Fixed Income

Dividends

Ever heard of the Yield Dogs? Neither had equity portfolio manager Joyce Gordon when, as a young investment analyst in 1990, she was asked by a mentor, portfolio manager George Miller, to help him solve a problem.

“At the time, the analysts covering industries that paid good dividends each made their recommendations in a silo,” recalls Gordon, who was covering savings and loans companies. “He’d hear my idea to invest in a bank, then the utilities analyst’s ideas, then he’d listen to the phone analyst make another recommendation.”

But Miller wanted to compare dividend paying companies across industries so he could identify the best opportunities for the retirees and other income seekers who invested in his fund.

So the analysts compiled key metrics for each company and put them all on one page. They gathered in a conference room to debate the merits of each. Soon the group began meeting every two weeks and taking research trips together.

Thus were born the Yield Dogs, a group of dividend-focused portfolio managers and analysts whose name stands for “Dividends Ought to Grow.” Through the decades, as dividends have come in and out of favour with investors, the Dogs have continued to meet regularly. Today the group has expanded to more than 25, covering companies across all sectors as well as markets outside the U.S.

“Our mission has become more challenging,” says Gordon, now a portfolio manager on Capital Group Capital Income BuilderTM (Canada) and Capital Group U.S. Equity FundTM (Canada). “A great many of our investors need income from their investments, and we need many ideas to meet this challenge.”

Dividends are making a comeback

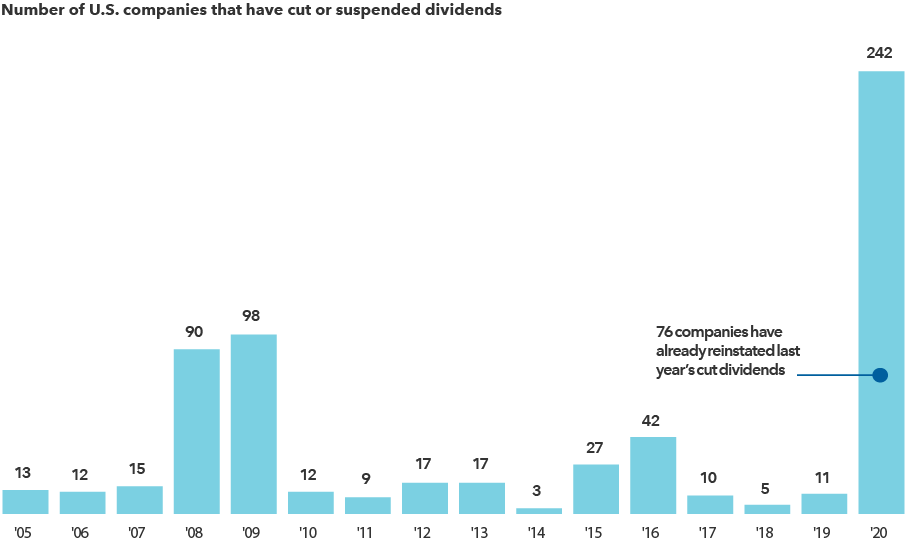

In fact, the past 18 months have been extremely challenging for the Yield Dogs and any other income-focused investors. The pandemic and global shutdown walloped many areas of the market that pay dividends in 2020, including airlines, hotels, energy and financials. In a spirit of caution — or, in some cases, facing questions of survival — companies suspended or reduced their dividends at historic levels.

In the U.S. alone, 242 companies cut or suspended dividends, nearly matching the total for the previous 11 years combined. In non-U.S. markets, particularly in Europe, government officials pressured or required some industries to suspend dividend payments during the crisis.

But the picture is brightening. With the rollout of COVID-19 vaccines and the reopening of economies, companies have begun to resume payments. As of May 31, 2021, 76 American companies had reinstated dividends.

After historic cuts, some U.S. companies are restoring dividends

Source: Wolfe Research, LLC. Copyright © Wolfe Research, LLC 2021. All rights reserved. Only companies with market cap of at least US$250 million included. Reinstated dividends statistic is through 5/31/21.

“I am pleased to see that many dividends have been restored, and in many other cases, particularly in Europe, are at least under discussion,” says Gordon, “I expect many more companies will bring them back in the coming months.”

Dividend growth: The special sauce

For many investors, the search for dividend income might naturally start with companies that pay the highest yields. These companies can be sound investments, but the high yield can also be a warning sign. “Companies that have very high dividends to start may not be able to sustain them,” Gordon notes. “The high yield may indicate a company is a melting ice cube, and their business is in decline and they're not reinvesting.”

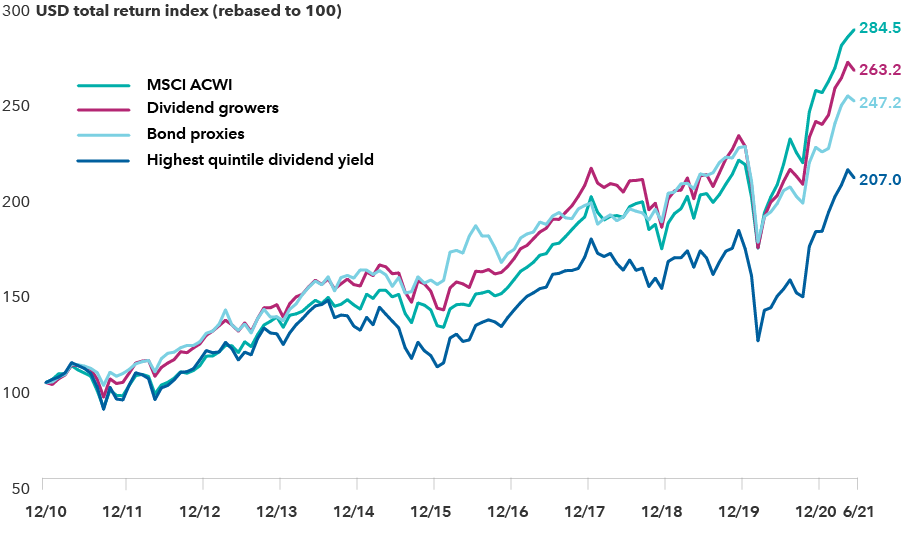

Instead, Gordon prefers to seek out dividend growers — strong companies that she believes are likely to be even stronger in five or 10 years. “I look for a company that can demonstrate the capacity and commitment to raise its dividends over time,” Gordon says. “I look for dividend growth that matches the underlying earnings growth of the company.”

Dividend growers historically have tended to generate greater returns than other dividend strategies, while also keeping up relatively well with the broader market. People assume that growth companies far outpaced dividend-paying stocks over the past decade, and that’s true when you look at the highest yielding stocks. But dividend growers did nearly as well as the overall market.

Dividend growers have outpaced other income strategies

Sources: Jefferies, FactSet Alpha Tester. Results are cumulative total returns in USD (with gross dividends reinvested) of companies represented in the MSCI ACWI (All Country World Index) segmented by dividend policy for the period December 31, 2010, through June 30, 2021. Highest quintile dividend yield are the top 20% of companies by 12-month forward dividend yield. Bond proxies are those stocks that tend to have higher yields but lower growth. They include stocks in the telecom, utilities and consumer staples sectors as well as REITs, railroads and transportation infrastructure stocks. Dividend growers include stocks with consistent dividend growth over the previous five years. Past results are not predictive of results in future periods.

In addition to providing a growing stream of income, dividend growth can be a sign of management’s more rigorous capital allocation process. “Because they are committed to setting aside some proportion of their earnings for investors, they tend to have better discipline and may be less likely to make some ill-advised acquisition,” Gordon says.

Because it is reflective of growing earnings, dividend growth can also offer a measure of resilience against interest rate hikes, Gordon adds.

Supersize me: The power of reinvested dividends

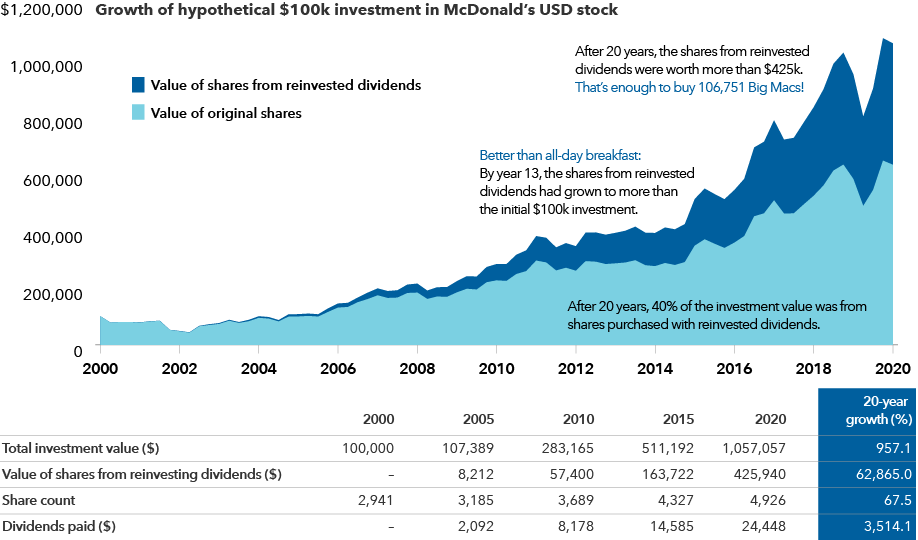

One company that has consistently grown its dividends is McDonald’s. To get a sense of how regularly reinvesting dividend payments can compound over time, consider a hypothetical US$100,000 investment in the company for the 20 years from December 31, 2000, through December 31, 2020, with all dividends reinvested.

Big Macs were probably not what Albert Einstein imagined when he called compound interest the “Eighth Wonder of the World.” But the power of compounding can be a wonder to behold.

In this hypothetical example, the total return of the investment would have been impressive — from US$100,000 to US$1,057,057, a 957% gain.

Reinvested dividends: Better than breakfast all day

Sources: Capital Group, FactSet. Growth rate calculations for value of shares from reinvested dividends and dividends paid use the first year's dividends payment ($676 USD) as a starting value. This information should not be considered a recommendation to purchase or sell a particular security and is provided for illustrative purposes only.

Take a look at what happened with the dividends. The value of shares from reinvested dividends would have grown from US$676 in 2001 to US$425,940 in 2020, or enough to purchase 106,000 Big Macs last year.

The special sauce of compounding in this example lies in the growth in share count from reinvested dividends. The number of shares purchased with the original investment would have been 2,941. By the end of the 20 years, the share count would have increased to 4,926, a 67% increase. For the length of the investment, dividend payments would have represented 40% of the total return.

Yield Dogs remain vigilant in the hunt for income

Although the search for dividend-paying stocks has expanded and become more challenging since the Yield Dogs took their first investment research trip to Cleveland some three decades ago, Gordon remains energized by the work.

“We had virtual meetings recently with 15 companies,” Gordon says. “We spoke with the CEOs and CFOs to try to get a good sense of management's willingness to recommend raising the dividend to the company’s board of directors.”

And as economies increasingly normalize, Gordon says she is finding a broader set of opportunities that she believes represent compelling value for investors. “I look for companies that are yielding around 2.5% to 3.0%, and that are growing their dividends and earnings around 10% or 12% a year. Today I am finding a number of companies that meet that criteria across a wide range of sectors and global markets.”

That’s how the Yield Dogs continue to make a meal out of dividend investing.

Our latest insights

RELATED INSIGHTS

Commissions, trailing commissions, management fees and expenses all may be associated with investments in investment funds. Please read the prospectus before investing. Investment funds are not guaranteed or covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. For investment funds other than money market funds, their values change frequently. For money market funds, there can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capital Group‘s Canadian investment funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capital Group. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. We assume no liability for any inaccurate, delayed or incomplete information, nor for any actions taken in reliance thereon. The information contained herein has been supplied without verification by us and may be subject to change. Capital Group funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2024 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2024. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

MSCI does not approve, review or produce reports published on this site, makes no express or implied warranties or representations and is not liable whatsoever for any data represented. You may not redistribute MSCI data or use it as a basis for other indices or investment products.

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capital Group trademarks are owned by The Capital Group Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capital Group funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capital Group, a global investment management firm originating in Los Angeles, California in 1931. Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

Joyce Gordon

Joyce Gordon