Economic Indicators

Biotechnology

It wasn’t long ago that China’s biopharmaceutical industry was considered yet another manufacturer for hire — up to the task of making simple medicines or generic knockoffs but hardly the go-to destination for producing complex or novel treatments.

But that perception is changing as China’s medical industry continues to mature and evolve. A growing number of businesses aren’t just making generic versions of well-known medications; they’ve moved up the complexity curve and are now researching and developing their own novel treatments in cutting-edge technologies, such as novel immuno-therapies, cancer-fighting CAR-T treatments and gene therapies. Western companies have taken notice, with an increasing number of large multinationals licensing some of these medicines for distribution outside China.

Several factors have worked in tandem to foster that advancement. The state has supported the industry as part of a larger push for self-sufficiency and social harmony. Similarly, China’s middle class is large and wealthy enough to support homegrown research and development. And an array of demographic trends are powering health care industries generally — populations worldwide are aging and powerful new technologies are speeding up drug discovery.

Of course, China’s drug researchers and manufacturers face potential hurdles. Near term, the financing environment has been subdued by high interest rates and is particularly challenging for biotech. Another issue: the growing tensions between China and the U.S. Potential trade barriers or sanctions could have an outsize effect on China’s pharmaceutical companies.

Even so, the long-term outlook for China’s biopharmaceutical industry looks bright, says Capital Group equity analyst Laura Nelson Carney, who covers pharmaceutical and biotechnology companies in Europe and Asia.

“China’s biopharma is rapidly becoming more innovative despite the short-term struggles, like rising interest rates and the looming potential for a recession,” she says. “And domestic demand for newer, better medicines is stronger than ever.”

A confluence of factors, both sector-wide and region-specific, could be long-term tailwinds for China’s biopharmaceuticals.

Health care–focused industries are enjoying some multiyear trends, and Chinese biopharmaceuticals are no different. There’s the simple fact that demand for high-quality health care — in this case, lifesaving and quality-of-life medications — is perennial. This is compounded as populations around the world, including China, skew older. On the research side, new technologies and deeper understanding of the underlying biology of diseases have vastly improved drug discovery.

Local trends further favor China’s companies. The government has pursued advancements in health care businesses, partly because of its push for self-sufficiency but also for the pragmatic reason that a healthy population is more productive and less restive.

“Fundamentally, the government recognizes both that health care is important for a harmonious society and that this is an industry in which China can innovate and globalize to drive growth over the next few decades,” Nelson Carney says.

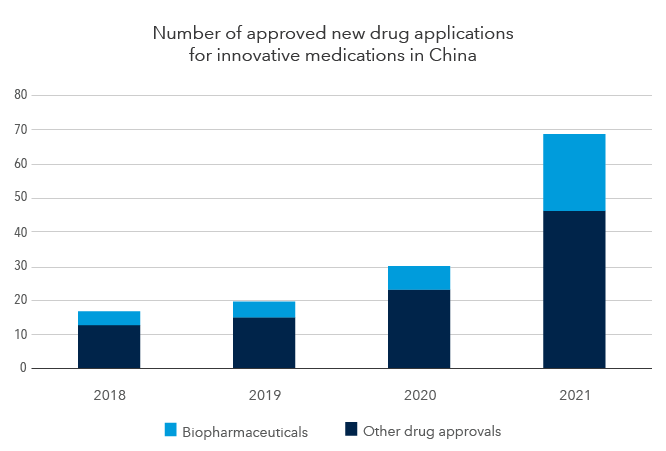

China is approving more innovative drugs, including more biopharmaceuticals.

Source: Statista. As of June 30, 2022.

To those ends, China has spent a lot of time and effort fine-tuning its regulatory apparatus. In 2015, as part of an effort to better balance consumer safety and drug efficacy with company profits, it overhauled its approval processes, using the U.S. Food and Drug Administration as a model. Under the current system, reviews for medicines that address unmet medical needs are prioritized.

Around the same time, the country also changed its drug reimbursement structures, widely expanding the number of newer and more innovative treatments that are eligible for coverage and creating more predictable guard rails for the progression of price cuts.

“The logic is that companies will take a larger price cut per dose in exchange for access to China’s huge market,” Nelson Carney explains. “Initially, the price cuts went too far, and companies began shying away from reimbursement. New guidance makes progressive future price cuts both more modest and more predictable, similar to Japan’s system.”

China’s companies are well poised to cater to a significant yet neglected market.

One of the biggest draws of highly developed markets are the much higher prices they can afford to pay for cutting-edge medication, Nelson Carney says.

“There are somewhere between 750 million and a billion people who live in countries that can afford to reimburse cancer drugs at $10,000 to $15,000 a month — U.S. or European prices,” she notes. “However, as an executive at a leading Chinese biotech company points out, there are 4 billion people in countries that can afford to do so at China’s pricing level, which is under $1,000 a month for the same drugs.”

That price differential is a major reason many European and U.S. countries have neglected those regions. However, those populations need high-quality medications as much as anyone else, and that’s created a huge market in need of low-cost treatments — one that Chinese companies are happy to step into.

“This high-volume, low-price model meshes really well with China’s reimbursement structures,” Nelson Carney says. “Companies do need to have a lot of manufacturing scale to make the map work, and that’s become a differentiator for some emerging biotech companies.”

The fraying U.S.-China relationship poses a potential long-term snag.

Of course, it’s impossible to ignore the friction between the U.S. and China. Their trade dispute has already snared some companies, as dual-purpose goods with potential health care and military applications have been targeted for sanctions or restrictions. That’s unlikely to go away, as both countries have demonstrated a willingness to engage in tit-for-tat trade retaliation.

Regulatory actions have also proven to be potential thorns. The FDA recently reversed a rule that had been read as encouragement for companies to seek drug approval in the U.S. using only Chinese clinical data.

The good news is that much of the sparring has occurred in technology and commodity sectors — cellphones, soybeans and steel have all felt the sting of trade barriers — while medicines have been less affected to this point.

“Health care — in particular innovative medicines for life threatening diseases — generally doesn’t have the same overhangs of national security,” Nelson Carney says.

Related Insights

Related Insights

-

-

-

Long-Term Investing