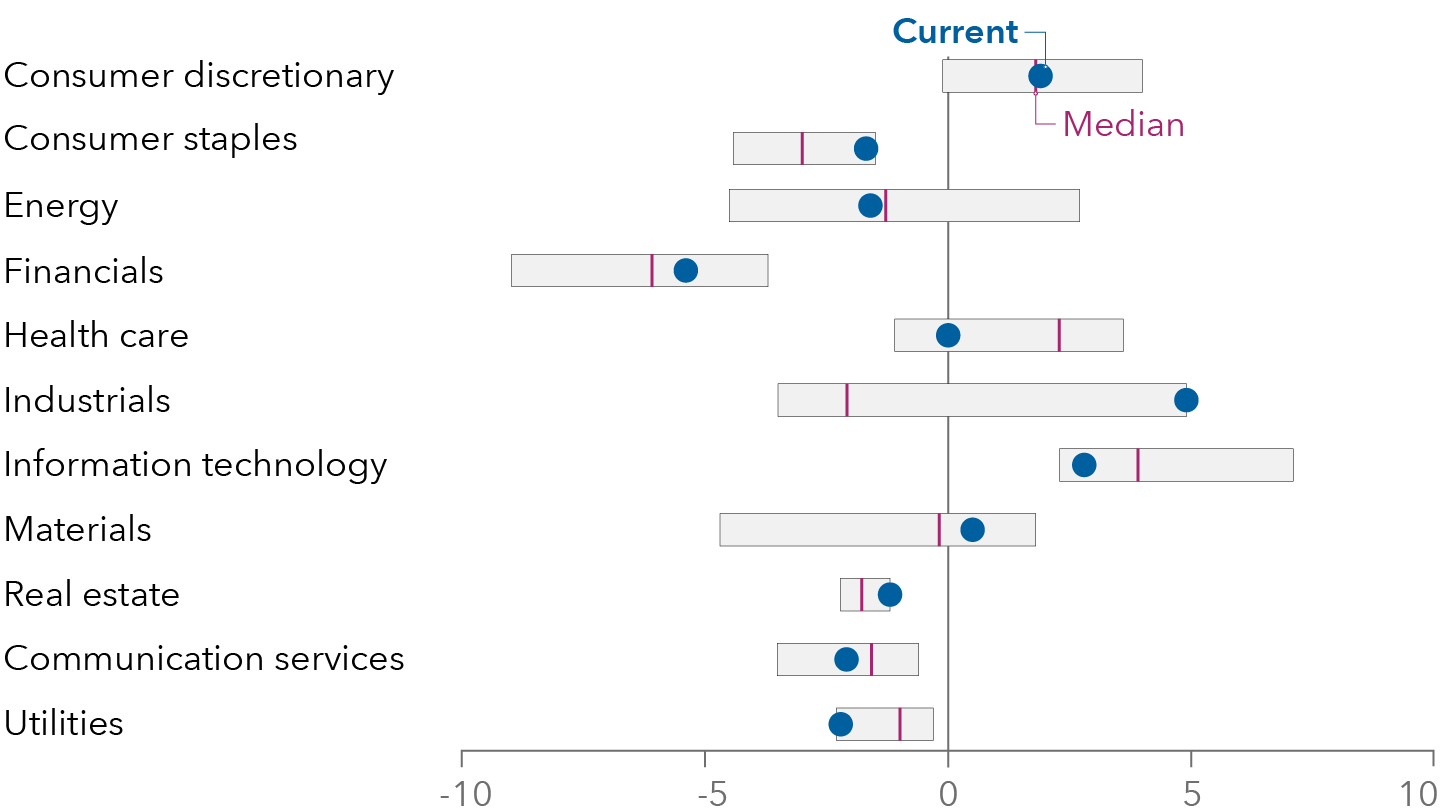

Today, we feel confident that our portfolio’s similarly positioned to benefit from market developments in the coming years.

Take industrials, for example. As little as four years ago, the industrials sector was the fifth-heaviest weight in the portfolio. As of March 31, 2025, it is the second heaviest weight. This reflects the view among some portfolio managers that we could be on the verge of a new industrial renaissance fueled by energy transition efforts, supply chain reshoring and a sharp post-COVID recovery in air travel.

EuroPacific Growth Fund’s flexible approach to investing in attractively valued companies has helped generate strong results in the past 40 years. We expect it to continue to do so in the next 40 years, as we research companies in emerging and developed markets for those that could be positioned to benefit from innovation, global economic growth and increasing consumer demand.

Sector weights over time reflect a changing landscape of potential investment opportunities

EuroPacific Growth Fund’s sector weighting relative to MSCI ACWI ex USA Index (%)

Source: Capital Group. As of 3/31/25. Weights reflect the relative weight of the stocks in EuroPacific Growth Fund vs. MSCI ACWI ex USA Index over the past 10 years. Relative weights over 0 signify that the fund was more concentrated in a given sector than the index, whereas weights under 0 signify that the fund was less concentrated in a sector.

1The statement here refers to results for A, F-1, F-2, F-3, 529A, 529E, 529F-1, 529F-2, 529F-3, R-2E, R-3, R-4, R-5, R-5E and R-6 share classes.