Client Relationship & Service

Tax & Estate Planning

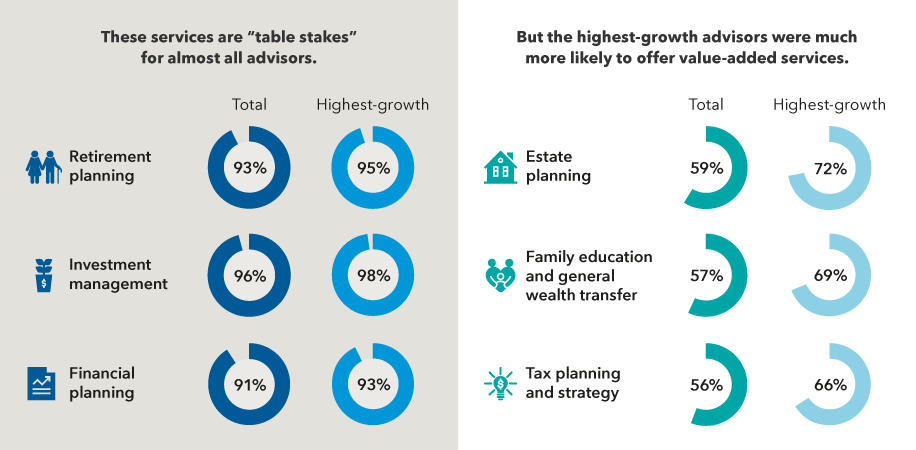

If you’re looking for ways to strengthen your client relationships and grow your practice, tax and estate planning may help you stand apart from the competition. Indeed, among the more than 1,500 advisors in our Pathways to Growth: 2022 Advisor Benchmark Study, most offered traditional services like investment management or retirement planning. But the advisors that were growing the fastest were more likely to offer a broader range of services tied to the long-term goals of clients, including tax and estate planning. And with the estate tax exemption set to fall to $5 million by 2025, the need for this type of advice may be greater than ever.

Moreover, these specific services offer a way to connect with clients on what matters most: family, legacy, and purpose. Successfully prioritizing these goals can help lead to greater consumer loyalty, retention, and referrals.

Topics to address with clients

Estate planning involves a lot of components, but these topics can help anchor your discussions.

Source: Capital Group research

Estate planning is a broad topic with many potential services to consider. Depending on in-house resources, your team may not be able to provide all the expertise needed for many clients. Still, you can familiarize yourself with those needs and advise clients through the process, or make yourself the quarterback of your client’s financial team.

To help you get a better understanding of the issues and client needs, we’ve organized our estate and tax planning thought leadership around four themes: life milestones and transitions, philanthropy and gifting, tax and estate planning, and business and career transitions. We also highlighted some of our pragmatic content on how to incorporate these various services into your practice.

Life milestones and transitions

Estate planning needs often arise around pivotal life moments. Marriage, the birth of a child, divorce, and death of a loved one tend to bring about a need for making new plans or updating a plan that was previously in place.

When getting married for the first time, for instance, a client may be financially unprepared due to unbridled optimism. And experience doesn’t necessarily improve things, as planning can be lacking even with a second or third marriage when financial and personal situations are more complex. In fact, the ramifications are often more pronounced in remarriages with blended families adding complexity and the need for clarity. You’re in a position to motivate these soon-to-be-wed clients to address financial and estate planning issues before the big day.

Of course, marriage is just one example. A growing family is a great motivator for writing a will and making financial gifts. But children can also create new questions, such as how to select a guardian, or appoint a trustee or executor — and why these three people should be different. Does your client know the differences between executors, trustees, and guardians? They may need to be educated on those distinctions, and you can add value by helping with that too.

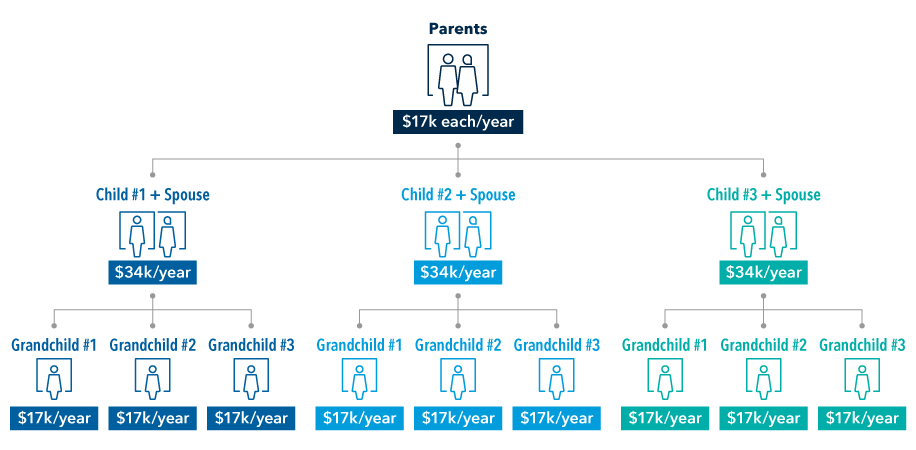

The gift of annual exclusions

Tax-free gifting can add up quick when it’s done right to take advantage of the annual exclusion threshold.

Source: Capital Group research

As the family ages, clients will naturally reach other pivotal stages and start to think about things like paying for college for their kids, while also looking at various levels of care for their aging parents. Some clients will opt to make use of annual exclusion gifts below the threshold to incur gift taxes. They can even make these gifts in the form of a donation to a 529 education savings plan. Individuals are allowed to give away $16,000 per person each year to as many people they wish without tax consequences. Married couples can give $32,000. In a large family, these gifts can add up quickly and remove significant assets from the client’s taxable estate.

Read more on life milestones and transitions

- Marriage/divorce

My client is getting married (or married again)

My client is getting divorced

- Growing family

My client is a new parent

Expand your practice with 529 education savings plans

My client is caring for elderly parents

Philanthropy and gifting

Passing wealth from one generation to another is at the heart of estate planning. But one opportunity that is sometimes overlooked is making generational connections early in the client relationship. Plan to bring the family in early to understand the goals for the wealth transfer and how to make it successful. These connections may represent the future of your business, as younger clients are poised to be on the receiving end of the largest wealth transfer in history.

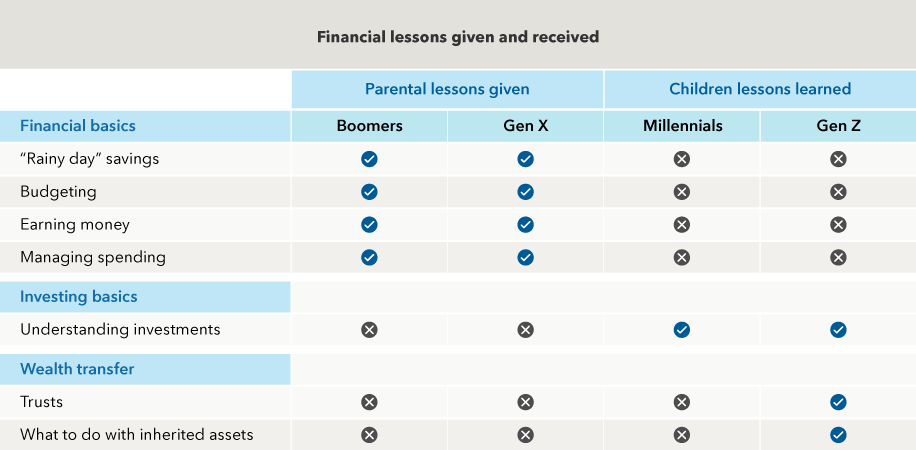

Advisors have an opportunity to improve this process by keeping a focus on the communication involved. That may sound like a cliché, but more than half of wealth transfers fail — not because of the quality of estate planning advice, but due to inadequate preparation of the family and issues of trust and communication. Data from Capital Group’s February 2020 Investor Generational Wealth Transfer Study shows a disconnect between the generations in terms of lessons given and lessons learned.

Mismatch between the generations

A lack of clear communication can thwart the best-laid plans if the intended message is not received.

Source: Capital Group Investor Generational Wealth Transfer Study, February 2020

It’s not just investment expertise that will win the business stemming from this money in motion. Technical expertise will also be needed. Large inheritances don’t always come in lump sums that are ready to invest. Instead, they will often be in the form of trusts, so the ability to help with the related legal and technical issues is another way advisors can add value.

Money in motion won’t always go to a family member, of course. Many high-net-worth investors also give to charitable causes. In those cases, there are considerations like the timing of a contribution, not to mention which assets exactly to donate. But first, there is a decision to make about where the donation should go. And the number of options is bewildering. According to the National Center for Charitable Statistics, in 2020 there were more than 1.5 million nonprofits in the United States alone. Savvy advisors can help clients navigate this landscape.

Clients can think of this akin to a hiring process: They need to consider their own needs, find a set of potential candidates, and then vet the finalists. And as the trusted advisor, you can help clients discover and dial in to a core set of family values, which can then guide how clients target their philanthropy.

Specifically, help clients develop a personalized mission statement that will drive their philanthropic efforts. Encourage them to define what’s important to them and how they want to be remembered. Make this the focus of a client meeting, and encourage them to invite their children. Getting input from family members can clarify where priorities overlap. Then they can zero in on sectors or population groups they most want to impact or help.

As your clients begin to identify the types of causes that resonate most with them, connect them to resources that could help them find individual charities in those areas. Then clients can create a short list of candidates for donation.

Read more on philanthropy and gifting

How to help HNW investors create a values-based charitable giving plan

Bridge the Generation Gap: How to have a family wealth briefing

My client received an inheritance

Tax and estate planning

For high net worth and ultra-high-net-worth clients, tax strategies may be as important as investment advice.

Your approach to these conversations with clients will depend on their specific circumstances. For instance, if a client understands the tax benefits of making a gift but is reluctant to give up access to the assets, there are trust strategies that allow some degree of access to the gifted assets. One example is a spousal lifetime access trust. Encourage a discussion with an estate planning attorney for this client.

Many clients are concerned about a taxable estate upon death but don’t like complexity. For these clients, there are some simple gifting techniques to consider, such as annual exclusion gifts or direct payments of tuition and medical expenses. A simple 529 education savings plan, for example, allows clients to make large tax-free gifts with very little complexity.

Help clients plan charitable giving

Understanding the tax benefits of donating different types of assets and when can help clients make smart decisions for giving.

Source: Capital Group research

Finally, what about the client who has an asset that is expected to substantially appreciate? They may want to consider estate “freeze” techniques that allow them to gift future appreciation of an asset. Again, encourage clients to discuss these strategies with an estate planning attorney or tax professional before making any moves.

Read more on tax strategies

3 financial planning and tax moves to consider now

Build a multigenerational growth strategy

Business and career transitions

Not all windfalls will come from a traditional inheritance. Some clients will sell their small businesses and create their own liquidity event outside the generational wealth transfer. There are more than 30 million small businesses in this country, and many of them will transition to new ownership over the next decade, according to the U.S. Small Business Administration.

Even the ultimate career transition — retirement — has been rewritten by evolving expectations of life. Many of today’s investors see retirement as a new stage of life full of reinvention that could last as long as 30 years and, consequently, requires careful planning.

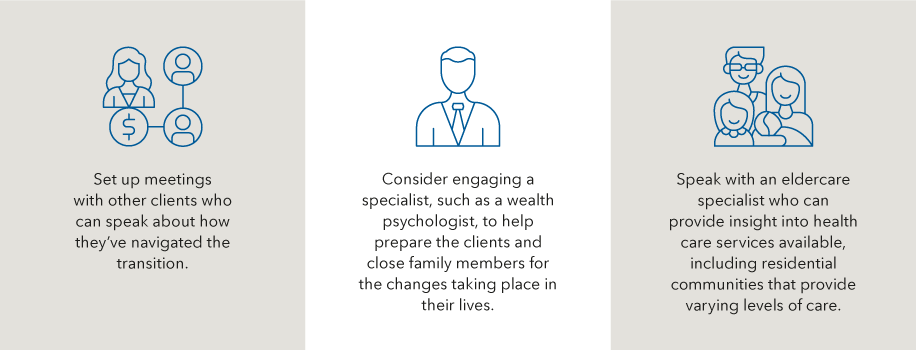

Helping clients prepare emotionally for retirement

When clients sell a business, advisors can add value by helping them mentally prepare for their new lives.

Source: Capital Group research

That mindset is likely to only grow larger. More than a third of Americans are over the age of 50, a percentage that will increase over the next two decades, according to a 2016 study by the Joint Center for Housing Studies at Harvard University. This suggests it may be time for advisors to change how they engage with clients so that they can become the retirement advisor today’s retirees want.

Read more on business and career transitions

Exit this way: How to help clients sell a business

4 steps to reinvent your retirement playbook

Adding estate planning to your practice

Getting your practice in the center of clients’ estate planning needs will require a calculated approach. If you have the resources, you may hire the law and accounting expertise needed in-house. You might also use the center-of-influence strategy, knitting together a group of qualified professionals who want to work with clients like yours and have clients like theirs work with you.

Tax and estate planning are aligned to growth

The highest growth advisors in our benchmark study are more likely to advise on estate, tax and wealth transfer matters.

Source: Pathways to Growth: 2022 Advisor Benchmark Study

The perceived complexity of trusts and estate tax law may keep some advisors from offering these services. But there are many ways you can add value to the estate planning process — from identifying the need for a plan, to helping find the right professionals to execute it, to making sure necessary changes are considered after important life events.

Read more about adding estate planning to your practice

Finding your role in estate planning

Create a center-of-influence strategy that works for you

Leslie Geller

Leslie Geller

Jeffrey Brooks

Jeffrey Brooks