The last time U.S. inflation spiked above 9%, Ronald Reagan was the newly elected president of the United States. IBM was selling its first personal computer using Microsoft software. And stainless steel DeLorean sports cars were rolling off the production line.

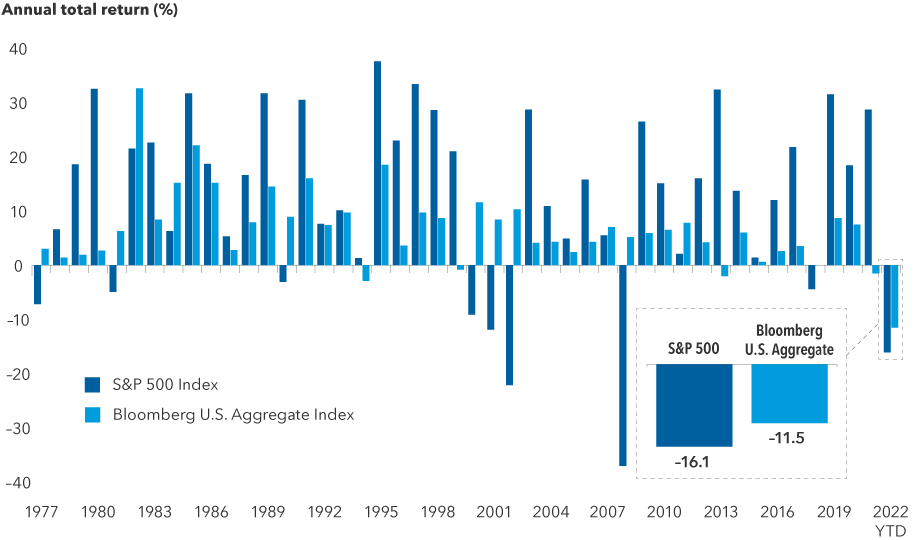

Perhaps that’s why 2022, in some ways, feels like taking a trip back in time. High inflation, rising interest rates, a bruising bear market and a proxy war with Russia seem all too familiar to anyone who lived through the early 1980s.

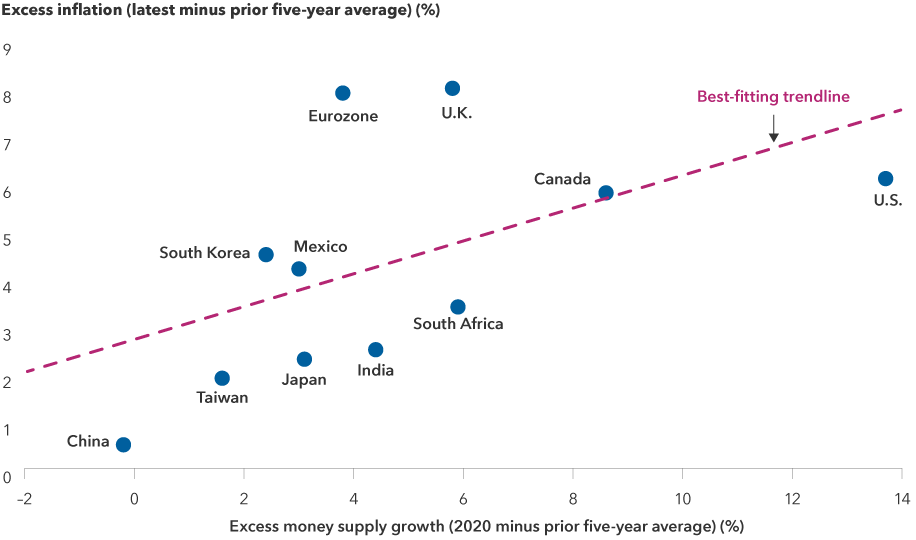

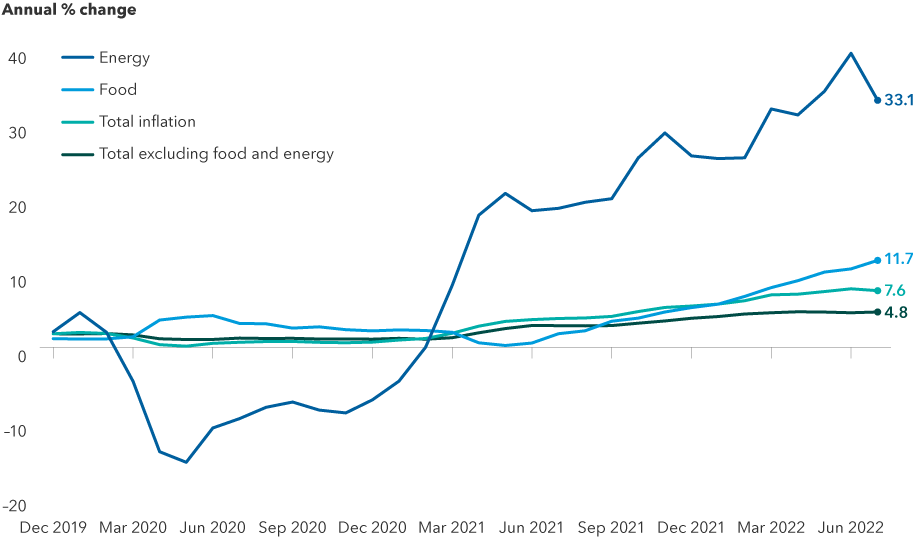

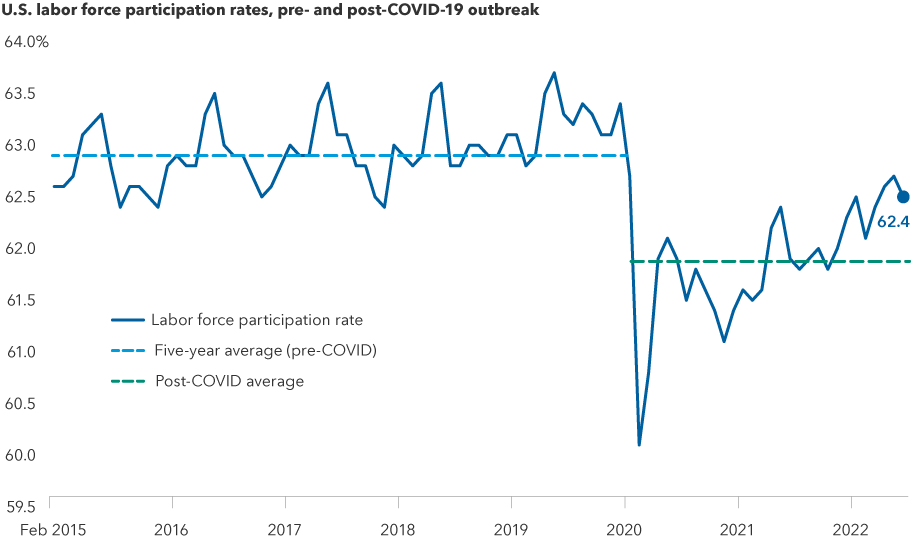

Today’s market environment, however, has been shaped by an entirely different event. The COVID-19 pandemic and, crucially, the response to the pandemic have created large distortions in the economy and markets — from sky-high inflation to chronic labor shortages to broken supply chains.

Which of these COVID distortions will fade over time and which will remain long term? That is a key question for investors.

“There are some aspects of the pandemic that are fleeting and some that will persist,” says Alan Wilson, a portfolio manager for Washington Mutual Investors Fund SM. “That’s the issue we are grappling with today. We need to get the answer right because it will likely determine which companies thrive in a post-COVID world and which fall behind.”