Economic Indicators

Market Volatility

A “soft landing” looks more likely but inflation remains a question mark.

Just a few months ago, the economic consensus seemed straightforward — a bit dispiriting but at least clear cut. An assertive Federal Reserve was pushing up interest rates to stanch inflation. History suggested that repeated rate hikes would clip the job market and depress consumer spending. In other words, a recession seemed to be on the way.

However, a soft landing, in which long-term inflation is brought to heel without cracking the economy, seems within reach as 2023 draws to a close. Inflation is down markedly, with all-important “core” prices appearing to have peaked. The labor market continues to impress even as wage pressures subside.

“Resilient labor markets are helping support consumer spending growth, while inflation is slowing and business investment is rebounding,” says Capital Group economist Jared Franz. “I’ve reduced my recession probability — not eliminated it — and, while uncertainty is elevated today, I see a soft landing as the most likely scenario.”

Of course, the economy still faces plenty of headwinds, and a recession — albeit what would likely be a mild one — remains a distinct possibility. Inflation is still nearly double the Fed’s preferred level, with gas prices serving as a regular reminder of that. Higher interest rates could extract their pound of flesh as time wears on. Other risks range from the auto workers’ strike to the periodic specter of government shutdowns to the economic challenges in China. The incipient war in the Middle East adds additional uncertainty.

Underlying it all is the fact that even in calm environments economic forecasts can be dicey. On-the-ground conditions can shift quickly and economic cycles can start or stop with a lurch. That opacity tends to worsen after turbulent, world-shaping events — and there’s no playbook for how to overcome the inflation and supply chain knots stemming from the pandemic.

“I think the economy is entering a proving ground as to how quickly inflation can return to 2%,” says Capital Group economist Darrell Spence. “Current inflation was born of the COVID-19 pandemic, and there are no models for exactly how this is supposed to work out.”

A “rolling recession” may mask the cumulative hit to the economy.

Beyond resilience in the labor market and the animal spirits of U.S. consumers, another factor may explain the absence of a broad-based contraction. Instead of a simultaneous and widespread downturn, corporate America has endured scattered pullbacks.

In other words, a “rolling recession” has bulldozed different industries at different moments, inflicting deep pain on each but not enough to cumulatively tug GDP into negative territory.

For example, rising interest rates lashed the housing market last year. Semiconductor stocks were bloodied around the same time. Meanwhile, the travel industry was rebounding powerfully, but only after having been pulped during the global pandemic. Technology shares surged over the summer amid boiling excitement over artificial intelligence.

One potential helpmeet could already be in place: The Inflation Reduction Act and the CHIPS Act earmarked funds for research and manufacturing that could spur productivity. An efficiency boost could offset the impact of wage growth by effectively lowering per-unit costs.

“I have been a U.S. productivity bull for a long time,” Franz says. “I think the industrial policy implemented in recent legislation could be a real boost. I’m also bullish on generative artificial intelligence, which could help many industries become more efficient.”

Inflation could prove more difficult to tame than markets anticipate.

Though U.S. inflation has fallen significantly — August’s 1-year inflation was 3.7%, far lower than last year’s peak of 9.1% — it’s still well above the Fed’s target of approximately 2%.

“The dream scenario for the Fed is if growth, inflation and labor costs all moderate at the same pace,” Spence adds. “But reducing inflation all the way to 2% may require generating more slack in the labor market — that is, pushing the unemployment rate up. That’s basically the definition of a recession.”

And while there are signs of continued improvement, they’re not across the board: Spence cites medical care as one of the areas in which prices are still growing.

“In my view, core inflation will likely continue to fall, but I think that pace will slow,” he says. “I think there is a high probability that price growth could get stuck at a level reasonably higher than the Fed’s target.”

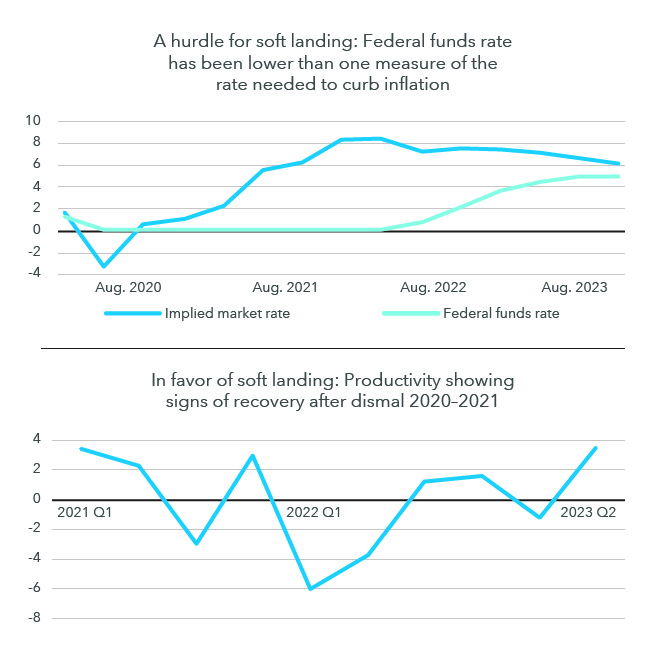

Indeed, some measures suggest that today’s elevated interest rates might not be sufficient to fully bring inflation under control, Spence explains.

Expectations are growing for a soft landing, but not all the signals are clear cut

Source: Bureau of Labor Statistics, Federal Reserve Bank of Atlanta. Implied market rate is defined as the Taylor rule, which seeks to find a federal funds rate that would account for various market conditions when trying to keep inflation at the Federal Reserve’s target rate (in this case, of approximately 2%). As of September 30, 2023.

There’s also the chance that a soft landing might only push the problem forward: A Capital Group analysis of past soft landings — defined as three quarters of below-potential real GDP growth without any contractions — showed that the economy tended to accelerate in subsequent periods. That could force the Fed to tighten during a future recovery to keep inflation from taking off again, Spence says.

“My concern is that a recession might be the only way to reduce inflation to 2%,” he adds. “A soft landing might not free up enough resources.”

Long-term investors should look beyond short-term market movements.

Franz notes that markets have a history of turning quickly, so he suggests that investors be prepared for a variety of conditions and look through any downturn.

“The strength of the post-COVID labor market prevented a deep downside,” he says. “Looking to next year, I think resilient and broad economic growth could be a tailwind, even if we have to get through some pain to get there.”

Spence cautions that elevated recession risk makes economically defensive securities more attractive, especially in a world where 10-year Treasury yields are nearing 5%. The bright side, he says, is that high-volatility situations are nothing new for seasoned investment professionals.

“Volatility has happened many times before, and it will happen again,” he says. “It’s like flying. In clear skies, the ride is smooth, but once you get into the clouds, things can get turbulent. Passengers might not like it, but the pilots don’t get nervous — they stay the course. They know it’s part of the journey.”

Related Insights

Related Insights

-

-

-

Long-Term Investing

Darrell Spence

Darrell Spence

Jared Franz

Jared Franz