Have you ever driven behind a car with broken brake lights? It’s not necessarily disastrous, but any missing safety feature increases the likelihood of error, which could range from minor to catastrophic. The same is true of retirement plans.

February 21, 2024

Retirement plans’ safety mechanisms, like auto features, may help participants avoid common errors and uncommon catastrophe. As retirement professionals, I believe it is our responsibility to encourage plan sponsors to use every one of them — including and especially the often-overlooked investment re-enrollment.

What investment re-enrollment is and how it works

Many people mistake investment re-enrollment for auto-enrollment or auto-sweep. Although it relies on similar mechanics, investment re-enrollment is a distinct “safety” feature that may help reduce DIY investing errors.

- What it does: All participants’ assets and future contributions are automatically moved into the plan’s default investment option, usually a target date fund — unless they opt out.

- When it happens: Re-enrollment could be annual, bi-annual or every third year.

- How it works: The plan team works with the recordkeeper to set trade dates and distribute communications.

- Why it exists: The goal is to help plan participants stay on track through retirement with well-diversified, age-appropriate portfolios.

Helps prevent one-and-done investing disasters

Consequences of non-participation in a plan are easy to see. A young professional buried under mountains of student debt opts out of the company plan. Auto-enrollment prevents that opt-out from being a permanent decision. But what if, instead of opting out, they join the plan with a flawed understanding of investment risk and return? As they try to sort through confusing investment options, they may choose the lowest-risk, most conservative investments.

Remember, the concept of loss aversion tells us that investors are more motivated by fear of losses than they are by anticipation of gains. If a participant makes a fear-based allocation, they risk missing valuable gains during their peak earning years. Investment re-enrollment prevents that from being a one-and-done decision. Unfortunately, investment re-enrollment remains under-utilized.

Under-utilized in plan menus

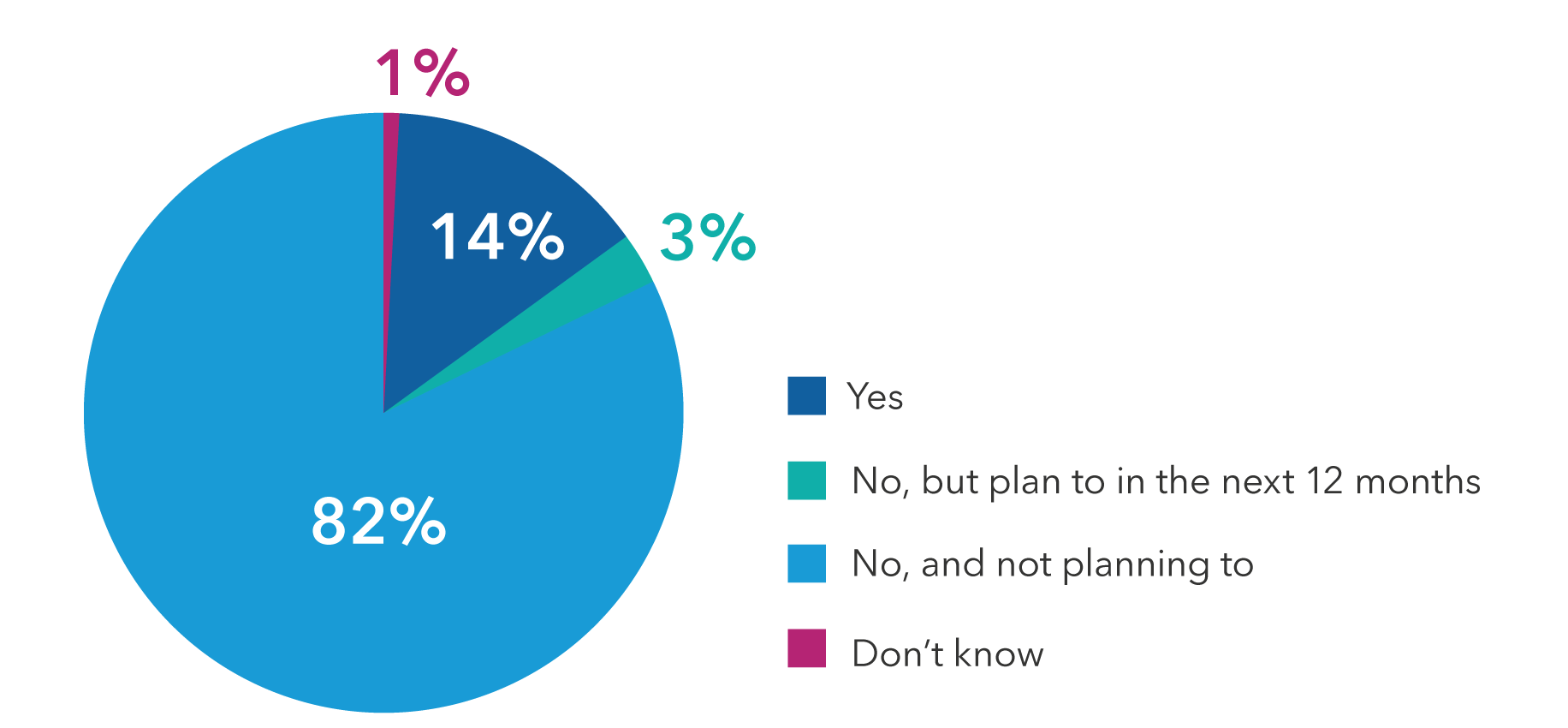

Despite investment re-enrollment’s power to help divert DIY investment disasters, plan sponsors often opt to forgo this important safety feature. According to the Callan 2022 Defined Contribution Trends Survey, the vast majority of plan sponsors are neither employing nor considering investment re-enrollment, which the study refers to as asset re-enrollment. Only 14% of plan sponsors indicated they had conducted one, and 82% responded “No, and not planning to.”

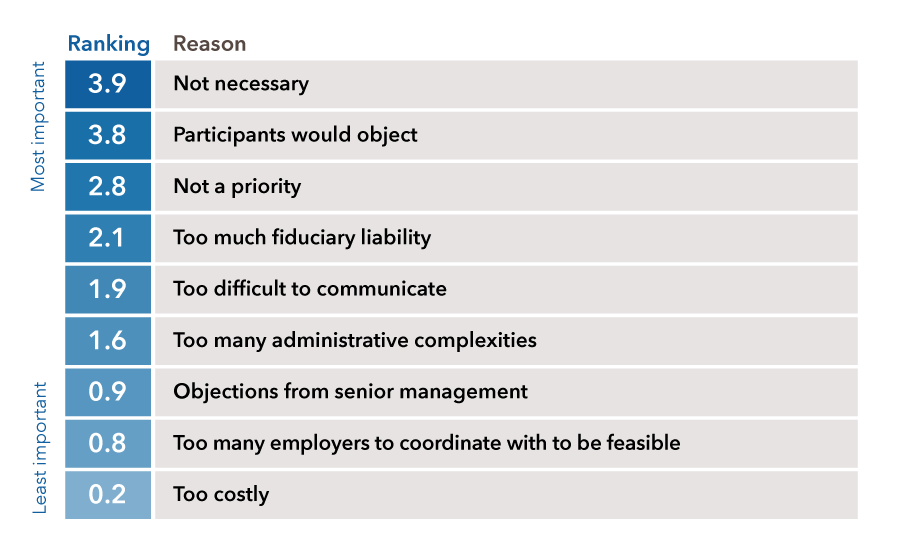

Why don’t more employers conduct investment re-enrollments? Among the reasons given most often by those surveyed were that it’s unnecessary, not a priority and too much potential fiduciary liability. I disagree with all three.

Not only is it necessary to help guide investors away from critical errors, but one could argue that it’s a retirement plan professional’s responsibility to leverage every tool available to do so.

Investment re-enrollment is easy

Although sponsors may perceive investment re-enrollment as too much work, the reality is that it’s a fairly simple process. Talk with your recordkeeper, as most will already be able to help you implement this feature.

For more in-depth insights on implementing investment re-enrollment, check out 3 steps to a successful investment re-enrollment.

Even unlikely scenarios change lives

Some plan sponsors may not be convinced that investment re-enrollment is necessary, because investing disasters may seem like an outside chance. But for individual investors, the stakes are high. Let me tell you a story — one I might not believe if I hadn’t witnessed it.

At the end of an educational meeting for plan participants, an employee approached the HR director. This employee had been with the company for around 40 years. He said, “Sorry, I’m not good with all this internet stuff. Could you help me check my 401(k) balance?” The HR director pulled up his account. The balance was $0. He had never set up contributions, and now he was near retirement with no savings. It was heartbreaking to see and a good reminder that a risk that seems “unlikely” to a plan administrator could be a catastrophic outcome to a retirement investor.

As retirement plan professionals, what you do matters. We should be using every tool available to help protect participants, not forgoing critical safety features. Talk to plan sponsors, and use resources like this guide to a successful re-enrollment to help plan participants stay on track through retirement.

Jonathan Young is a senior national accounts manager with 35 years of investment industry experience (as of 12/31/2024). He holds a bachelor’s degree in speech communication from Old Dominion University.