Economic Indicators

Asset Allocation

There’s an old mantra for success you’ve probably heard: “Buy low and sell high.” The maxim’s broadly right, but I’ve always been unsatisfied with it — it’s a little too simple for my taste. It glosses over too many critical components of investing, such as dedicated research and the importance of a long-term perspective. But perhaps more important, the saying doesn’t account for all the ways that an investor’s own state of mind can get in the way of his or her ability to stick to a long-term strategy designed to help them achieve their financial goals.

The traps are as common as they are compelling. Due to the pain associated with losing money, many of us have the natural impulse to sell when markets are falling, potentially offloading securities when they’re at their cheapest. On the flip side, I’ve seen many investors pursue soaring markets on the assumption that the upward momentum will never end. Just a few of these missteps can stall a portfolio’s long-term growth — after all, they could result in selling low and buying high.

For these reasons and more, I urge investors to embrace a practice called rebalancing. At its core, rebalancing is intended to keep your overall asset allocation in line with your goals and risk tolerance. In practice, it ensures that you incrementally adjust your portfolio to maintain your target mix of generally steady investments like bonds and potentially faster growing securities like stocks.

Committing to a systematic rebalancing process can help investors rise above sometimes difficult decisions, such as taking profits after markets have dramatically risen, staying the course when markets decline and even buying on dips to return to asset allocation targets.

In short, rebalancing can help investors make small decisions and lean into buying low and selling high, rather than trying to make big — and much more difficult to forecast — decisions around market peaks or troughs. Rebalancing is all about risk management and aiming to keep your portfolio aligned with your goals.

Rebalancing can help you stick to your long-term investment plan.

When Capital Group Private Client Services rebalances portfolios, which we do on a regular cadence, I’ll sometimes get questions from clients about our thinking. I’ve been asked why we trimmed stocks when markets are very strong and added often steadier — but sometimes unexciting — fixed income.

The answer comes down to our commitment to the long-term plan we help each client establish. Those plans aren’t off-the-shelf, one-size-fits-all solutions. They’re carefully calibrated on an individual basis to help clients pursue their goals while respecting how much risk they’re willing and financially able to take. However, a plan only matters insomuch as clients stick with it, and rebalancing is an important tool to help investors stay focused and disciplined.

I’ve found that rebalancing is a particularly valuable tool during periods of high stress, such as market downturns. When stock prices fall, the impulse to sell and avoid further losses can be powerful. Staying focused on the long-term plan can prove critical — not merely as an exercise in discipline but because sharp market movements literally change portfolio composition.

Historically, in periods when equity prices fell, core bonds tended to do well. Even in the rare instances when both fell, as they did in 2022, core bonds still typically fared less badly. That means portfolios naturally tend to become more conservative in down markets as their asset mix skews toward bonds. This effect can make achieving growth-focused investment goals far more difficult, as portfolios simply may not have enough exposure to equities when a recovery begins.

This means that when stocks are doing badly, sticking to the long-term plan can require rebalancing back toward equities — potentially purchasing them in a volatile period. That can feel unintuitive, but it makes perfect sense from a long-term perspective. Not only are investors moving back toward the risk profile they initially sought, but they’re doing it when prices are low — the “buy low” half of the old maxim.

Rebalancing also has a place in healthier markets. That’s because equities have historically tended to grow faster than bonds over extended periods. As a result, many portfolios run the risk of becoming much more stock-focused (and consequently more exposed to volatility) than originally intended. In these cases, periodically trimming equities and adding fixed income is designed to keep the portfolio aligned with the investor’s goals without adding more risk than he or she anticipated. Many investors will appreciate that when market downturns occur at some point in the future. And consciously trimming stocks to return to target when they’re doing well helps investors stick to the “sell high” half of the equation.

Rebalancing is an ongoing effort.

The unusual conditions of 2022, in which equities and bonds both fell, meant that many investors didn’t need to do much to keep their asset class allocation in line with their long-term plans. That doesn’t mean they don’t need to worry about their mix going forward, though. Historically, stocks have tended to recover quickly when they found their feet after a downturn. And bonds are in an interesting position, too: The interest rate hikes that pummeled them in 2022 are now powering handsome yields. In short, conditions are ripe for portfolios to get out of balance.

One of the ongoing ways that Capital Group Private Client Services keeps portfolios in balance is through thoughtful sourcing of cash flows. We tend to make distributions from whichever part of a portfolio is overweight, for example, and that can be a small but effective way to nudge portfolios back into alignment. Similarly, when new funds are added to a portfolio, we can purchase underweight components.

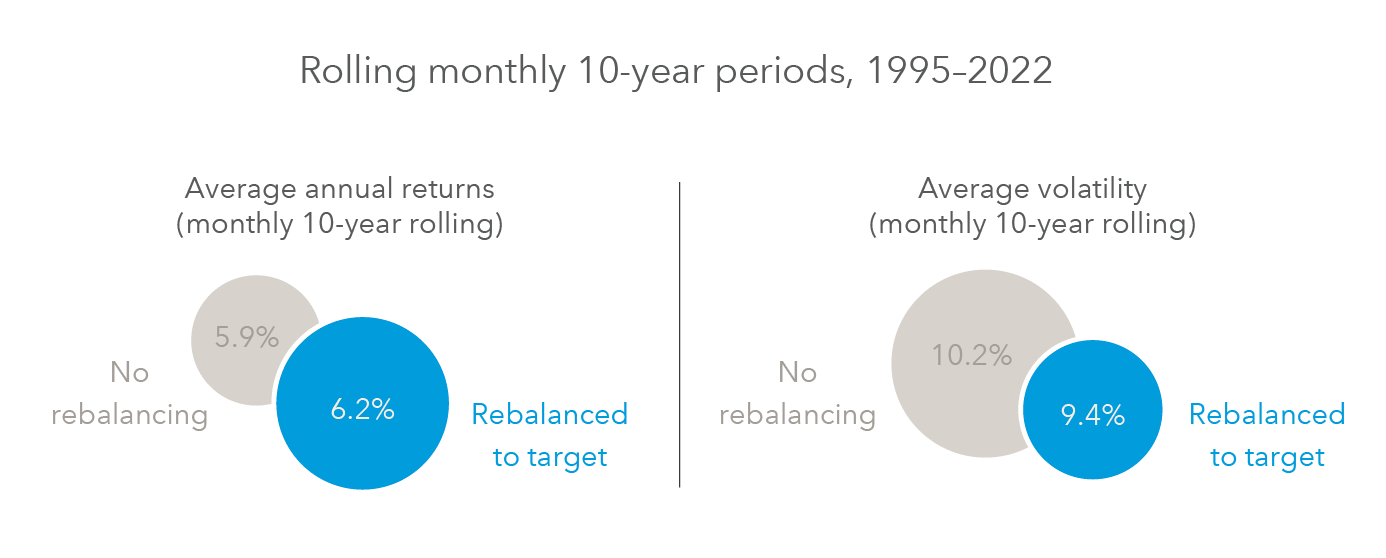

Rebalancing offered higher returns, lower volatility in hypothetical portfolios

Sources: Capital Group Private Client Services, Morningstar Direct. The hypothetical portfolio allocation consists of 60% stocks and 40% bonds. Stocks are represented by MSCI ACWI index. Bonds are represented by Bloomberg Municipal 1-10Y Blend Index. Results reflect the reinvestment of dividends, interest and other earnings. Results are presented in US$. Rebalancing assumes 5% absolute limits. Rebalancing occurs when equity allocation moves above 65% or below 55% of the total portfolio. The average of rolling monthly 10-year returns represents the annualized average of the 120-month returns of the portfolio before accounting for taxes. The average volatility is represented by the standard deviation of the 120-month portfolio values before accounting for taxes. Calculations are based on monthly 10-year rolling periods beginning 1/1/1995 and ending 12/31/2022. Neither Morningstar nor its content providers are responsible for any losses arising from the use of this information. The indices are unmanaged and, therefore, have no expenses. Investors cannot invest directly in an index. Past performance is no guarantee of future results.

And perhaps most important to investors, our research shows that rebalancing can help boost results and lower volatility. Capital Group wealth planning professionals examined hypothetical portfolios that were 60% stocks and 40% bonds for 10-year rolling periods from 1995 to 2022. One set of the portfolios was not rebalanced, while the other set was rebalanced whenever its asset class mix drifted more than 5 percentage points away from that 60/40 split. They found that the untended portfolios would have had an average annualized return of 5.9%, but the rebalanced portfolios would have returned 6.2% while experiencing less volatility.

For me, rebalancing is an elegant way to stay focused and make smart decisions. This simple discipline, applied incrementally and consistently, helps protect investors from facing a singular market timing decision. That’s why we keep tabs on each client’s asset class allocation and regularly make adjustments to help preserve the intended target mix.

Related Insights

Related Insights

-

-

-

Long-Term Investing

Sandra Morelli

Sandra Morelli