Artificial intelligence (AI) is having an iPhone moment with the launch of ChatGPT, a chatbot technology that can simulate human-like understanding and produce well-crafted, conversational responses.

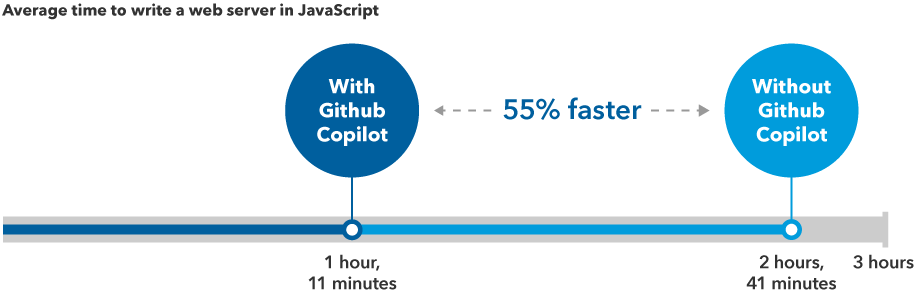

Racing to a million users in five days — and 100 million by January 2023 — ChatGPT has already been used to write short stories and academic papers as well as to create music and videos. Since the release of the chatbot, developed by OpenAI with a more than $10 billion investment from Microsoft, every day seems to bring news of incremental advances in natural language models, along with occasional apocalyptic warnings about the rise of robot overlords.

“As was true with the mainframe era in the 1950s, PCs in the 1980s and 90s and most recently the mobile and cloud era, AI has the potential to be the next technology platform that drives major productivity gains and changes the world,” says equity investment analyst Drew Macklis, who covers semiconductors, autos and mobility technology. “Each of these eras created investment opportunities, but it’s critical for investors to separate the reality from the hype and be sharp on where value can accrue in the chain.”

For starters, ChatGPT does not yet possess human logic per se, but can be better thought of as hyper-scale pattern recognition. Such chatbots built on large language models are one example of how AI is already being applied across the economy. The key question for investors is: Has AI finally reached a commercial tipping point?