Retirement Income

Tax & Estate Planning

Many high net worth investors have a desire to give to charitable causes, but the options — and the need — can be overwhelming. According to the National Center for Charitable Statistics, in 2020 there were more than 1.5 million nonprofits in the United States alone.

But savvy financial professionals can help investor clients navigate the nonprofit landscape with a charitable giving plan that guides them as they consider the causes and specific charities they hope to support, while also optimizing any tax benefits that accompany those donations.

And you should be aware that charitable planning is one of the services tied to the long-term goals of clients and their families that advisors in the highest growth practices have in their playbooks, according to Capital Group’s Pathways to Growth: 2021 Advisor Benchmark Study. Helping clients engage in strategic philanthropy can enable you to attain the level of relationship alpha shown by those successful firms.

Here are five steps to help your clients create personalized charitable giving plans:

1. Create a philanthropic mission statement

For many of us, an instinct and desire to help often rapidly collides with the daunting reality of just how great the need is. As a trusted advisor to your clients, you can help clients discover and dial in to a core set of family values, which can then guide how they target their philanthropy.

One way to get started is to turn to the values and legacy section of Capital Group’s client workbook: My Best Retirement (PDF). This planning tool can help clients start to corral the resources they have to work with, as well as any big-picture goals they may have for their charitable efforts.

Next, make this topic the focus of a client meeting (if you haven’t already scheduled dedicated time for this discussion) and encourage clients to invite their children or other heirs whose opinions they value. There are commercially available “values” card decks — your firm may have created a branded set — that allow participants to gamify the process. But the point is to get family members together to discuss what they care about as individuals and see where priorities overlap.

“Understanding shared values helps clients make good choices when making charitable gifts,” says Jeffrey Brooks, Capital Group wealth strategist. “You want to help clients find what motivates them and their families.”

Takeaway: Help clients develop a personalized mission statement that drives their philanthropic efforts.

2. Find charities that align with client values

Once your clients have agreed to a set of values they have in common, you can help them zero in on sectors or population groups they most want to impact or help.

Talk to clients about specific aspects of their lives that could motivate their charitable giving, such as helping others avoid life-threatening diseases that have caused a beloved family member to suffer. A client who is a successful athlete or artist may want to create similar opportunities for others by funding scholarships or programs.

Heritage and religious ties could prompt clients to set their sights across the globe, while a family’s multigenerational ties to their local community might move them to focus their efforts close to home.

As your clients begin to identify the types of causes that resonate most with them, consider connecting them to resources that could help them find individual charities working in those areas. For example, if your clients are passionate about animal welfare, Animal Charity Evaluators publishes an annual list of its top animal welfare charities.

Keep track of these resources as your conversations with clients and their families introduce you to additional nonprofits in various areas of interest. Also, don’t forget to connect clients with donor relations staff at nonprofits. They are typically eager to meet prospective donors, answer any questions about how they can work with your clients, and can often personalize a donor’s giving program.

Takeaway: Connect clients to resources that can help them find organizations they want to support.

3. Vet the “finalist” candidates for donation

Once clients have a list of finalists, help them conduct due diligence against some key selection criteria, including financial health, accountability and transparency. There are a number of reputable organizations that ensure well-intended funds are going to well-managed organizations:

- Charity Navigator and GuideStar are two well-known organizations that analyze IRS 990 tax forms and disclose important metrics, such as what portion of a nonprofit’s budget actually goes toward programs and services versus administrative costs and fundraising.

- Give Well, another research organization, focuses on international nonprofits and publishes a list of its top charities vetted by how they maximize the value of each dollar donated. (Be sure to inform clients that some donations to non-U.S. charities may not be eligible for tax breaks.)

- Google and other sources of publicly available information can also help clients evaluate a charity’s overall success. For example, “Year in Review”-type reports on a nonprofit’s website can help establish a track record of achievement. Simple news searches can reveal whether leadership has been steady over the years, or if there has been volatility in the ranks (which could be a red flag).

Another factor clients might consider is how a charitable prospect might be affected by their donation. Giving What We Can, another charity research group, suggests some questions donors can ask to try to determine a gift’s potential impact:

Takeaway: Connect clients to resources that can help them evaluate “finalist” organizations.

4. Optimize the donation and tax benefits

Now that you’ve laid out the “why” for clients making donations, it’s time to explore the “what,” “when” and “how.”

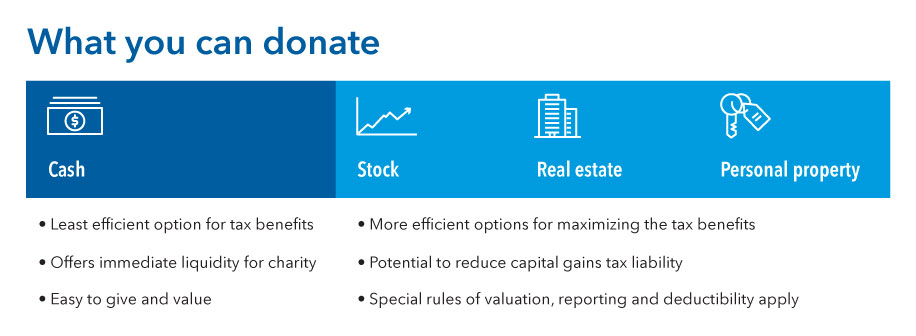

Individuals may make cash donations to charity or give appreciated assets or property. Here’s how the options stack up.

Source: Capital Group research

Clients and charities alike may gravitate toward the convenience of cash donations. For those who want to optimize their tax benefits, however, cash donations may provide the fewest tax benefits compared to other gifting options.

Donating other assets, such as real estate, stock or personal property, could help support a charity’s efforts while also maximizing the tax benefit to clients. For example, if a client sells stock to make a donation, she will have to pay capital gain taxes on that sale before receiving a deduction. But directly donating the shares means a tax deduction for the full fair market value of the stock as well as the option to avoid paying taxes on the appreciation. Remind clients that under current law, the historically high federal estate and lifetime gift tax exemption of $12.06 million will be reduced by approximately one-half in 2026.

Clients may also consider making qualified charitable distributions (QCDs) directly from an IRA to a qualified charity. In this case, the donation (which is not tax deductible) can count toward the donor’s required minimum distribution, but is not considered taxable income.

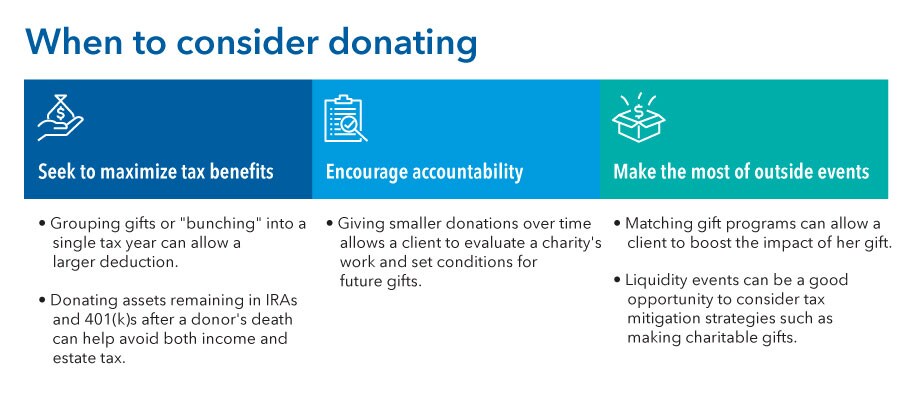

Timing can be an important factor in charitable giving. Here’s what to consider when developing a giving plan.

Source: Capital Group research

Donating assets in qualified retirement accounts, such as IRAs or 401(k)s, at the donor’s death can get the double benefit of avoiding both income and estate tax.

Giving smaller donations over time can be a good tactic to both support the organization and allow for the donor to take a more active role in managing the donation, setting conditions for the charity to meet and adjusting along the way. You can also encourage your clients to ask a prospective charity’s leadership if they are working with a foundation or other group on a matching gift program. Making a donation during a time period when the charity is receiving matching funds could essentially double or triple its impact.

Lastly, walk clients through how they might want to donate. Consider a business owner who is selling her company and wants tax mitigation strategies for the gain she’ll receive upon the sale. She’s interested in making a donation but wants control and influence regarding how the money is used over time. Setting up an intermediary organization can allow her to make a substantial donation from the business’s sale, take that deduction in a single year, and also give her say over how the money is distributed over time.

Of these options, donor-advised funds (DAFs) have been particularly popular recently. Contributions went up 20% to $47.85 billion in 2020 compared to a year earlier, according to a National Philanthropic Trust survey. DAFs allow the donor to take the tax deduction in the year the fund is set up – even if you postpone the actual grant-giving to later years. (It’s important to remind clients, however, that once the fund is set up it cannot be revoked.)

Among these intermediary options are:

Public charities |

Donor-advised funds |

Supporting organizations |

Private foundations |

|

Description |

An organization with broad public support and active programs. Has been granted federal 501(c)(3) status. |

Collects, invests and administers charitable donations on behalf of multiple organizations and/or individuals. |

Similar to a private foundation but with a focus on, and managed by, a public charity (the “supported” organization). |

A corporation or trust that is funded by a single source (an individual, family or corporation) and managed by its own trustees and directors. |

Characteristics |

Simplicity and maximum income tax advantages for donors. |

Immediate, maximum tax advantages for donors. Enables “bunching” deductible gifts in a single year. Also provides donors with anonymity and some control over grant-making. |

Focused philanthropy and active involvement for donors with maximum tax-deductibility. |

Maximum control over foundation activities. Allows employment of family members and creation of a multigenerational philanthropic legacy |

Control, privacy & intergenerational transfer |

No ongoing control or intergenerational transfer. Privacy can be requested. |

Contributions controlled by the receiving charity or fund sponsor. Donors can recommend grants and investment management. Contributors’ names can be kept private, and grants can be made anonymously. Donors may appoint successors for one or two generations. |

Donors may recommend members to the board of directors, which makes all grants. Little privacy as directors are listed on IRS Form 990. Board may allow succeeding generations to serve. |

Donor appoints all members of the governing body and retains control of investments and grant-making, subject to IRS rules. Little privacy because detailed public tax returns must be filed on grants, investment fees, trustee names, staff salaries and names of major donors on Form 990s. Allows multigenerational philanthropy. |

Tax deductibility of cash gifts* |

Immediate deduction of up to 60% of adjusted gross income. |

Immediate deduction of up to 60% of adjusted gross income. |

Immediate deduction of up to 60% of adjusted gross income. |

Immediate deduction of up to 30% of adjusted gross income. |

Tax deductibility of long-term, publicly traded, appreciated securities and other long-term capital assets* |

Immediate deduction of fair market value of assets, up to 30% of adjusted gross income. |

Immediate deduction of fair market value of assets, up to 30% of adjusted gross income. |

Immediate deduction of fair market value of assets, up to 30% of adjusted gross income. |

Immediate deduction of fair market value of assets, up to 20% of adjusted gross income. |

*Taxpayer must itemize deductions in order to qualify for this tax deductibility treatment.

Source: Capital Group research, Internal Revenue Service, Silicon Valley Community Foundation

For clients who are more focused on mitigating taxes (on income and gifts), and less focused on the charitable element, split-interest gifts could be effective. Two of these options are:

- Charitable remainder trusts (CRTs): These trusts can be a way to give while also retaining some benefit for the donor by reserving an income stream for the donor’s lifetime. CRTs could be especially useful for clients who hold investments with unrealized capital gains, specifically if the donor wants to sell those assets but defer paying capital gain taxes. (Think income tax benefits.)

- Charitable lead trusts (CLTs): In this case, the donor transfers an asset into an irrevocable trust, through which a charity receives the “lead” interest in the form of annual payments from the trust. If the CLT is structured in a certain way, your client could get a current income tax deduction upon the trust’s funding, equal to the present value of all of the “lead” interest payments over the term of the trust. (Think gift and estate tax benefits.)

Takeaway: Help clients understand the variety of charitable vehicles available to them and the tax benefits of each.

5. Make the charitable giving plan a living document

Part of what’s made your clients successful is a willingness to consistently evaluate how they operate and adjust as needed, whether that’s a sales strategy or a market expansion overseas. So, it makes sense to channel those same instincts toward their charitable giving.

Check in with clients in your annual meetings or schedule separate meetings to review their charitable mission statements and how their giving programs have met their tax and estate planning needs.

Consider encouraging clients to meet with leadership at the organizations they are supporting at midyear to get a progress report. This is a good chance for the client and the nonprofit to discuss both the charity’s goals and overall impact, as well as the specific impact of the client’s donation. This could be a great time for the client to meet the ultimate beneficiaries of the money, such as students who receive endowed scholarships.

The idea behind this is to make sure that the client’s charitable giving plan is robust enough to adhere to her values and the legacy they hope to leave, but flexible enough to change as the client’s priorities do.

“Helping clients create a personalized giving plan helps them meet their goals to give back while also reinforcing to them your role as a trusted partner who can support them in building fulfilled lives,” Brooks says.

Takeaway: Assess the impact of a client’s giving once a year and help them adjust the size and placement of donations as necessary.

RELATED INSIGHTS

-

-

Client Conversations

-

Client Relationship & Service

Jeffrey Brooks

Jeffrey Brooks