Fixed Income

Bonds

Who’s the new bond leader among active management firms in the U.S.? According to Institutional Investor magazine, it’s Capital Group.

In an article published in March entitled “This New Bond Leader Doesn’t Have a King,” the magazine documents the slow, steady rise of the global Capital Group organization in the fixed income universe. Founded 92-years ago as an equities-only investor, Los Angeles-based Capital Group bought its first bonds — U.S. Treasuries and corporates — many years later in 1973.

The magazine extols Capital Group as an “intentionally faceless asset manager” that has “significantly outgrown its peers” among U.S.-based active managers. Over the past five years, Capital Group’s U.S.-based fixed income strategies have pulled in more than double the fixed income strategy assets of any active peer, according to the magazine.

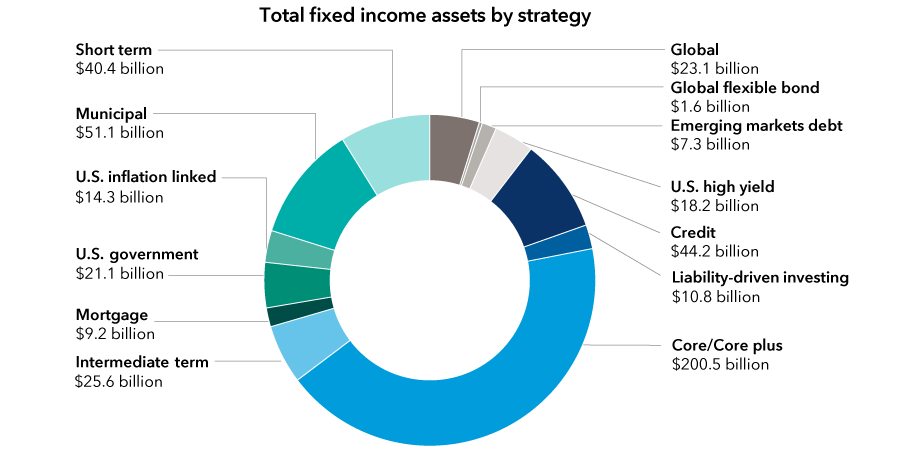

As of March 31, 2023, Capital Group manages US$467 billion in fixed income assets around the world across a wide variety of bond strategies, including core, global, and multi-sector credit.

Broad fixed income capabilities

Assets under management by Capital Fixed Income Investors as of March 31, 2023. All values are in USD. Totals may not reconcile due to rounding.

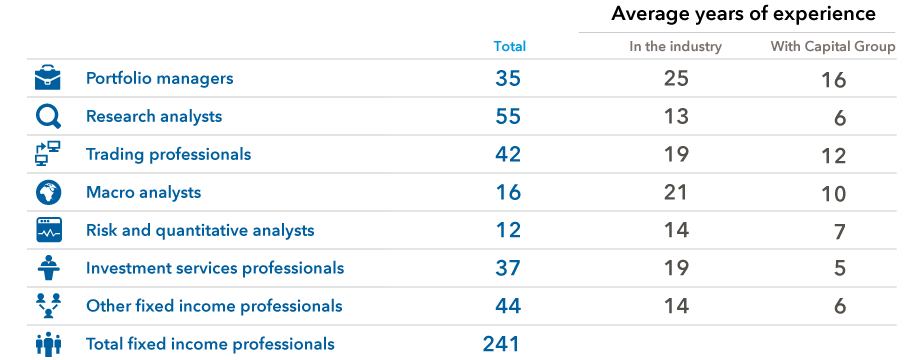

In terms of personnel, the global Capital Group organization has 241 investment professionals in fixed income, with expertise spanning portfolio management, research and macro analysis, trading and more.

A process built on experience

Data as of March 31, 2023. Trading includes traders, trading analysts and head of Global Fixed Income Trading. Investment services professionals includes investment specialist, Investment management associates, directors of fixed income markets and liability-driven investing solutions associates. Other fixed income professionals includes strategists, research associates, Aladdin team and business management.

This didn’t happen overnight, explains Capital Group fixed income business development director Ryan Murphy, who is featured in the article. Murphy acknowledges the fixed income buildout picked up speed over the last 10 years as the fixed income world demanded greater research capabilities, coverage and expertise.

The Capital System™

The foundational pillar bringing it all together is The Capital System™ of investing, which also explains the “doesn’t have a king” reference in the article’s title. Unlike some investment management companies that rely on a single individual or “star portfolio manager,” Capital Group doesn’t have any singular decision-maker or “star.” Rather, for its funds the firm uses teams of portfolio managers who manage individual sleeves. Another crucial point of differentiation is that Capital Group analysts also get their own sleeve of a portfolio to manage, a structure uncommon in the industry. The multi-manager structure has resulted in better collaboration and investing, and it incentivizes analysts who often deliver the best ideas out of their research, Murphy says.

“As a firm with deep research and immense collaboration among the fixed income and equity analysts, the investment teams know the industries and companies — their businesses and the capital structures — really well,” Murphy says.

Discussions with Capital Group equity professionals bridge the world between stocks and bonds, with fixed income investment professionals routinely meeting with their counterparts sharing research, intelligence and insights that benefits investors in both asset classes.

Investment opportunity

“There’s always an investment opportunity somewhere across the fixed income universe. Maybe it can be found in credit curves, maybe liquidity is mispriced, maybe the market’s view of an industry or country or sector is different from ours or maybe companies aren’t valued correctly. Because there’s always an investment opportunity, you must be flexible when it comes to generating alpha. If you rely too heavily on one tool or only have skills in one area, then when that area is fairly priced, there’s less room to add value. But our investors deserve and expect good returns, so you should have experience, capabilities and insight in every dimension of the market,” says Murphy.

Overlaying both equity and fixed income worlds are macroeconomic and political economists who are regional specialists. Some are U.S.-focused, others European and still others Asia and the Pacific Rim. There’s also a multidisciplinary research team at Capital Group that seeks to gain a deeper understanding of market disruptions, assessing the risks and evaluating the opportunities that arise during times of crisis.

“Collaborative views — independent views — is how you elicit better bottom-up implementation and investing. It’s an acknowledgement that you don’t want one voice dominating the room and you don’t want to run into the perils of groupthink,” Murphy said.

The structure also creates career development and succession opportunities that might be less common or even nonexistent at other asset managers.

Smooth transition

This was recently exemplified in 2023 with the retirement of fixed income portfolio manager Thomas Høgh, who retired after 32 years with Capital Group. Høgh, who got his start at Capital as a fixed income analyst covering Yankee bonds and non-U.S. bond markets, progressed to become a portfolio manager and worked on two Capital Group funds in Canada: Capital Group Global Balanced Fund™ (Canada) and Capital Group World Bond Fund™ (Canada). He has been succeeded by fixed income portfolio managers Philip Chitty on Global Balanced and Tom Reithinger on World Bond. Chitty has 19 years of experience at Capital and Tom Reithinger, nine years.

“The multiple-manager system eases transition planning and avoids the perils of a ‘star system’ reducing key-person risk,” says Murphy.

In so doing, it’s designed to last generations and is a key reason the global Capital Group organization is marking 50 years of fixed income investing.

“And we’re looking forward to the next 50,” says Murphy.

Our latest insights

RELATED INSIGHTS

-

Fixed Income

-

Asset Allocation

-

Interest Rates

Commissions, trailing commissions, management fees and expenses all may be associated with investments in investment funds. Please read the prospectus before investing. Investment funds are not guaranteed or covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. For investment funds other than money market funds, their values change frequently. For money market funds, there can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capital Group‘s Canadian investment funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capital Group. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. We assume no liability for any inaccurate, delayed or incomplete information, nor for any actions taken in reliance thereon. The information contained herein has been supplied without verification by us and may be subject to change. Capital Group funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2024 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2024. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

MSCI does not approve, review or produce reports published on this site, makes no express or implied warranties or representations and is not liable whatsoever for any data represented. You may not redistribute MSCI data or use it as a basis for other indices or investment products.

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capital Group trademarks are owned by The Capital Group Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capital Group funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capital Group, a global investment management firm originating in Los Angeles, California in 1931. Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capital Group funds offered on this website are available only to Canadian residents.

Ryan Murphy

Ryan Murphy