Chart in Focus

Market Volatility

Stock markets around the world have entered bear territory. In the U.S., the S&P 500 Index slid nearly 21% for the six months ended June 30, 2022, suffering its worst first half in 52 years. Today, many investors are focused on the likelihood of recession and more pain ahead.

“No one knows when this decline will end, but I am confident it will end, so I encourage you not to get caught up in pessimism,” says equity portfolio manager Don O’Neal, who has 36 years of investment experience and has navigated several bear markets. “Declines create opportunities for investors who remain calm. If we make good decisions in times of stress, we can potentially set up the next several years for strong returns.”

The importance of experience

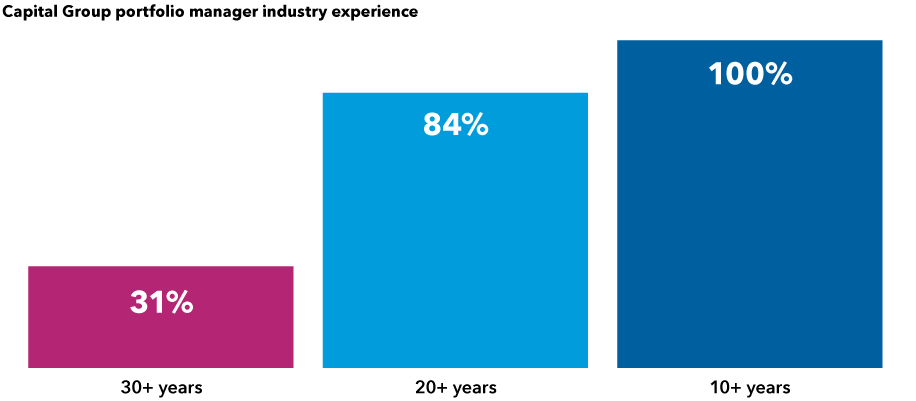

Source: Capital Group. As of 12/31/21.

In unnerving times like these, it’s helpful to hear from veterans like O’Neal who have survived numerous bear markets. At Capital Group, 31% of portfolio managers have more than 30 years of investment experience while 84% have 20 or more.

We asked O’Neal and four of his colleagues, each of whom has been investing for more than three decades and 171 years collectively, to share lessons learned from past bear markets and how they are applying those lessons today.

1. Avoid the winners of the last cycle

Lisa Thompson, Portfolio Manager, New World Fund®

33 years of investment experience

My experience has taught me that markets have long cycles. I believe the pandemic marked the end of the post-global financial crisis cycle — a cycle dominated by deleveraging, demand shocks and expanding globalization. These conditions led to looser monetary and fiscal policy, low cost of capital and stock price inflation.

Today we are at the beginning of a new cycle, one that I expect will be marked by deglobalization, a shrinking labor supply and decarbonization — conditions that will lead to a shift from asset price inflation to goods inflation. Profit margins and highly valued stocks will face continued pressure. Because I expect generally higher inflation during this period, I want to steer clear of many of the fast-growing primarily U.S. companies that were the winners of the previous cycle.

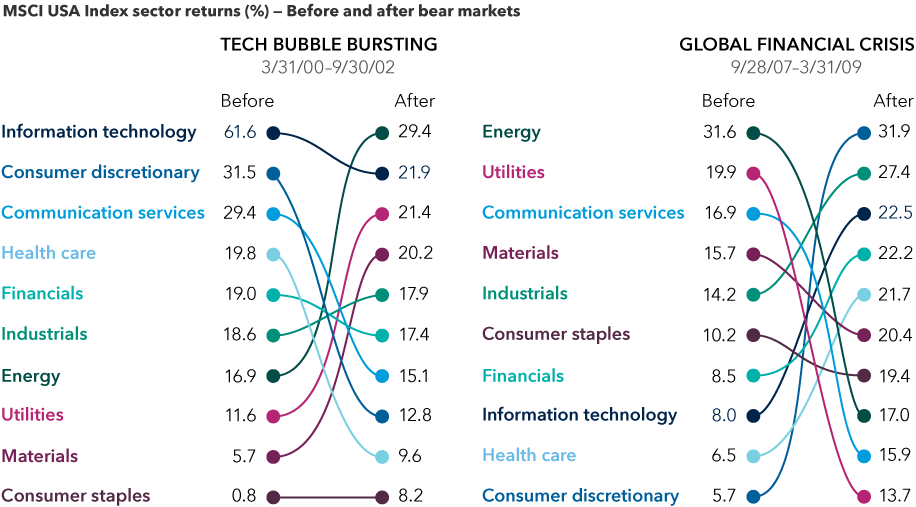

Market leadership often changes after a bear market

Sources: Capital Group, MSCI, Refinitiv Datastream. Returns shown are from the MSCI USA Index and are absolute total returns in U.S. dollars. For the tech bubble the dates represented are December 31, 1996, to March 31, 2000 (before bear market), and September 30, 2002, to December 30, 2005 (after bear market). For the global financial crisis the dates represented are December 31, 2003, to September 28, 2007 (before bear market), and March 31, 2009, to December 31, 2013 (after bear market).

When cycles shift, market leadership changes. So, in today’s rising rate environment, I am focused on opportunities to invest in lower priced companies that generate strong cash flow. I think of this theme as the Revenge of the Nerds. I am generally staying away from the cool kids of the last decade — glitzy tech and media companies — and looking for opportunities among the unpopular kids in those industries hurt by the low cost of capital, poor capital allocation and adverse regulations. Some examples here might include leading telecom companies in markets like Europe, Mexico and Japan.

In fact, I am focusing largely on companies outside the U.S. In my view, many U.S. companies have benefited more from globalization and the low cost of capital than similar companies in other markets.

Given recent fears of deglobalization and rising inflation, I am looking at companies in Europe and Japan, as well as emerging markets that I have covered for decades. This might include, for example, commercial banks and consumer staples in China, but also in Italy, France, Japan and Latin America.

2. Separate the wheat from the chaff

Don O’Neal, Principal Investment Officer, The Growth Fund of America®

36 years of investment experience

First, it’s important to recognize that things have changed. What used to work for stock picking won’t work in the same way, possibly for years. Holding the best companies with the best growth stories seemed to be a good approach over the past 10 years.

But I believe the last decade was too easy. Whenever retail investors get hyped up and day traders abound via Robinhood, that is a sign.

Going forward it will likely be harder to generate good returns, and the factors that drive returns most likely will change. For example, you can no longer buy and hold the fastest growers without regard to profits. I see this as a welcome return to fundamentals.

You may hear the current decline described as a correction of high multiple growth stocks. While this is generally true, it is incomplete. The stocks that have fallen the most all had fundamentals that disappointed versus expectations. Stocks with continued good fundamentals have held up better.

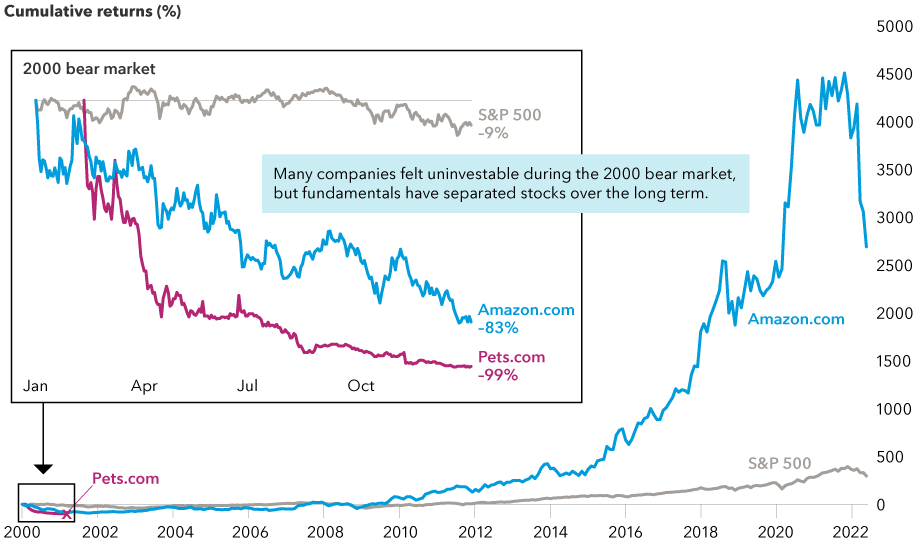

A lot of stocks have plummeted, but that doesn’t mean they are all bad investments. Consider this example: In the 2000 bear market, both Amazon and Pets.com declined more than 80%. Pets.com went on to become a poster child for irrational exuberance as its stock went to zero. Meanwhile Amazon went on to become …. Amazon.

Bear markets can inflict pain indiscriminately

Source: FactSet. Full chart shows monthly returns from 1/31/00–6/30/22. Smaller chart shows daily returns from 1/3/00–12/31/00.

For me, it’s time to get out a clean sheet of paper, focus on the fundamentals and concentrate your portfolio. Ruthlessly throw out the pretenders and hold only the highest conviction investments. Separate the wheat from the chaff.

For the next few years, the best strategy is not likely to be focused simply on finding growth. Instead, the balance of good fundamentals at a good price should prevail. Look for a diversified mix of companies. This could include companies in the semiconductor, cloud services or search areas, for example. But it could also lead to more value-oriented companies like defense contractors, insurers or energy companies.

3. Trade the intangible for the tangible

Carl Kawaja, Principal Investment Officer, EuroPacific Growth Fund®

35 years of investment experience

For the last 10 years the stock market placed a lot of value on companies that offer intangible things like software. But we've recently seen it demonstrate a greater embrace of companies that make tangible things. We all know and appreciate how rapidly electric vehicles are growing, but I think people may have underappreciated how much nickel and copper are needed to build their batteries.

That’s why demand for some commodities, like nickel, is benefiting from secular tailwinds, and markets are starting to recognize this. Of course, to succeed in a commodity investment, you need to identify a company that has an enduring resource or a cost-effective means of finding and producing more of it.

Consider iron ore, a key ingredient in steel. One of the reasons it has been important since the Iron Age — that’s a long time — is that we haven't really found another material that replaces it in terms of strength, cost, weight, flexibility and ability to be molded and transported. This substance underpins so much of the world’s progress. Skyscrapers are not made of brick or wood or some New Age material. They are built of steel. There's also a lot of steel in the computer I use. And most people probably drive to work in a car built with steel.

Iron ore can be found throughout the world, so in theory a lot of people could produce steel. But there really are only two places where it can be mined economically — Brazil and Australia — because it needs to be mined in pure quantities.

Brazil is home to a unique source of high-quality iron. When iron is mined it is often dropped directly into containers that are covered with blankets because it's so fine it can blow away in the wind, like baby powder. This makes Brazilian iron ore particularly good for blending with other grades because it lowers the cost of producing the ore in a blast furnace to make steel. It also increases the strength of the steel, so that high-quality iron ore generates a premium.

You can't invent that somewhere else. I’m not worried about Silicon Valley disrupting iron ore or some brilliant scientists in Switzerland discovering a different way to produce it. The market moves in cycles, so it will fall in and out of favor, but I feel reasonably confident that 50 years from now, production of iron ore will remain important.

4. Ride supertankers, limit moonshots

Jody Jonsson, Principal Investment Officer, New Perspective Fund®

33 years of investment experience

One observation over my career is that when there are regime shifts in the market, the stocks that represent the former leadership can take a long time to recover. Rotation away from the dominant companies can go on much longer than you think it can or should.

In the late 1990s-early 2000s period, some of the largest tech stocks went down 80% or more and stayed down for five to 10 years. And these were the strong companies that survived; many others went to zero. You needed a very strong stomach to hold on through this period. It took almost a decade for tech to regain market leadership again. Financial stocks behaved similarly after the financial crisis in 2008 — out of favor for another decade. In periods like these, you must consider that something has changed beyond just the valuation for these former leaders. Usually, the valuation corrects first and the fundamentals follow.

So how am I thinking about investing in today’s environment? I believe that we are experiencing “climate change” in the market, not just a passing storm. We need to avoid anchoring on past growth rates, profit margins or stock prices. Given the high level of uncertainty, I focus primarily on “supertankers” — dominant companies in their industries that generate solid cash flow, have strong competitive moats and can fund their own growth. I am investing more sparingly in what I would call “moon shots” — higher risk, higher reward companies that are more volatile — because in a rising interest rate environment, investors are less forgiving on valuations for more speculative companies.

I try to hold companies with reasonable, understandable valuations on near-term earnings and cash flows. Some examples include leading managed care providers or device makers in the health care sector, or nonbank financials such as insurers and exchanges that can benefit from rising interest rates and elevated trading volumes and are not overly sensitive to the economy.

5. Bear markets can be your friend

Steve Watson, Principal Investment Officer, International Growth and Income FundSM

34 years of investment experience

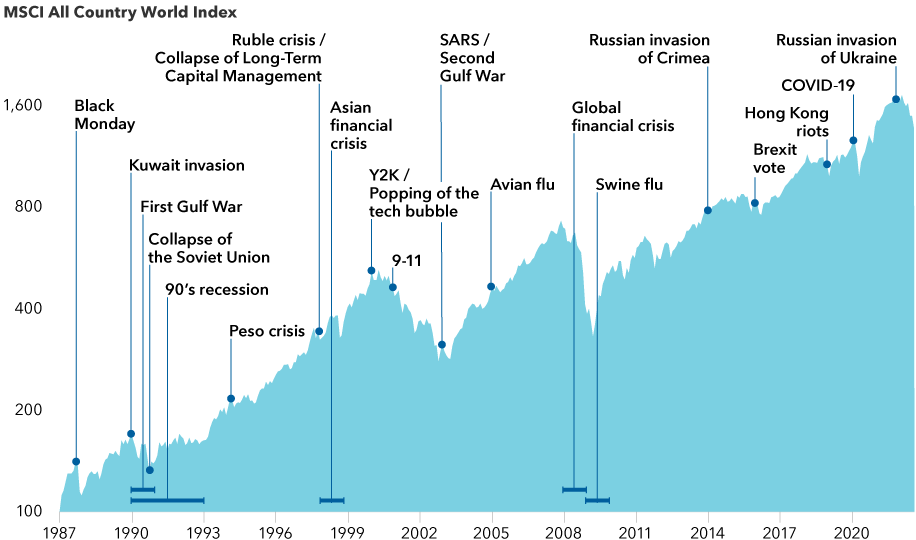

Over my career I have experienced 21 market shocks, including the collapse of the Soviet Union, the bursting of the technology bubble, the global financial crisis and now COVID-19. I mention these events only to highlight the fact that market disruptions are a fact of life. It’s just a matter of time before the train goes off the rails. My list suggests it happens every 18 months or so.

Market disturbances are a fact of life for investors

Sources: MSCI, RIMES. As of 6/30/22. Data is indexed to 100 on 1/1/87, based on the MSCI World Index from 1/1/87–12/31/87, the MSCI ACWI with gross returns from 1/1/88–12/31/00, and the MSCI ACWI with net returns thereafter. Shown on a logarithmic scale.

As long as I’ve been in this business, I’ve seen the market swing from excessive enthusiasm to extreme pessimism. An investor with a reasonable degree of objectivity can benefit from selling the former and buying the latter. It’s an approach that frequently causes pain and tends to pay off mostly during the early stages of market upturns, as pessimism gives way to optimism. Warren Buffett said it best: Be fearful when others are greedy and greedy when others are fearful. Put another way, bear markets are an investor’s friend, provided they remain calm, patient and focus on the long term.

I like to purchase shares when they are down and out, but I also like to hang on long enough to let the market catch up with what I think is the true value of the company in question. Despite my value bent, I remain a strong believer in the resilience of the tech sector. Entry point is important to me. Therefore, I will look to invest in some select tech companies when their shares are beaten down.

What’s more, I have long placed an emphasis on dividends as the primary way that a company transfers value to its investors. In my view, the potential for dividend payers to provide relative stability during market turbulence is more important than ever. And I continue to hold several high dividend payers, as well as dividend growers. The shares I invest in, like my own children, should pay rent to live with me.

Bottom line

Today, there are thoughtful, experienced economists and professional investors who can give you well-reasoned arguments why this bear market is different, why the economic problems are different and why this time things may get worse. But while some others might tell you, “This time is different,” our message to you is, “we’ve seen this before.”

“I don’t know if the current decline will fit into the pantheon of bear markets past,” O’Neal says. “But what I do know is that every bear period has eventually ended, and the market started back up again.”

Over time, and in time, the financial markets have demonstrated a remarkable ability to anticipate a better tomorrow even when today’s news feels so bad. While no one can predict the future and no two market declines are the same, we have been here before, and we’ve learned how to survive and prosper when markets begin to recover.

Investing outside the United States involves risks, such as currency fluctuations, periods of illiquidity and price volatility, as more fully described in the prospectus. These risks may be heightened in connection with investments in developing countries. Small-company stocks entail additional risks, and they can fluctuate in price more than larger company stocks.

The market indexes are unmanaged and, therefore, have no expenses. Investors cannot invest directly in an index.

MSCI All Country World Index is a free float-adjusted, market capitalization-weighted index designed to measure equity market results in the global developed and emerging markets, consisting of more than 40 developed and emerging market country indexes.

MSCI USA Index is a free float-adjusted, market capitalization-weighted index designed to measure the U.S. portion of the world market.

S&P 500 Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks.

MSCI has not approved, reviewed or produced this report, makes no express or implied warranties or representations and is not liable whatsoever for any data in the report. You may not redistribute the MSCI data or use it as a basis for other indices or investment products.

S&P 500 (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2022 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part is prohibited without written permission of S&P Dow Jones Indices LLC.