Chart in Focus

Retirement Income

- Estimating your future expenses can help determine how much retirement savings you need.

- A Capital Group survey found that retirees spend less than pre-retirees anticipate spending.

- Studies also show retirees spend efficiently and adjust their spending in retirement.

Nearly all retirement savers worry whether their savings will be enough to support their retirement lifestyle. While a number of factors determine how much one can save for retirement, it is more difficult to accurately predict – and plan for – the total amount of your actual retirement expenses.

To explore how much a person typically spends in retirement, a Capital Group survey asked pre-retirees what their anticipated retirement expenses would be, and how quickly they expected to spend their retirement nest eggs. We then asked a group of retirees what their actual retirement expenses have been, and how much of their savings they had actually spent. The contrast was surprising.

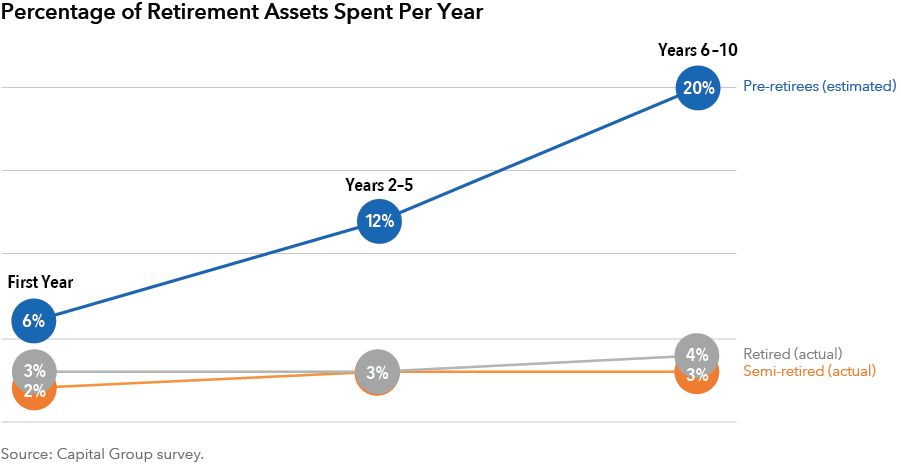

Pre-retirees in the survey expected to rely on their retirement savings once they stop working. They anticipated spending approximately 20% of their savings they’d earmarked for retirement per year by the tenth year of retirement. For actual retirees and semi-retirees, however, it was a different story. By year 10, they had actually spent only about 4% and 3% of their retirement funds per year, respectively.

In his study, “Is Asset Preservation the Guiding Principle behind Retirement Spending,” Sudipto Banerjee, PhD at EBRI found similar results, utilizing data from The University of Michigan’s Health and Retirement Study. For the cohort aged 70-79 years, Banerjee found that non-housing assets were practically unchanged after 10 years, from $53,600 in the first year to $53,000 after 10 years.

It’s important to note that current retirees have a different generational experience than pre-retirees, including a different experience of debt, home ownership and spending. Their actual experience in retirement may be different than that of current retirees.

Retirees spent far less in retirement than expected

Retirees increase their discretionary spending over time

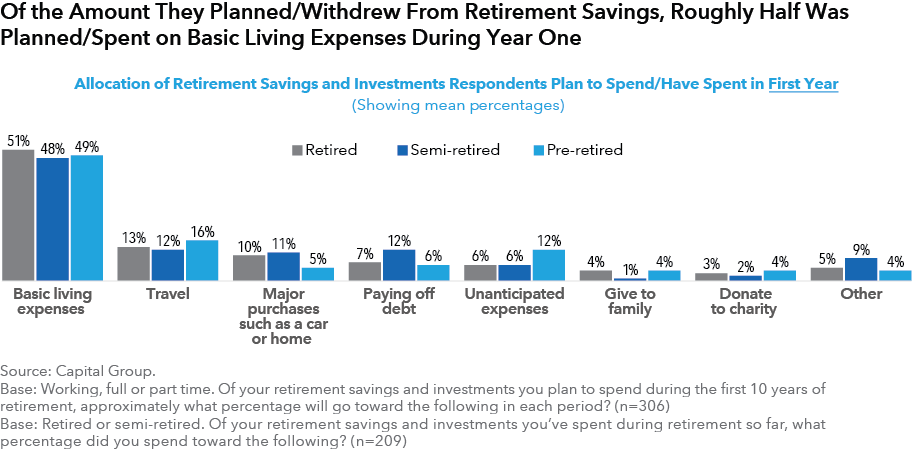

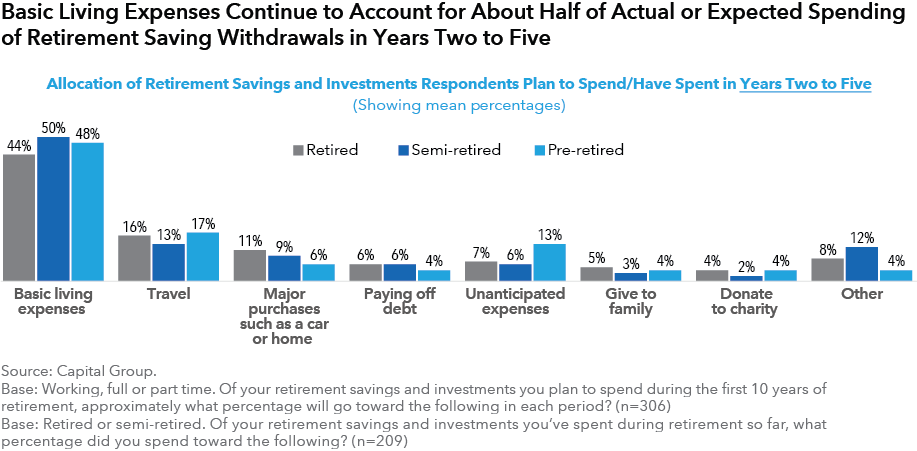

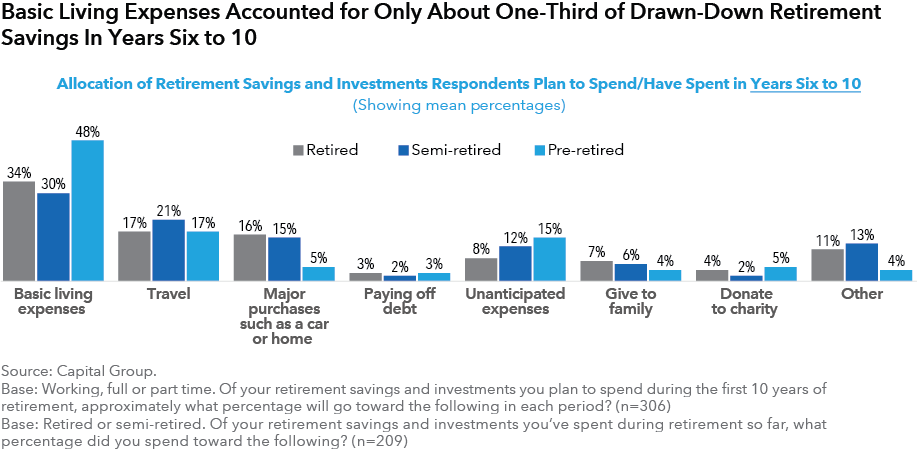

Our survey also indicated some interesting patterns in terms of where retirees spent their money. When we asked survey respondents about expenses by category over one, 2–5 and 6–10 years after retirement, basic living expenses accounted for approximately 50% of year one expenses for both pre-retirees’ estimates and the group of semi-retired and retired respondents’ actual expenses. However, by years six through 10, semi-retired and retired survey respondents had adjusted spending away from basic living expenses to more leisurely/discretionary-oriented consumption. They only spent 30% and 34% of annual expenses on basic living expenses, respectively, while the pre-retired cohort still anticipated basic living expenses to make up 48% of their annual expenses.

In theory, pre-retirees expected to hold spending fairly constant within various categories across time periods. But in reality, semi-retirees and retirees effectively learned how to better allocate their resources to more enjoyable activities.

For example, retired survey respondents increased annual spending on travel from 13% to 17% from year one to years six through 10, while semi-retirees boosted their annual travel spending from 12% to 21% over the same time frame. Retirees also – somewhat counterintuitively – made more major purchases, such as a car or a house, rather than decreasing such spending as they downsized.

These results are consistent with Banerjee’s study, which demonstrates that retirees adjust spending according to their income in retirement. Retirees’ median expenditure to income ratio not only remained below 1.0 over all periods in the Banerjee study (i.e., they spent less than they earned), it was also either constant or decreased over time.

Estimate expenses for a more complete picture of retirement planning

Determining how much to save for retirement can be nerve-racking. Our survey – which measured retirees’ actual spending patterns – can help ease that stress by demonstrating how adept retirees really are at preserving their nest egg and adjusting their retirement spending over time to suit their needs. By utilizing data from our survey and budgeting expenses as retirement approaches, retirement investors can gain a better understanding of what their annual expenses will be in retirement and, thus, how much money they will need to fund it.

Our latest insights

-

-

Economic Indicators

-

Demographics & Culture

-

Emerging Markets

-

Related Insights

-

Retirement Income

-

Retirement Planning

-

Regulation & Legislation

Never miss an insight

The Capital Ideas newsletter delivers weekly insights straight to your inbox.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.

Troy Block

Troy Block

Wesley Phoa

Wesley Phoa