Chart in Focus

U.S. Equities

Value stocks, after seeming to spend an eternity wandering in the wilderness, have captured investor attention this year. For the three months ended March 31, 2021, the Russell 1000 Value Index recorded an 11.26% total return, far outpacing the 0.94% gain of the Russell 1000 Growth Index. Investors want to know: Will this rotation toward value-oriented shares prove to be a lasting one?

“There can be growing companies that are cheap and cheap companies that grow, so value and growth are not in opposition,” says equity portfolio manager Martin Romo. “We are in a target rich environment, and there are opportunities to invest in fast growing companies as well as classic cyclical companies."

As a portfolio manager for The Growth Fund of America®, Romo has a mandate to take a flexible approach to growth, seeking opportunities with classic growth stocks, cyclical stocks and companies in turnaround situations with the potential to generate capital appreciation.

Romo recently sat down with us to share how he is thinking about investing in today’s environment, the pandemic’s long-term impact on industries and what he believes are the most important innovations for the next decade.

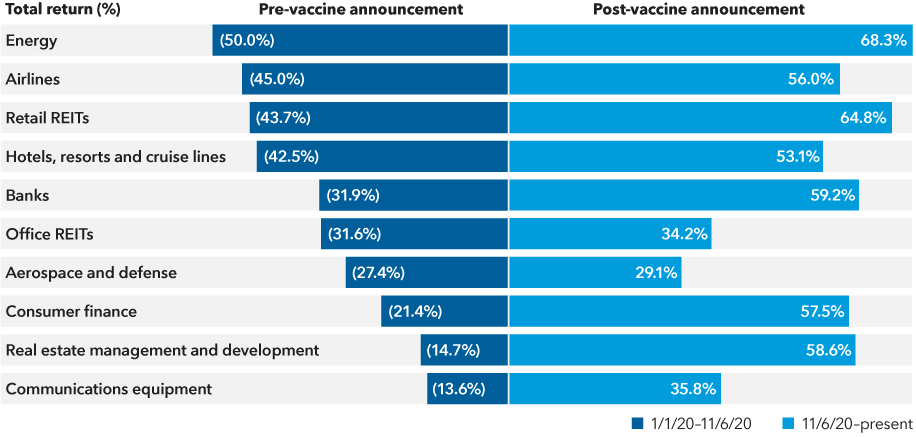

Turning point: A cyclical rotation may be underway

Sources: RIMES, Standard & Poor’s. November 6, 2020, was the last business day before the COVID-19 vaccine was revealed to have more than 90% efficacy against the virus in global trials. Data is as of 4/23/21.

Do you expect the recent rally in more cyclical areas of the market to continue?

As a former chemical analyst, I've spent a lot of time thinking through the cyclical implications, and there are clearly some powerful ones. We've got fiscal and monetary policy that's incredibly supportive of the stock market. But as a former cyclical analyst, I'm also a bit cautious. The enthusiasm in the market today for a recovery and a return to normal is quite startling to me.

I think there are some industries like commercial real estate and energy where COVID is a bit of an extinction event for their future fundamentals. To be clear, I don’t think these industries are going away, but the basis for making predictions about the fundamentals of their businesses has forever changed.

Some scientists have long theorized that the extinction of dinosaurs was the result of a giant meteor crashing into earth about 65 million years ago. Whatever the catalyst, dinosaurs did not survive dramatic shifts in the climate, whereas warm-blooded mammals did. Some industries will adapt and thrive after COVID; others may be more like dinosaurs and go into decline.

Do you view the COVID pandemic as an inflection point that will lead to major changes in the way we live and work?

I have spent a lot of time with Capital’s investment analysts trying to figure out how the pandemic will permanently change people’s behavior and how that might affect the long-term fundamentals of various industries.

What we found is that select companies are using the pandemic as an opportunity to adapt — to be like mammals, not dinosaurs — by using data, technology and analytics that could lead them to a much stronger competitive position and help us address some of the biggest issues we face in the U.S. today.

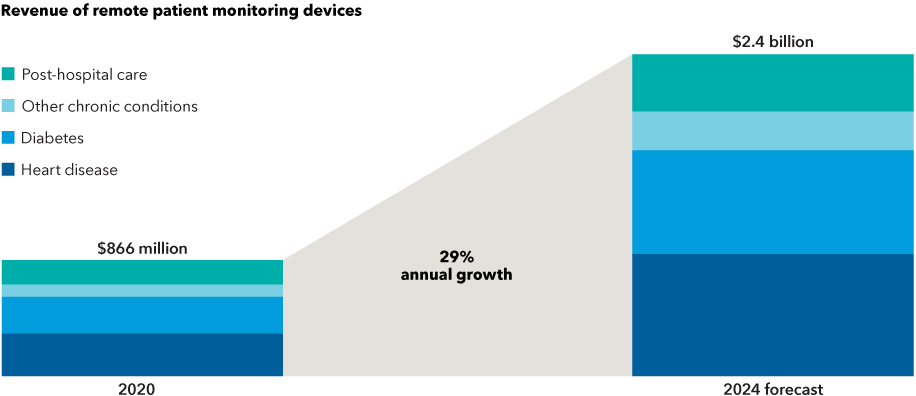

For example, health care is at a big inflection point and is changing for the better. Regulators have relaxed antiquated rules related to “in person” visits, and now doctors everywhere are doing virtual visits. We’re also seeing exciting innovation in wearable monitoring devices — including continuous glucose monitors, insulin pumps, implantable EKG loop recorders and connected sleep apnea devices — that are increasingly enabling physicians to monitor patients remotely.

Wider use of wearable monitors could help improve health care delivery

Sources: Industry & government data, Kagan estimates, Standard & Poor’s. Data compiled June 2020. Values in USD.

Can you share some of your thoughts on the most important innovations for the next 10 years?

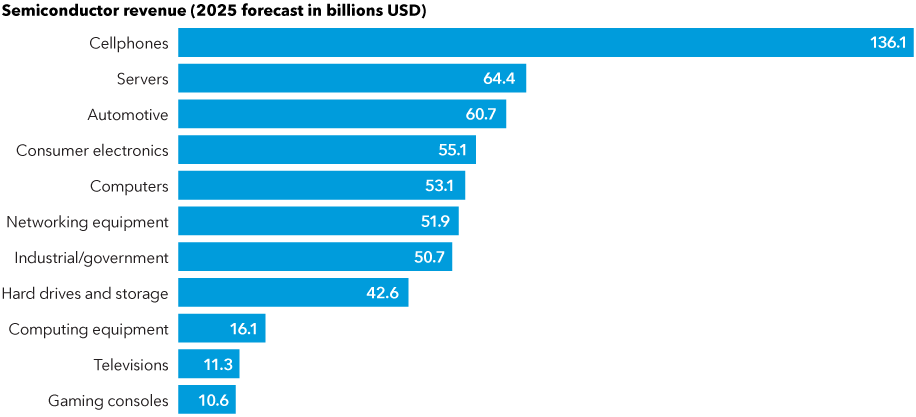

I view semiconductors as the single most important innovation of our generation. This innovation stems from World War II, so it’s not new. But like the cotton gin, railroads, electricity, oil and petrochemicals, and mass production, it has the power to drive industrial development for decades. Semiconductors have become central to telecommunications, the internet, data analysis, artificial intelligence, cars and physical products of all kinds.

Since about 1965, the computing power of semiconductors has doubled about once every 18 months to two years — so-called Moore’s law. We're now into cosmic measurements. And that's why it's impacting almost everything we do. As World War II was a leap forward in mass production, COVID, I think, is a leap forward in the capabilities of the semiconductor.

Recent chip shortages are a case in point. Companies can't get enough of them. Auto companies are struggling with their production costs, and countries are starting to say, “This is a strategic resource, and we've got to either develop our own domestic industry or find ways to capture production.”

Take, for example, specialty retailer Williams-Sonoma, which recently said its online sales have surpassed their physical store sales. They are using that leverage to renegotiate lease agreements, changing the economics of their physical stores as their online traffic has increased. They flipped the world from physical to virtual in one year and aren't turning back.

Companies like Mondelez, which spent billions of dollars and a great majority of their advertising budget on TV, are now getting a 25% greater return online and, in fact, 40% better than that if they think about Google and Facebook as their primary ad sources.

And then, in streaming content services, Netflix became the largest content creator in the world at more than $20 billion spend in 2020.

Semiconductors have enabled this flywheel of innovation and efficiency. The collection of data, the analysis of that data to develop a better product that draws more consumers, whose use generates more data, becomes a virtuous cycle of improvement and wider adoption. It is driving the cost of engagement down and the effectiveness of all our activity higher. And I believe we are still early in this cycle.

Chip suppliers fuel the power behind great products

Sources: Capital Group, Bloomberg. Data represents semiconductor revenue in 2025, as forecast by Bloomberg, categorized by its end-use product. Estimates are the latest available as of 3/31/21.

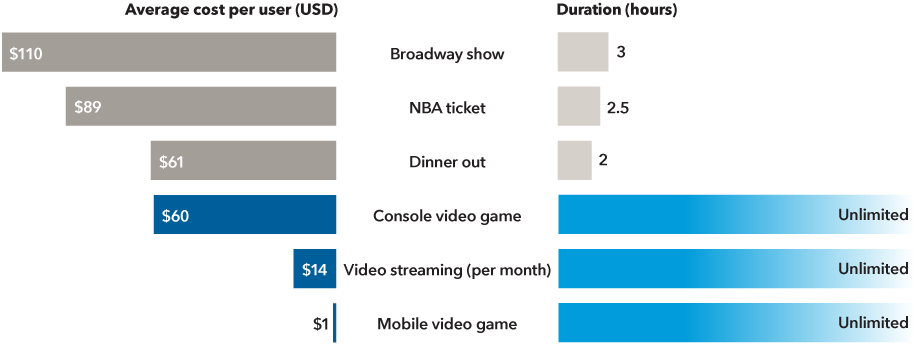

What are your thoughts about the growth potential for streaming content and video games?

I remember hours and hours spent on my Atari 2600 when I was 10 or 11 years old. Today’s gamers enjoy unlimited use in an interactive format. Considering the relevance and potential adoption of this form of entertainment by the next generation of consumers, the potential return on the dollar is compelling.

Total global spending on games was up 20% last year to $180 billion. Keep in mind that the global movie industry peaked in 2019 at $100 billion. So it's one of these quiet, overnight stories that really isn't overnight, and the thing that's fascinating is that games aren't just participatory. They're spectator sports that are going to take on Broadway and the NBA. Many of these online players collect multimillion-dollar annual contracts in addition to endorsement deals.

Consider that Amazon Twitch, one avenue of spectating, has 1.9 billion hours per month in viewership. That compares to the NFL at 1.65 billion per month. That’s remarkable — and these games are only getting more immersive. There's a company called Roblox that represents a generation of kids — most of them under 15 — who not only are playing in this collective universe with their friends, but they're actually developing games for each other.

The foundation for companies that can leverage these opportunities is profound. So I will watch gaming closely as it continues to encroach on other forms of entertainment.

Streaming entertainment will take center stage

Source: Capital Group. Broadway show cost from Jefferies, as of July 2019. NBA ticket cost from Barrytickets for 2018–19 season. Console video game cost from Business Insider, as of October 2018. Video streaming cost is for a standard monthly Netflix subscription as of December 2020.

When do you think life will get back to the “new normal?”

We're in the business of figuring out the “what,” not the “when.” Most of our competitors are looking for the when. When will COVID be over? When will rates go up? Neil deGrasse Tyson is famous for talking about the difference between climate change and weather prediction. And he uses a great example where he's walking his dog on a leash on the beach. He's walking to a flag, and his dog is wiggling back and forth. And he says, "I'm climate change, and the dog is weather prediction." And we have the benefit at Capital Group of looking forward and looking at elements of climate change that are happening within a company, within an industry, but we also look back to learn lessons from history.

You may be surprised at how much we talk about the principles of our company's foundation in 1931, and how we still hold those commitments to research, a long-term focus and objective-based investing. We take the responsibility of being stewards of capital for our investors incredibly seriously. We've been here for 90 years, 13 market crashes, 15 recessions, 16 presidents, one world war and now a pandemic. But our principles haven't changed. It's a remarkable testament to the success of the model. To use my earlier metaphor, I like to think we’re more like mammals than dinosaurs, adapting to a changing world while staying true to our fundamental DNA.

Investing outside the United States involves risks, such as currency fluctuations, periods of illiquidity and price volatility, as more fully described in the prospectus. These risks may be heightened in connection with investments in developing countries. Small-company stocks entail additional risks, and they can fluctuate in price more than larger company stocks.

The Russell 1000 Growth Index measures the results of the large-cap growth segment of the U.S. equity universe.

The Russell 1000 Value Index measures the performance of the large-cap value segment of the U.S. equity universe.

Standard & Poor’s 500 Composite Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks.

The market indexes are unmanaged and, therefore, have no expenses. Investors cannot invest directly in an index.

Bloomberg® is a trademark of Bloomberg Finance L.P. (collectively with its affiliates, “Bloomberg”). Barclays® is a trademark of Barclays Bank Plc (collectively with its affiliates, “Barclays”), used under license. Neither Bloomberg nor Barclays approves or endorses this material, guarantees the accuracy or completeness of any information herein and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). © LSE Group 2021. FTSE Russell is a trading name of certain of the LSE Group companies. FTSE® and Russell® indexes are trademarks of the relevant LSE Group companies and are used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication.

Standard & Poor’s 500 Composite Index is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2021 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

This report, and any product, index or fund referred to herein, is not sponsored, endorsed or promoted in any way by J.P. Morgan or any of its affiliates who provide no warranties whatsoever, express or implied, and shall have no liability to any prospective investor, in connection with this report. J.P. Morgan disclaimer: https://www.jpmm.com/research/disclosures.

Investing outside the United States involves risks, such as currency fluctuations, periods of illiquidity and price volatility. These risks may be heightened in connection with investments in developing countries.

Martin Romo

Martin Romo