Current forward price-to-earnings (P/E) ratio is a current stock’s price over “predicted” earnings per share. P/E ratios are used to determine the relative value of a company’s shares against similar companies within the same industry or a single company across a period of time. A high P/E ratio may imply that a company’s stock is overvalued or investors are expecting high growth rates in the future.

A passive fund is an investment vehicle with minimal trading, that tracks a market index or a market segment, to determine what to invest in. An actively managed fund or strategy rely on a single fund manager or group of fund managers making investment decisions in an attempt to surpass an index over time.

A factor is a characteristic relating to a group of securities that can help explain their risk and return. Certain factors have historically earned a long-term risk premium and represent exposure to systematic sources of risk.

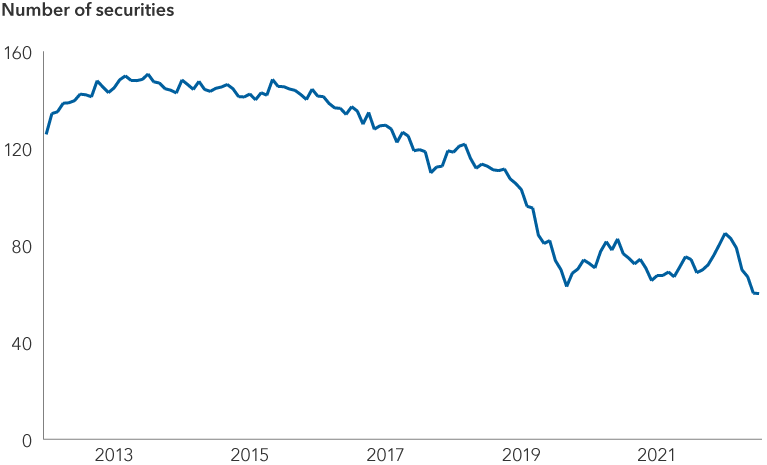

The HHI takes each index constituent’s percentage weight in the index, squares it and sums them up. (The higher the index, the greater the concentration). Taking the inverse of this total gives the “effective number” of constituents.

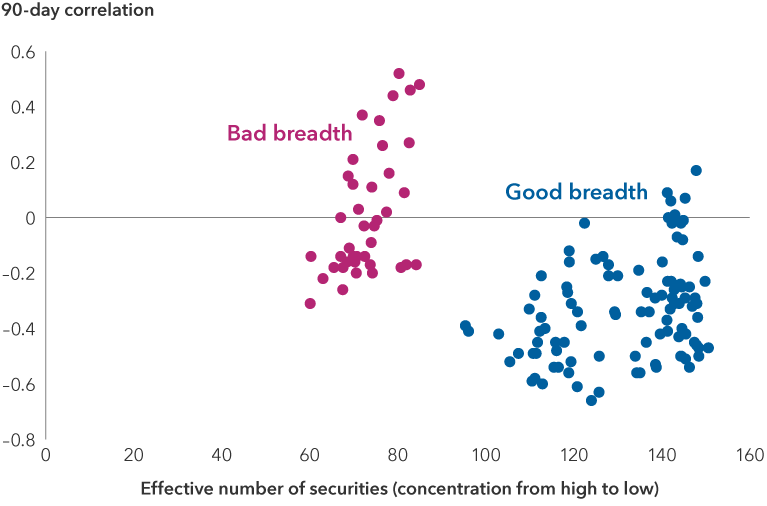

Correlation is a statistical measure of how a security and an index move in relation to each other. A correlation ranges from negative 1 to 1. A positive correlation close to 1 implies that as one moves, either up or down, the other will move in “lockstep,” in the same direction. A negative correlation close to negative1 indicates the two have moved in opposite directions.

In an equal-weighted index or portfolio, securities have the same weight or representation. In a market-weighted portfolio, the market gains or losses affect each security's weighting in the index.

The Bloomberg U.S. Aggregate Index represents the U.S. investment-grade fixed-rate bond market.

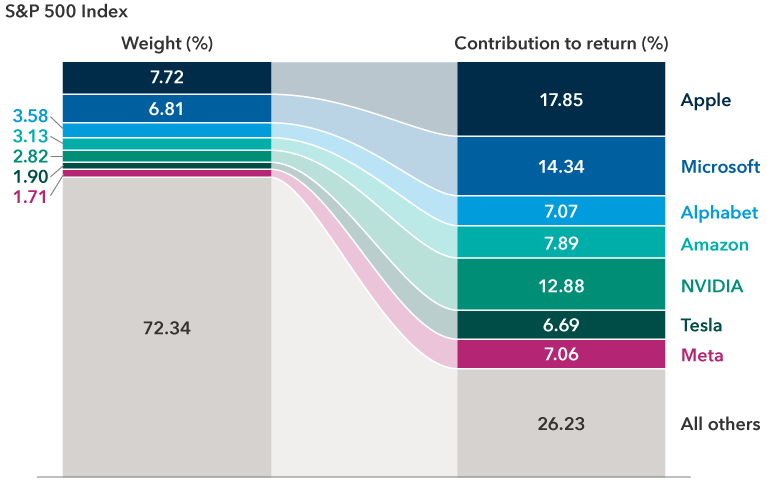

The S&P 500 Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks.