Fixed Income

Currencies

For advisor use only. Not for use with investors.

Rarely has an emerging technological development captured as much attention as Bitcoin in such a short period of time.

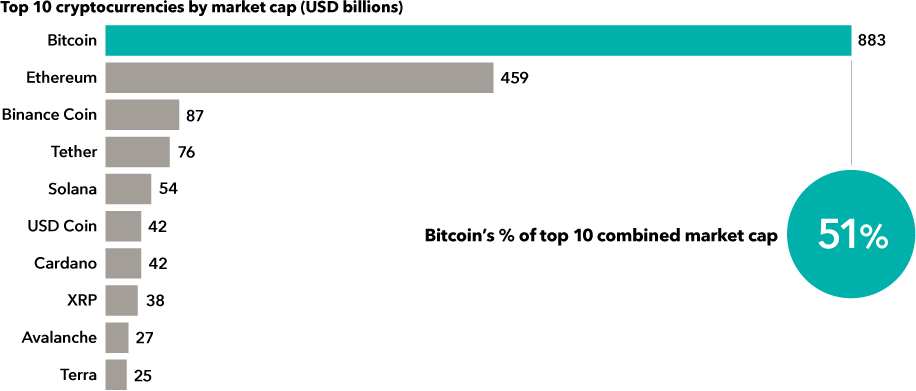

The debate over Bitcoin — and the cryptocurrency craze it has spawned — runs the gamut from advocates who see it as the future of finance to skeptics who compare it to a classic pyramid scheme. As the arguments intensify, so have the stakes: The market capitalization of the crypto universe has increased from roughly US$200 billion in 2019 to more than US$2.2 trillion at the end of 2021.

The rapid growth of the crypto industry has inspired a lively debate among Capital Group’s investment professionals, as well. To provide a glimpse into these discussions, we are sharing thoughts from two of Capital’s brightest minds on the advantages and disadvantages of Bitcoin.

Mark Casey, an equity portfolio manager, provides the “pro” argument, while Douglas Upton, an equity analyst covering the metals and mining industry, provides the “con” rebuttal.

We start with perhaps the toughest question of all:

Given Bitcoin’s volatility, how can investors determine a reasonable price for it?

Mark Casey: Bitcoin's valuation is a real paradox. On the one hand, it’s an asset that can never produce earnings and, like all assets that can never produce earnings, it has an intrinsic value of zero. You can't do a discounted cash flow analysis of Bitcoin just as you can’t do a discounted cash flow analysis of gold, or a Stradivarius violin, or fine art, or any other form of collectible. Anything that can't produce earnings is only worth what other people will pay for it. And so, in a sense, the valuation is completely arbitrary.

On the other hand, I think Bitcoin might become one of the most valuable assets in the world. And the reason is, the unique properties of Bitcoin are almost universally interesting to everybody who interacts with money.

1. No one can create any more of it. There will always be a supply cap of 21 million bitcoins, so no person or government can dilute your position by printing more.

2. Bitcoin is the only form of money that can’t be censored. It’s available for use by anyone with an internet connection, and no one can stop you from sending or receiving a transaction.

3. It’s hard to confiscate. Your bitcoin is really just a password. You can carry it around in your head, or write it down, and take it with you across any border in the world. Unlike the money in your chequing account, it can’t be confiscated by the government or creditors.

Half the people in the world live under authoritarian regimes that can block them from using the money system or remove money directly from their bank accounts, so I think there's tremendous appeal to this type of asset. There’s roughly US$600 trillion of wealth in the world. If Bitcoin gains a larger share of that, the price can go up a lot.

Douglas Upton: I’m kind of jealous, actually. I wish I had thought of creating something that’s divisible, with rules that can’t be changed and a limited supply — and then convince people to buy it from me. I honestly feel like I would have been laughed out of the room. Mark puts Bitcoin in the same category as fine art and fancy violins. You can always question the valuation, but the scarcity of those items is genuine. Whereas the scarcity of Bitcoin is artificial; someone just made it up.

When I look at the history of Bitcoin, it was originally established as a way of sending money over the internet, and it's bad at that. It’s very inefficient. Over time, somehow the thesis changed to: “It’s a store of value.” As an analyst who has followed gold for many decades, I feel like I've seen this movie before.

“The financial markets don’t need Bitcoin, but Bitcoin needs the financial markets.”

In my first job I worked on the biggest bullion desk in the world. We would say, "Well, if everybody put 5% of their assets in gold, the gold price would be a lot higher." And now here we are with Bitcoin. It’s the same argument.

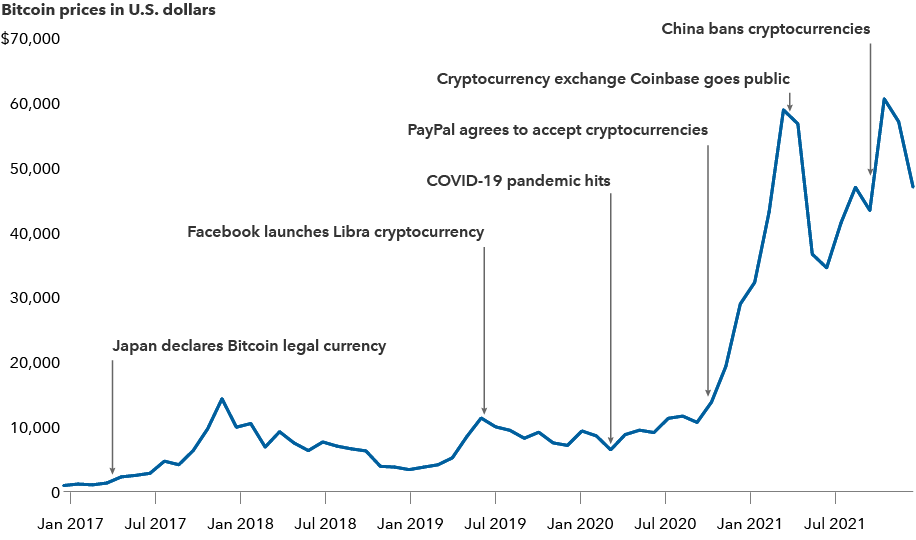

What’s driving Bitcoin’s price surge?

Sources: Capital Group, Refinitiv Eikon. As of 12/19/2021.

The price of Bitcoin is set by the financial markets — by people who are buying it solely because they think other people will pay more for it in the future. That sounds a lot like a pyramid scheme to me. The financial markets don’t need Bitcoin, but Bitcoin needs the financial markets. People can make a lot of money and they can lose a lot of money, but putting an intellectual framework around Bitcoin’s valuation is near impossible.

Is Bitcoin an effective hedge against inflation?

Casey: I think Bitcoin will prove to be an excellent inflation hedge. If you look around the world, there are about US$100 trillion of assets held in various forms of cash. All of it is essentially losing purchasing power over time because governments tend to print fiat currency faster than the economy grows.

There's also about US$125 trillion of bonds and about US$20 trillion of them have negative yields, so investors know they will lose money. There are many more bonds where inflation is probably going to be larger than the coupon. So investors think they're going to earn 3%, but they will actually lose 3% if inflation turns out to be 6%.

“Bitcoin is the only form of money in human history where you can't change the monetary policy and you can't print more.”

Some of those people are going to look at their portfolios and say, “It would be nice to own something that can actually hold its value or goes up over time.” They are going to look at their cash holdings and wonder why they are losing purchasing power in fiat currency. (The answer is money printing.) And some percentage of them will come to Bitcoin, because it is the only form of money in human history where you can't change the monetary policy and you can't print more.

Upton: First, throughout most of history, negative interest rates have been rare. Holding fiat currency normally earns you interest over time. Mark’s argument only makes sense in a world with negative real interest rates. That may be the specific circumstance we are in right now, but throughout history, real interest rates have been positive the vast majority of the time.

Second, if you’re looking to avoid currency risk, then the key decision is to get your money out of that currency. If you’re in Lebanon, for instance, and the Lebanese pound has just collapsed, you would have been fine whether you moved into gold, Bitcoin, the U.S. dollar, or New York real estate.

Third, there are lots of tangible assets that can work well as a hedge against inflation, including nearly every commodity you can think of. Commodities have been an effective inflation hedge over many cycles. The point is, you have choices and many of them have a much longer track record than Bitcoin.

Is Bitcoin mining bad for the environment?

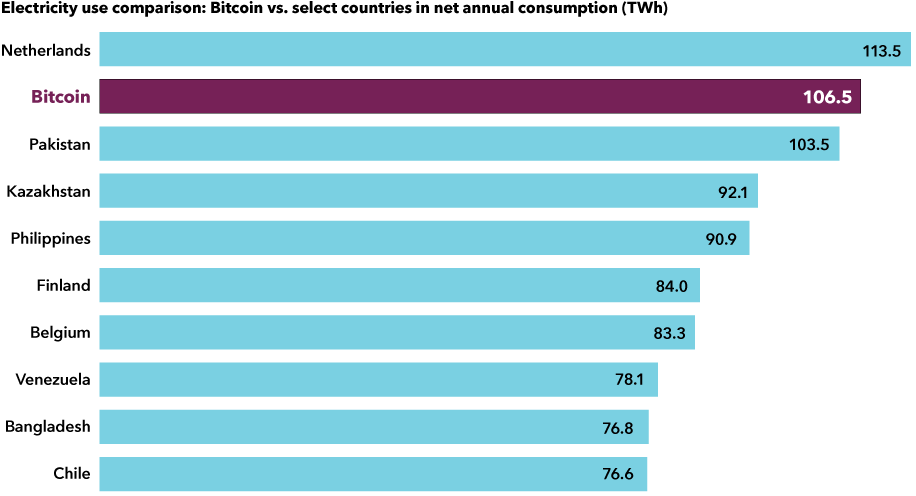

Upton: Bitcoin mining uses more electricity than some countries, and most countries around the world are working hard to reduce their carbon footprint. Any use of energy that doesn't go toward the sustenance of people I think is questionable and should be examined closely.

Bitcoin mining consumes more power than some nations

Sources: Capital Group, Cambridge Centre for Alternative Finance, U.S. Energy Information Association (EIA). "TWh" refers to terawatt-hours. Latest available country figures are from 2019, while Bitcoin's estimated energy consumption is based upon trailing 12-month energy consumption, as of November 2021.

According to various estimates, Bitcoin mining uses over 100 terawatt hours of electricity per year. If you purchase that energy even in a low-cost electricity system, it’s going to run US$3 billion to US$4 billion a year. We should think of this amount, as well as the other costs associated with Bitcoin mining, as a negative carry, similar to currency depreciation. It’s material and it’s meaningful.

Society has to ask: What value is Bitcoin adding that justifies such a high cost and such a large carbon footprint? In my view, Bitcoin only creates value for a small number of people. It’s an easy win for the planet to say we don’t really need this.

Casey: On the contrary, I think Bitcoin has a great energy consumption story. The software that drives the system is designed to thrive regardless of the number of miners, the price of computer chips, the price of energy, or the price of Bitcoin. The system is adaptable, and it flexes up and down based on these variables.

Compared to other industrial activities, Bitcoin is one of the greenest industries on the planet. And it’s getting greener all the time because Bitcoin miners are uniquely positioned to take advantage of intermittent forms of energy, such as a temporary oversupply of hydropower during the rainy season.

Today, Bitcoin miners purchase one tenth of 1% of all the energy in the world. So that means 99.9% of the world’s energy is going to other things. Even in a very bullish case where Bitcoin rises to US$1.5 million per coin over the next 10 years, miners will still be purchasing less than 1% of the world’s energy. Bitcoin’s energy use is negligible. It will always be nothing more than a rounding error.

What’s the risk that governments will ban Bitcoin?

Upton: I think there is a very real risk that governments will eventually decide to ban Bitcoin and other cryptocurrencies or severely restrict their use. We’ve already seen it happen in China, and it could happen elsewhere if governments feel like they are losing control of the financial system.

There is an interesting precedent, of which Mark reminded me. In 1933, the U.S. government banned private ownership of gold. That was during the Great Depression when the government was looking for every lever it could to control the supply and cost of money. For governments and central banks around the world, I think losing control is unacceptable.

Bitcoin’s rapid growth could lead to its own unwinding.

Bitcoin’s rapid growth has spawned many crypto competitors

Sources: Capital Group, CoinMarketCap.com. As of 12/17/21. All figures are estimates and subject to change based on volatility in coin prices, circulating supply and foreign exchange rates. "Market cap" refers to market capitalization and is calculated based on current price multiplied by circulating supply as quoted on CoinMarketCap.com.

Casey: I agree that some governments might try to ban Bitcoin. I view this as the biggest potential headwind to adoption and the best multi-year bear case, but it’s not a decisive bear case. I don’t think governments can extinguish Bitcoin — and attempts to ban it might actually accelerate adoption by people who are already skeptical of heavy-handed government intervention.

Bitcoin was designed with a decentralized architecture precisely to prevent anyone from being able to control the future of the system — and that includes governments. Bitcoin operates outside government boundaries, and I don’t think it could be banned, although such a move by the U.S. or the European Union would certainly hurt prices in the short term. Over the long term, however, it could cause demand for Bitcoin to skyrocket.

Will Bitcoin eventually fall prey to competition from other digital currencies?

Casey: Bitcoin is built on open-source software, so anyone can make a copy of it, change a few variables and launch a new type of coin. That experiment has taken place literally thousands of times. So every person who holds Bitcoin has had thousands of opportunities to sell it and buy some other cryptocurrency — perhaps one that has a higher supply cap than 21 million or a faster method to process new transactions.

What I find interesting is that so far, Bitcoin owners have considered these options to diversify and yet an overwhelming majority have said no. So I think Bitcoin is likely to survive in the same fundamental form that it exists today. It has seen plenty of competition over the past decade and it remains the king of the cryptocurrency realm.

Our latest insights

RELATED INSIGHTS

The Cambridge Bitcoin Electricity Consumption Index provides a real-time estimate of the total electricity consumption of the Bitcoin network.

Commissions, trailing commissions, management fees and expenses all may be associated with investments in investment funds. Please read the prospectus before investing. Investment funds are not guaranteed or covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. For investment funds other than money market funds, their values change frequently. For money market funds, there can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Past performance may not be repeated.

This content is confidential and designed for the exclusive use of registered dealers and their representatives. Canadian securities legislation, including National Instrument 81-102, prohibits its distribution to investors, potential investors or the general public. It is not intended to be a sales communication, as defined in the Instrument, and has not been designed to comply with its requirements relating to sales communications.

Unless otherwise indicated, the investment professionals featured do not manage Capital Group‘s Canadian investment funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capital Group. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. We assume no liability for any inaccurate, delayed or incomplete information, nor for any actions taken in reliance thereon. The information contained herein has been supplied without verification by us and may be subject to change. Capital Group funds are available in Canada through registered dealers.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2023 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2023. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

MSCI does not approve, review or produce reports published on this site, makes no express or implied warranties or representations and is not liable whatsoever for any data represented. You may not redistribute MSCI data or use it as a basis for other indices or investment products.

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capital Group trademarks are owned by The Capital Group Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capital Group funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capital Group, a global investment management firm originating in Los Angeles, California in 1931. Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capital Group funds offered on this website are available only to Canadian residents.

Mark Casey

Mark Casey

Douglas Upton

Douglas Upton