Economic Indicators

Dividends

Over the last 18 months or so, it’s been easy to be dazzled by glitzy growth stocks, as the technology-laden “Magnificent Seven” companies flew much higher than other parts of the S&P 500.

But growth, as important as it is, isn’t the only metric that matters. Steadiness can be critical, especially for investors who fund their lifestyles with the proceeds of their holdings. While rapidly appreciating stocks can plump portfolios, relying too heavily on such highly volatile equities can be risky when seeking sustainable income. Case in point: “Magnificent Seven” member Tesla raced from less than $30 in late 2020 to more than $400 a year later. But various challenges have tugged at it since then, with the stock finishing the third quarter at less than half its peak. And to say it fluctuates would be a vast understatement. In the year ended March 31, it swung more than 5% higher or lower from the previous day 20 times.

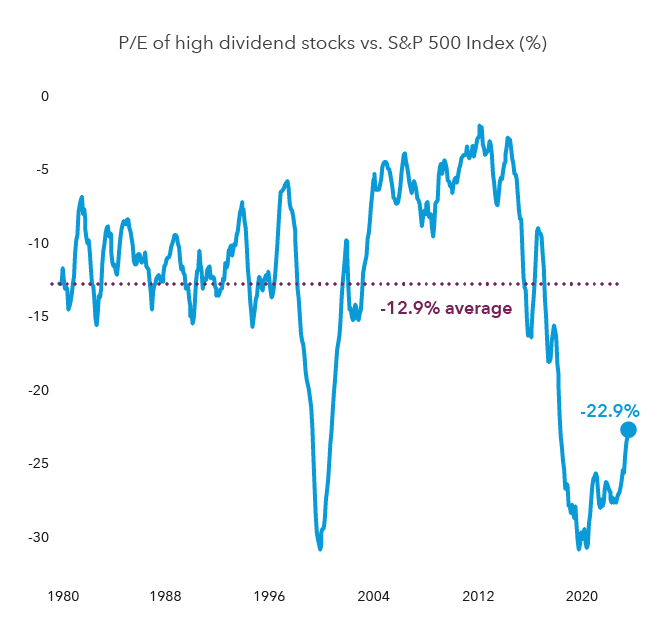

One way to help cushion gyrations in the broad market: Dividend-paying equities. Dividends are cash payments made by companies to their shareholders, so such stocks offer income alongside the potential for price appreciation. They’re not a substitute for bonds in a diversified portfolio, but they can be an important part of a strategy that seeks to smooth out volatility. Today, they’re also attractive for another reason: dividend-payers as a group appear to be undervalued. That's not just against the expensive big technology stocks, but also on a historical basis. That means they may have a long runway for growth.

Of course, dividends should not be a sole point of reference when evaluating equities. Just as there are many kinds of growth stocks, there are many types of dividend-payers. For example, high yields might look attractive, but they can actually signal company weakness. Additionally, while dividend income can help counteract portfolio volatility, it’s not guaranteed to smooth overall results.

There’s an art to finding opportunity in the dividend space.

Dividends are often expressed as yields, which are the ratio of a company’s per-share payouts to its share price. For example, if a company’s annual dividend is $1 per share and its stock is $100, its yield is 1%.

Yields are useful because they give me a sense of how high a stock’s dividend may be, but they don’t tell me anything about a leadership team’s capital allocation or dedication to shareholders. In fact, yield can be misleading in certain circumstances. Because it’s a ratio, it tends to move in the opposite direction of the stock price — that is, if nothing else changes, a company’s yield would fall as its share value rose, and vice versa. That can lead to scenarios where a struggling business trots out a very high yield to attract investors. In other situations, a yield might fall because of a banner year that drives up its share price. Microsoft offers a good example: It paid more total dividends than any other company in 2023, but its yield fell significantly amid a phenomenal advance in its share price.

I prefer to examine the total annual dividends a business has paid out over several years. Companies that consistently increase total payouts show fiscal discipline and consideration for shareholders, two admirable qualities that often reflect good management. Pair that with other signals of a successful and well-run business, such as growing revenue and profit, increasing market share, good return on investment and the like, and I’m interested — if the price is right.

Valuations for high dividend payers are far below the market average

Sources: Capital Group, Goldman Sachs. High dividend stocks refer to the cohort of stocks in the S&P 500 Index with the highest quintile dividend yield (sector-neutral) within the index. Line represents smoothed six-month average. P/E ratio = price-to-earnings ratio. Past results are not predictive of results in future periods. As of March 31, 2024.

Investors have shunned dividend-payers and dividend-heavy sectors, and that has created potential opportunities.

It’s an interesting environment to be a portfolio manager in income-oriented funds. Not long ago, we were finding many opportunities in semiconductors and similar technologies, with some solid and attractively priced companies offering yields as high as 3% — well above the market average. However, interest in artificial intelligence has driven up share prices, with many companies now yielding close to 1%. That’s great from a capital-appreciation standpoint, but it doesn’t do much for investors who seek income.

Today, I see a lot of potential in traditional dividend areas, such as financials and utilities. Investors have neglected these stocks and many of them seem to offer good value. That’s not just relative to very rich growth stocks or even the broad market — many of these companies are less expensive than their historical valuations.

I’m also interested in health care. This sector has some unusual drivers right now that could affect near-term valuations. For example, we’re closely watching how new weight-loss drugs will impact various companies. I think the market has been a little too broadly negative in health care on concerns that healthier consumers will need less and less-expensive medical intervention. I think a lot of the companies with above-market yields could offer decent growth at a good price.

Another potential benefit of traditional dividend-paying sectors is they typically have very different drivers than boldface tech names. I believe many of them are well positioned to better hold their value if a setback were to yank big equities back to earth. Considering the high level of concentration in U.S. markets, it’s critical to be mindful of diversification.

Related Insights

Related Insights

-

-

-

Long-Term Investing

Aline Avzaradel

Aline Avzaradel