Economic Indicators

Long-Term Investing

The market has a history of rewarding those who look through short-term ups and downs

In theory, the early stages of a stock market recovery should spark joy. After all, a lengthy selloff is finally giving way to a long-awaited rebound. The problem, of course, is that investors don’t yet know that a durable recovery is underway. It’s impossible to tell if a nascent upturn is a definitive turning point or just a momentary respite on the way to a deeper drop.

In uncertain moments, the natural instinct can be to proceed cautiously — to wait on the sidelines until clear signs emerge. That sentiment is on display today, with assets in money market funds swelling to an all-time high. The hesitation is driven by an assortment of challenges, including rising interest rates, higher gas prices and the specter of a potentially drawn-out autoworkers’ strike.

However, these concerns have an element in common: They’re focused on the short term rather than the long term. Quite frankly, it’s always easy to come up with reasons not to invest. Even in the hardiest of economies, there are plenty of short-term indicators, business trends and political developments to worry about.

“When we talk about risk, we always want to talk about it over a certain time period,” says Ed Gonzalez, a portfolio specialist at Capital Group Private Client Services. “If you’re always managing risk for just one year, you’ll stay in cash your whole life. You’ll never reap the potential benefits of investing in companies for the long term.”

Indeed, a fixation on short-term hazards overlooks a powerful historical truth: Markets have reached new heights after every downturn. And while past results do not dictate the future, bull markets have historically been far more powerful and prolonged than the bear markets preceding them. For example, in the 70 years ended September 30, 2023, the S&P 500 has returned an average of 10.99% per annum, despite the COVID pullback of 2020, the global financial crisis of 2008, the dot-com crash in 2001, Black Monday in 1987 and the doldrums of the 1970s.

This suggests that investors who stay the course with a balanced portfolio are better positioned over time. Furthermore, it implies that short-term fluctuations aren’t a barrier to desirable results over long periods. In other words, getting invested and staying invested, even when volatility is high, has historically been a better option than remaining on the sidelines.

With markets overall advancing this year after a dismal 2022, it’s worth taking a moment to examine the nature of recoveries and how they can affect investors, and to share a few practical steps that investors can take in pursuit of their goals.

Recoveries have favored investors who stayed the course for the long term.

Market recoveries are the periods directly after a bear market hits its bottom. As businesses slowly adapt to more favorable economic and business conditions, stocks begin to reclaim lost ground. Historically, these periods segued into expansions, when markets rode a new wave of growth and exceeded previous highs. Together, these bull market periods have tended to be longer and more powerful than bear markets. That might be scant consolation in the middle of a downturn, when a selloff can feel like it’ll never end. But over the long term, bull markets have been much more meaningful than bears.

For example, since 1950 through June 30 of this year, bear markets have lasted an average of 12 months. That’s a significant chunk of time, but it pales before the average bull market of 59 months. There have been outliers, but that stark difference shows just how much more time markets have spent growing than contracting. Historical returns have been just as dramatically lopsided: The average bull market enjoyed a 265% gain — nearly fourfold growth — while bear markets averaged about a 33% contraction.

It’s critical to note that recoveries have rarely been smoothly upward sloping and that downturns do not provide clear signals when they’re about to break. Investors who attempt to time the market, pulling their money out at the first signs of trouble and reinvesting when things begin to turn up, can lock in losses while missing the best days.

“We’re investing for generations, and I think investors should think about their assets in terms of generational wealth,” Gonzalez says.

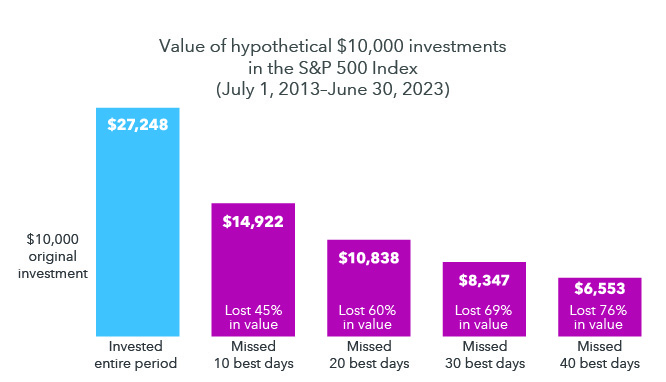

Missing just a few of the market’s best days can hurt investment returns

Source: RIMES, Standard & Poor’s. Values in USD and exclude the impact of dividends. Past results are not predictive of results in future periods. As of June 30, 2023.

Consistently missing upswing days can really cut into returns, as illustrated by a Capital Group analysis. In the five biggest bear markets since 1929, the average return in the first year after markets troughed was an astounding 70.9%. However, that return was often sprinkled among a relatively small number of days. We analyzed the last 10 years of S&P 500 returns, through June 30, 2023, and found that a hypothetical $10,000 investment in the index would have nearly tripled over that period, to $27,248. However, if that same portfolio had missed the 10 best trading days, its value would have been only $14,922 — nearly half.

The takeaway is that, whenever possible, investors should think about markets in terms of time invested, not timing. Despite new technology and reams of data, markets continue to resist short-term predictability. Taking your money out of the market on the way down means that if you don’t get back in at exactly the right time — a moment that’s rarely if ever telegraphed — you can’t capture the full benefit of any recovery.

There’s no time like the present to invest.

One of the truths of recoveries — that they have never taken a smooth ride up — can feel insurmountable if you focus on short-term losses. Instead, extend your time horizon to focus on the long-term growth potential of your investments and the progress made toward your goals.

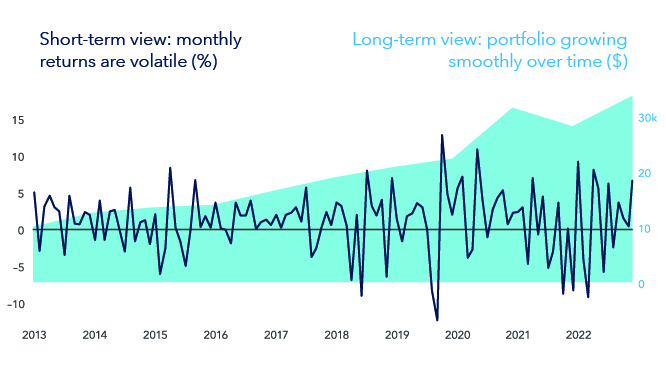

Two views of the same hypothetical investment tell very different stories

Source: Standard & Poor’s. Short-term view represents the S&P 500 Index and reflects monthly total returns from June 30, 2013 through June 30, 2023. Long-term view represented by a hypothetical $10,000 initial investment in the same index over the same period. Past results are not predictive of results in future periods. As of September 30, 2023.

Consider the following chart, which shows contrasting perspectives of the same hypothetical investment. The short-term view is one that many investors have of their portfolios — tracing the percentage change in returns over short periods of time. The long-term view plots the investment over the same period but instead shows the annual change in portfolio value. With this perspective, the short-term fluctuations of the jagged line have smoothed out over time, and the picture of a growing portfolio becomes clearer.

The flip side is that there has never been a bad time to make a balanced investment. Today’s economic and geopolitical challenges may seem unprecedented, but a look through history shows there have always been such forces at play, from the European debt crisis to periods of labor unrest in Europe to uncertainty about China’s economy. Despite negative headlines, the market’s long-term trend has always been positive. In fact, great investment opportunities often emerge when investors are feeling most pessimistic.

Consider a hypothetical investment in the S&P 500 on December 7, 1941, the day Pearl Harbor was bombed. That investor would suffer serious losses in the next several days and weeks, but if the investor persevered and stayed invested for the next 10 years, the result would be an average annual return of 16%.

Likewise, a hypothetical $10,000 investment in the S&P 500 on September 15, 2008, the day Lehman Brothers declared bankruptcy, would have grown to more than $30,000 a decade later.

Investing is like gardening — you need to keep up the maintenance.

It’s important to remember that a long-term investor is not the same as a “set it and forget it” investor.

Holdings naturally tend to shift over time. Assets appreciate at different rates, which has tended to make portfolios riskier over time as more-volatile growth holdings outpace steadier securities, such as bonds. But every part of your portfolio plays a role. To that end, there are a few items you can discuss with your Private Wealth Advisor to make sure your investments are on track.

Run a portfolio checkup.

Whether you stayed invested or shifted some assets into cash over the past few years, your holdings almost certainly look different than they did before this year’s advance. Although Capital Group Private Client Services occasionally updates portfolio mixes to keep holdings aligned with your investment plan, it might be helpful to take stock of what you have.

Your Private Wealth Advisor can help analyze your holdings or run a Wealth Strategy Analysis to assess whether your asset mix still supports your investment goals.

Make sure your bonds are on track.

Fixed income can help soften short-term market noise and help you remain focused on longer-term goals. But it’s very easy for your stock-bond allocation to drift, especially when share prices are rising. When reviewing your equities, take time to gauge whether your bonds are still fulfilling their roles.

Remember that not all bonds are built the same. Fixed income can help provide resilience amid equity uncertainty, but only when it’s not correlated to stocks. It’s often tempting to reach for more yield, but the highest yielding securities often gain or lose value in tandem with stocks.

The role of core bonds is to anchor equities, not to drive overall growth. For high net worth investors, municipal bonds can provide a unique advantage in this part of their portfolios. These holdings often pay out less than traditional bonds, but they typically enjoy significant tax benefits — and that can represent a significant bump in after-tax returns.

Your time horizon isn’t the only place where you can take a wider view.

Many investors are focused on the U.S., and with good reason: Most of the companies topping this year’s strong returns are U.S.-based. However, there’s a benefit to broadening your horizons because opportunities exist everywhere. Over the last prolonged bull market, three-quarters of the top-returning stocks each year were from companies based outside the U.S.

“We like to lean into global strategies because we trust our analysts and our portfolio managers to choose great companies, wherever they are, anywhere in the world,” Gonzalez says. “We think that’s one of the best ways to get diversification and international exposure.”

Additionally, many of the most prominent U.S. stocks have become expensive, meaning the market might already be valuing them today for expected revenue growth over the next several years. They also tend to be highly concentrated in technology. If something pulls down one such company, it may very well tug down others.

Together, that suggests a lopsided risk ratio — potentially limited stock-value growth and reduced diversification. That’s not to say these businesses won’t do well or that they don’t have a place in a portfolio, but it is a reminder that investors need to take into account more factors than just recent returns when evaluating their portfolios.

S&P 500 Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks. This index is unmanaged, and its results include reinvested dividends and/or distributions but do not reflect the effect of sales charges, commissions, account fees, expenses or U.S. federal income taxes.

The S&P 500 Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2023 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part is prohibited without written permission of S&P Dow Jones Indices LLC.

Related Insights

Related Insights

-

-

-

Long-Term Investing

Ed Gonzalez

Ed Gonzalez