Economic Indicators

Long-Term Investing

Investing can feel daunting at times. From periodically unforgiving markets to mystifying jargon and opaque mathematics, I understand why smart and capable people sometimes approach financial decisions with trepidation. As a wealth advisor, it’s my job to cut through that noise to help clients make sensible decisions with an eye on the future.

Part of the way I do that is to get clients thinking about their goals. After all, investment plans should reflect investor ambitions. However, when I first work with a client, I’ve often found that their portfolio has grown out of sync with their goals, or it was built on truisms that may not apply to high net worth investors. Solving this problem takes a little reflection and often, if the portfolio has to change, a little gumption. But ensuring your holdings are helping you pursue your goals is an important part of being an investor.

Consider retirement. Conventional wisdom says retirees should have a higher portion of core bonds to help protect capital and generate steady income. That’s a perfectly fine solution for some of my clients, who simply want to maintain their lifestyle and either don’t like or cannot afford to take the potential volatility that’s historically been part and parcel of owning equities.

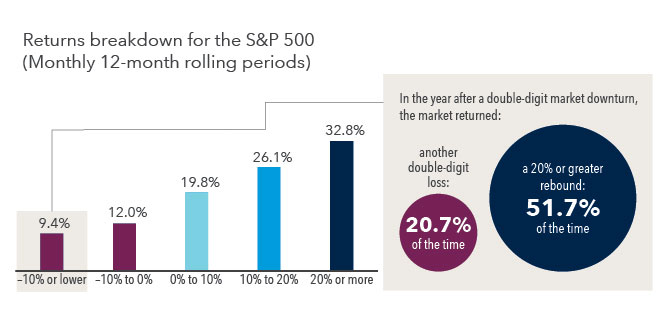

Sustained market downturns have been rare

Source: S&P Dow Jones Indices LLC, Capital Group. Monthly 12-month rolling periods from Feb. 1, 1941, through May 31, 2023. Past results are not predictive of results in future periods. As of June 27, 2023.

However, for many investors who have more than enough money for the rest of their lives, a heavily conservative portfolio can be more limiting than liberating. Historically, investments that are good at preserving wealth have not been strong growers, and focusing too heavily on them can make it hard, or even impossible, to achieve long-term goals.

It’s one of the reasons why I urge my high net worth clients to regularly think about and review their objectives. Not only does it help keep their portfolios focused on what they really want to achieve, but it’s a reminder that they’re in the fortunate position of being able to think about long-term goals that might yield ongoing financial benefits for future generations. Said another way, they likely have high “risk capacity.”

Goal-setting is a multifaceted process, and portfolios should reflect that.

One of the tricky things about goals is that they can be nebulous until you clearly articulate them. Obviously, investors want to earn a return. But I’m more interested in what they want to do with that return. Do they want to fund a loved one’s education or business idea? Buy a vacation cottage? Create an endowment for a local food bank? Many times, I’ve worked with investors who didn’t have firm ideas of what they wanted to do until we discussed it. And that’s critical, because every objective comes with its own timetables and funding needs, which have implications on how a portfolio should be structured.

While high net worth investors often have the core of their life needs well-funded, I’ve found they often have spent less time really thinking about how to fund their bigger ambitions. After a little discussion, many new clients realize they have much more leeway to invest for these goals than they’d realized, but they often also have a mismatch between their holdings and their desires. Many goals, especially long-term ones, have high growth requirements — and that can mean higher exposure to equities that can test an investor’s comfort with risk.

Shifting your portfolio to align with your goals can be daunting.

When investors’ goals clash with their appetite for risk, what do they do? Sometimes it’s necessary to reappraise those goals. First, however, I suggest they work with a Private Wealth Advisor to understand their options. Among other things, we can show clients that, over time, short-term volatility has often been a small price to pay for long-term growth. Or to put it another way, while short term volatility is a given, sustained periods of pain have simply not been the norm.

For example, the S&P 500 Index has advanced in nearly 80% of monthly rolling one-year periods since 1941. When double-digit losses occurred — which happened in 9.4% of such periods — the pain often didn’t last. In fact, over half the time, the index rebounded by 20% or more in the subsequent 12 months. However, investors must be prepared for the possibility of continued pain: in about 20% of these next-year periods, the market delivered a second loss of more than 10%. But these back-to-back declines happened less than 2% of the time.

So how can investors move forward if they should increase their exposure to stocks, but are hesitant because of the risk of a damaging loss? There is a way to gain some courage: inching into the market through a process called dollar-cost averaging. With DCA, as it’s known, investors make regular investments over a longer period of time rather than diving into the market with a single lump sum.

If you use DCA during a falling market, your newly invested funds won’t all take the full tumble. Additionally, as you further invest, you’ll systematically buy at lower prices. And when a recovery eventually comes, you would be at least partially invested. In an analysis of monthly rolling 1-year periods of the S&P 500 from February 1, 1941, through May 31, 2023, we found that hypothetical DCA investments made in 12 equal, consecutive monthly payments overall sustained less damaging declines, but also posted more modest highs, than the same amount hypothetically invested as a lump sum at the beginning of the periods.

That limited growth potential stemmed from the market tendency to rise more often than it fell in the 12-month periods we examined — four times more often, in fact. As a result, boldly investing into an allocation has historically outpaced DCA 71% of the time over the first year of investment. However, over a period of five years, the average difference shrank significantly. Importantly, sitting on the sidelines awaiting the perfect moment to enter the market would have resulted in far worse outcomes than either lump-sum or DCA investing for long-term investors over most periods. Of course, no method of investing, including DCA, ensures a profit or eliminates the potential for a loss. Investors should consider their willingness to keep investing when share prices are declining.

In the end, what’s important is that investors make sensible decisions that are aligned with their goals. Your Private Wealth Advisor is always available to discuss your objectives and portfolio.

Sandra Morelli

Sandra Morelli