Capital Group Emerging Markets Local Currency Debt Fund (LUX)

Die Dynamik von Lokalwährungsanleihen nutzen

Ab Dezember 2023 ist [Capital Group Emerging Markets Local Currency Debt Fund (LUX) [Capital Group Euro Bond Fund (LUX)] [Capital Group Global Corporate Bond Fund (LUX)] als Artikel 8-Fonds gemäß der EU-Verordnung über die Offenlegung nachhaltiger Finanzinstrumente (SFDR) eingestuft.

Aktuelle Mitteilungen für Anteilseigner

Ergebnisse

Informationen zum Index dienen nur zur Erläuterung und zur Illustration. Der Fonds wird aktiv gemanagt. Er wird nicht in Anlehnung an eine Benchmark gesteuert.

Die Ergebnisse der Vergangenheit sind kein Hinweis auf künftige Ergebnisse.

Preis und Ausschüttungen

Portfolio

Risiko-Betrachtungen

Risikofaktoren, die vor einer Anlage zu beachten sind:

- Diese Präsentation ist keine Investmentberatung oder persönliche Empfehlung.

- Der Wert von Anlagen und Erträgen kann schwanken, sodass Anleger ihr investiertes Kapital möglicherweise nicht oder nicht vollständig zurückerhalten.

- Wenn Ihre Anlagewährung gegenüber der Währung aufwertet, in der die Anlagen des Fonds denominiert sind, verliert Ihre Anlage an Wert. Durch Währungsabsicherung wird versucht, dies zu begrenzen, aber es gibt keine Garantie, dass die Absicherung vollständig erfolgreich ist.

- Einige Portfolios können zu Anlagezwecken, zur Absicherung und/oder zur effizienten Portfolioverwaltung in derivative Finanzinstrumente investieren.

- Dieser Fonds ist mit weiteren Risiken verbunden: Bond Connect, Anleihen, China IBM, Kontrahenten, Derivate, Emerging Markets, Liquidität, Operative Prozesse und Nachhaltigkeit.

Fonds Risiken

Bond-Connect-Risiko: Anlagen in chinesische Onshore-Anleihen (Festlandanleihen), die über Bond Connect auf dem CIBM gehandelt werden, unterliegen unterschiedlichen Clearing- und Settlement-Risiken sowie dem Liquiditätsrisiko, aufsichtsrechtlichen Risiken und dem Kontrahentenrisiko.

Anleihenrisiko: Der Wert von Anleihen kann aufgrund von Zinsänderungen steigen oder fallen. In der Regel fallen die Anleihenkurse, wenn die Zinsen steigen. Fonds, die in Anleihen investieren, unterliegen einem Kreditrisiko. Wenn sich die Finanzlage eines Emittenten verschlechtert, kann der Wert seiner Anleihen fallen, im Extremfall bis auf null.

China-IBM-Risiko: Der Fonds kann am China Interbank Bond Market investieren. Dieser Markt kann volatil sein, und seine Liquidität ist bei niedrigen Handelsvolumina eingeschränkt. Deshalb können die Kurse von Wertpapieren, die an diesem Markt gehandelt werden, stark schwanken. Außerdem können die Spreads und die mit einem Verkauf verbundenen Kosten hoch sein.

Kontrahentenrisiko: Andere Finanzinstitute erbringen Dienstleistungen für den Fonds (z.B. als Verwahrstelle) oder können Kontrahenten bei Kontrakten sein, beispielsweise bei Derivaten. Es besteht das Risiko, dass der Kontrahent seinen Verpflichtungen nicht nachkommt.

Derivaterisiko: Derivate sind Finanzinstrumente, deren Wert an einen Basiswert gekoppelt ist. Sie können dazu genutzt werden, Positionen abzusichern oder einzugehen. Derivate können sich anders entwickeln als erwartet oder Verluste erleiden, die größer sind als ihr eigentlicher Wert, sodass auch der Fonds Verluste erleiden kann.

Emerging-Market-Risiko: Wertpapiere aus Emerging Markets sind grundsätzlich anfälliger für Risikofaktoren wie Veränderungen der gesamtwirtschaftlichen Lage oder des politischen, steuerlichen und rechtlichen Umfelds.

Liquiditätsrisiko: Bei schwierigen Marktbedingungen können manche im Fonds enthaltene Wertpapiere möglicherweise nicht oder nur unter Wert verkauft werden. Deshalb kann der Fonds die Rückgabe seiner Anteile aussetzen oder verschieben, sodass Investoren möglicherweise nicht sofort Zugriff auf ihre Anlagen haben.

Operatives Risiko: Aufgrund unzureichender oder fehlerhafter Prozesse und Systeme oder menschlicher Fehler, auch beim Schutz von Vermögenswerten vor externen Ereignissen, kann ein direkter oder indirekter Verlust entstehen.

Nachhaltigkeitsrisiko: Ein ökologisches, soziales oder governancebezogenes Ereignis oder ein entsprechender Zustand, das/der erhebliche negative Auswirkungen auf den langfristigen Wert einer Anlage in den Fonds haben kann.

Ressourcen

Nachhaltigkeitsbezogene offenlegungen

Zusammenfassung

Kein nachhaltiges Investitionsziel

Dieser Fonds bewirbt ökologische und soziale Merkmale, hat aber kein nachhaltiges Investitionsziel.

Ökologische oder soziale Merkmale des Finanzprodukts

Der Fonds bewirbt die ökologischen oder sozialen Merkmale durch den Ausschluss von Anlagen in Emittenten auf der Grundlage von ESG- und normenbasierten Kriterien.

Anlagestrategie

CRMC (der „Anlageberater“) ermittelt bestimmte Emittenten oder Gruppen von Emittenten, die er aus dem Portfolio ausschließt, um die vom Fonds geförderten ökologischen oder sozialen Merkmale zu bewerben. Der Anlageberater bewertet und wendet ein ESG- und normenbasiertes Screening an, um Unternehmens- und Staatsemittenten in bestimmten Sektoren wie beispielsweise fossilen Brennstoffen und Waffen sowie Unternehmen, die gegen die Grundsätze des Global Compact der Vereinten Nationen verstoßen, auszuschließen (die „Ausschlusspolitik“).

Der Fonds bewirbt unter anderem ökologische und soziale Merkmale, sofern die Unternehmen, in die investiert wird, eine gute Unternehmensführung praktizieren. Praktiken der guten Unternehmensführung werden im Rahmen des ESG-Integrationsprozesses des Anlageberaters bewertet. Bei der Bewertung der Verfahrensweisen sieht sich der Anlageberater mindestens Aspekte an, die er in Bezug auf die vier genannten Säulen einer guten Unternehmensführung für relevant hält (d. h. solide Managementstrukturen, Beziehungen zu Arbeitnehmern, Vergütung von Mitarbeitern sowie Einhaltung der Steuervorschriften). Diese Praktiken werden im Rahmen eines Überwachungsprozesses bewertet. Gegebenenfalls wird auch eine Fundamentalanalyse verschiedener Governance-Kennzahlen durchgeführt, die unter anderem Bereiche wie Prüfungspraktiken, Zusammensetzung des Leitungs- oder Kontrollorgans und Vergütung der Führungskräfte abdecken.

Die Ausschlusspolitik der Capital Group gilt für das gesamte Portfolio mit Ausnahme von Barmitteln, Barmitteläquivalenten und Geldmarktfonds. Indexderivate, die zu Absicherungs- bzw. Anlagezwecken verwendet werden, werden nicht auf Look-Through-Basis bewertet. Daher kann der Fonds unter bestimmten Umständen ein indirektes Engagement in einem Emittenten eingehen, der zu den ausgeschlossenen Kategorien gehört (unter anderem durch Derivate und Instrumente, die ein Engagement in einem Index darstellen). Single-Name-Derivate müssen mit der Ausschlusspolitik übereinstimmen. Der Anlageberater stellt sicher, dass die erhaltenen Sicherheiten mit der Politik übereinstimmen.

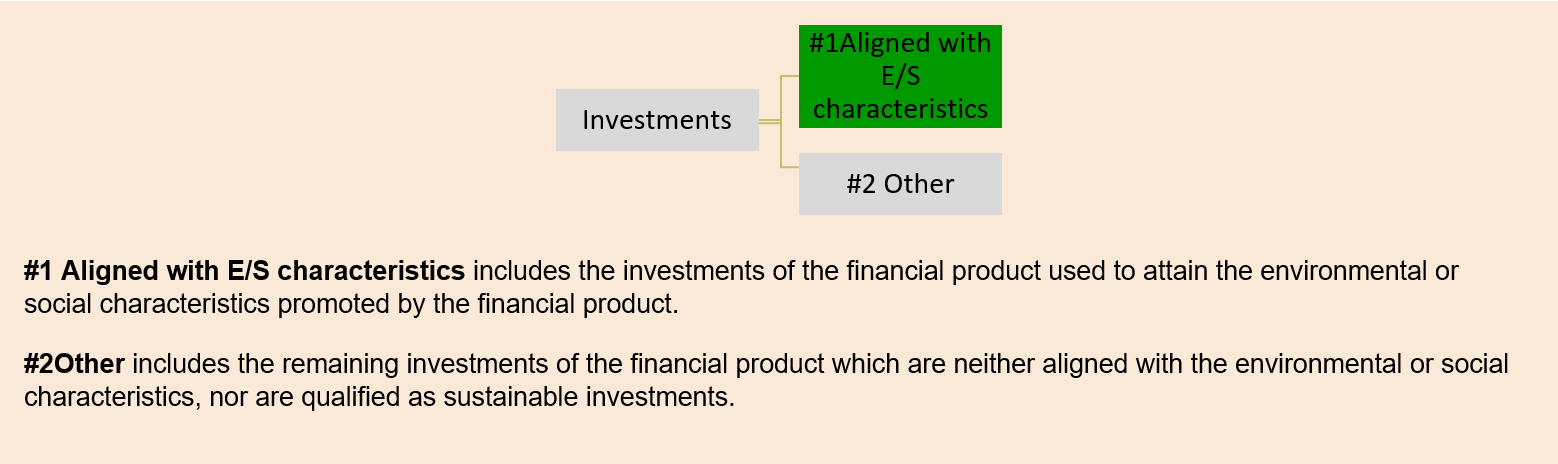

Anteil der Investitionen

Die geplante Vermögensaufteilung wird kontinuierlich überwacht und jährlich bewertet. Mindestens 90 % der Fondsanlagen sind auf ökologische oder soziale Merkmale ausgerichtet. Maximal 10 % der Fondsanlagen, einschließlich nicht auf die beworbenen ökologischen oder sozialen Merkmale ausgerichtete Anlagen und/oder Derivate, fallen in die Kategorie „#2 Andere Investitionen“. Der Fonds verpflichtet sich nicht, nachhaltige Anlagen zu tätigen.

Überwachung von ökologischen oder sozialen Merkmalen

Der Fonds zieht folgende Nachhaltigkeitsindikatoren heran, um die Erreichung der einzelnen ökologischen oder sozialen Merkmale, die durch ihn beworben werden, zu messen.

Der Anlageberater verwendet ESG- und normenbasierte Ausschlüsse, um die Fondsanlagen einer Ausschlusspolitik zu unterziehen. Der Fonds überwacht:

- den Anteil der staatlichen Emittenten, die auf den Prozess zur Bewertung von staatlichen Emittenten des Anlageberaters entfallen; und

- die Einhaltung der in der Ausschlusspolitik festgelegten Kriterien durch die Emittenten.

Methoden

Der Fonds setzt ein verbindliches ESG-bezogenes Kriterium um: sektor- und normenbasierte Screenings in Form von Ausschlüssen.

Datenquellen und -verarbeitung

Ausschlüsse werden in erster Linie durch einen Drittanbieter, MSCI ESG Business Involvement Screening Research („MSCI ESG“), ermittelt. Weitere Datenpunkte sind der MSCI United Nations Global Compact und MSCI Carbon Footprint Metrics.

Einschränkungen bei Methoden und Daten

Die Methoden und Quellen in Bezug auf die Ausschlüsse und den ESG-Integrationsansatz als Ganzes weisen gewisse Einschränkungen auf.

Due Diligence

Die Mitarbeitenden der Compliance-, Risiko- und internen Auditfunktion von Capital Group bewerten regelmäßig den Aufbau und die Wirksamkeit der ESG-Aktivitäten und wichtigen Kontrollsysteme der Firma.

Engagement-Richtlinien

Der Dialog mit Unternehmen ist fester Bestandteil der Vermögensverwaltungsdienste, die der Anlageberater seinen Kunden erbringt. So kann Capital Group mitwirken und einen Dialog über Themen anstoßen, die die langfristigen Aussichten eines Beteiligungsunternehmens beeinträchtigen könnten, wie etwa Risiken im Zusammenhang mit Nachhaltigkeitsthemen.

Bestimmter Referenzwert

Der Fonds hat keinen Referenzwert für die Erreichung der von ihm beworbenen ökologischen und/oder sozialen Merkmale bestimmt.

The sustainability-related disclosures are meant to be revised as necessary from time to time to capture any changes or reviews. The capitalized terms are used in accordance with the definitions and references outlined in Capital International Fund Prospectus.

Capital International Fund – Capital Group Emerging Markets Local Currency Debt Fund (LUX) (the “Fund”)

LEI: 5493009VJSAE25SFXL78

The below section “Summary” was prepared in English and is being translated to other official languages of the European Economic Area. In case of any inconsistency(ies) or conflict(s) between the different versions of this section “Summary”, the English language version shall prevail.

Summary

No sustainable investment objective

This Fund promotes environmental or social characteristics, but does not have as its objective sustainable investment.

Environmental or social characteristics of the financial products

The Fund promotes the environmental or social characteristics of excluding investments in issuers based on ESG and norms-based criteria.

Investment strategy

CRMC (the “Investment Adviser”) identifies certain issuers or groups of issuers that it excludes from the portfolio to promote the environmental or social characteristics supported by the Fund. The Investment Adviser evaluates and applies ESG and norms-based screening to implement exclusions on corporate and sovereign issuers with respect to certain sectors such as fossil fuel and weapons, as well as companies violating the United Nations Global Compact principles (the “Negative Screening Policy”).

The Fund promotes, among other characteristics, environmental and social characteristics, provided that the companies in which investments are made follow good governance practices. Good governance practices are evaluated as part of the Investment Adviser’s ESG integration process. When assessing good governance practices, the Investment Adviser will, as a minimum, have regard to matters it sees relevant to the four prescribed pillars of good governance (i.e., sound management structures, employee relations, remuneration of staff and tax compliance). Such practices are assessed through a monitoring process. Where relevant, fundamental analysis of a range of governance metrics that cover areas such as auditing practices, board composition and executive compensation, among others, is also conducted.

The Capital Group’s Negative Screening Policy will apply to the entire portfolio, with the exception of cash, cash equivalents and money market funds. Index derivatives that are used for hedging and/or investment purposes will not be assessed on a look–through basis. Therefore, there may be circumstances where the Fund may gain indirect exposure to an issuer involved in the excluded categories (through, including but not limited to, derivatives and instrument that gives exposure to an index). Single-name derivatives will need to be compliant with the Negative Screening Policy. The Investment Adviser will ensure that collateral received is aligned with the policy.

Proportion of investments

The planned asset allocation is monitored continuously and evaluated on a yearly basis. At least 90% of the Fund's investments are aligned with E/S characteristics. A maximum of 10% of the Fund’s investments including investments non-aligned with the E/S characteristics promoted and/or derivatives are in category “#2 Other”. The Fund does not commit to make any sustainable investments.

Monitoring of environmental or social characteristics

The sustainability indicators used by this Fund to measure the attainment of each of the environmental or social characteristics it promotes are as follows.

The Investment Adviser applies ESG and norms-based exclusions to implement a Negative Screening Policy to the Fund’s investments. The Fund will monitor:

percentage of sovereign issuers failing the Investment Adviser’s process for assessing sovereigns; and

adherence of corporate issuers to the criteria set forth in the Negative Screening Policy.

Methodologies

The Fund implements one binding ESG-related criteria: sector- and norms-based screens in the form of exclusions.

Data sources and processing

Exclusions are primarily identified through a third-party provider, MSCI ESG Business Involvement Screening Research (“MSCI ESG”). Other data points include the MSCI United Nations Global Compact and MSCI Carbon Footprint Metrics.

Limitations to methodologies and data

The methodology and sources relating to the exclusions and the ESG integration approach as a whole have certain limitations.

Due diligence

Members of Capital Group's compliance, risk management and internal audit staff conduct periodic assessments on the design and operating effectiveness of the firm’s ESG activities and key controls.

Engagement policies

Establishing dialogue with companies is an integral part of the Investment Adviser’s investment management service to clients. This enables Capital Group to engage and generate dialogue on any issues that could affect the investee company’s long-term prospects, including exposures to sustainability issues.

Designated reference benchmark

The Fund has not designated a reference benchmark to meet the environmental and/or social characteristics it promotes.

No sustainable investment objective

This Fund promotes environmental or social characteristics but does not have as its objective sustainable investment. The Fund does not make any sustainable investments.

Environmental or social characteristics of the financial product

The Fund promotes environmental and social characteristics, provided that the companies in which investments are made follow good governance practices.

The Investment Adviser evaluates and applies ESG and norms-based exclusions to implement a Negative Screening Policy to the Fund’s investments at the time of purchase.

For sovereign issuers, the Investment Adviser conducts an eligibility assessment leveraging its proprietary sovereign ESG framework, which covers a range of ESG indicators to evaluate how well a country manages its ESG risk. The Investment Adviser uses its proprietary sovereign ESG framework to assess the ESG and Governance score of a sovereign issuer against predetermined thresholds.

For corporate issuers, the Investment Adviser relies on third-party providers who identify an issuer’s participation in or the revenue which they derive from activities that are inconsistent with these screens.

The Investment Adviser selects investments to the extent they are in line with the negative screening policy.

Investment strategy

The Investment Adviser applies the following investment strategy to attain the environmental and/or social characteristics promoted.

Negative Screening Policy: The Investment Adviser evaluates and applies ESG and norms-based exclusions to implement a Negative Screening Policy to the Fund’s investments at the time of purchase.

To support this screening on sovereign issuers, the Investment Adviser conducts an eligibility assessment leveraging its proprietary sovereign ESG framework, which covers a range of ESG indicators to evaluate how well a country manages its ESG risk. To be eligible for investment, sovereigns must score above pre-determined thresholds for their proprietary ESG score on both an absolute and GNI-adjusted basis. The Investment Adviser leverages data from third-party institutions such as the United Nations and the World Bank to calculate ESG scores across the sovereign universe. Sovereign issuers are evaluated on: (1) a gross national income-adjusted basis to better understand how well a country manages ESG risk relative to its wealth and available resources, as well as (2) on an absolute basis. Sovereign issuers that score below pre-defined thresholds in either category are generally not eligible for purchase by the Funds. If the Investment Adviser believes that the third-party data and/or assessment is incomplete or inaccurate, the Investment Adviser reserves the right to identify exclusions for sovereign issuers through its own assessment. The Investment Adviser also periodically reviews sovereign issuers and if a previously eligible sovereign issuer held in the Fund becomes ineligible, the sovereign issuer will not contribute towards the environmental and/or social characteristics of the Fund and the sovereign issuer will generally be sold within six months from the date of such determination, subject to the best interests of investors in the Fund (save that if the Investment Adviser believes that a score is below a pre-defined threshold for a temporary or a transitory reason, the Investment Adviser may, from time to time, exercise its discretion to keep holding or purchase securities issued by the sovereign issuer).

For corporate issuers, the Investment Adviser relies on third party provider(s) who identify an issuer’s participation in or the revenue which they derive from activities that are inconsistent with the ESG and norms-based screens. In this way, third party provider data is used to support the application of ESG and norms-based screening by the Investment Adviser. In the event that exclusions cannot be verified through third-party providers or if the Investment Adviser believes that data and/or assessment is incomplete or inaccurate, the Investment Adviser reserves the right to identify business involvement activities through its own assessment (including by using other third-party data sources). If an eligible corporate issuer held in a Fund subsequently fails a screen, the issuer will not contribute towards the environmental and/or social characteristics of the Fund and will generally be sold within six months from the date of such determination, subject to the best interests of investors in the Fund.

What is the policy to assess good governance practices of the investee companies?

The Investment Adviser ensures that the companies in which investments are made follow good governance practices.

When assessing good governance practices, the Investment Adviser will, as a minimum, have regard to matters it sees relevant to the four prescribed pillars of good governance (i.e., sound management structures, employee relations, remuneration of staff and tax compliance).

As described above, the Investment Adviser applies a Negative Screening Policy to the Fund. As part of this, the Investment Adviser excludes companies that, based on available third-party data, are viewed to be in violation of the principles of the UNGC, which include Principle 10 (anti-corruption) and Principle 3 (employee relations).

In addition, good governance practices are evaluated as part of the Investment Adviser’s ESG integration process. Such practices are assessed through a monitoring process based on available third-party indicators relating to corporate governance and corporate behavior. Third-party data may be inaccurate, incomplete or outdated. Where the corporate governance and corporate behavior indicators cannot be verified through the third-party provider, the Investment Adviser will aim to make such determination through its own assessment based on information that is reasonably available. Where relevant, fundamental analysis of a range of metrics that cover auditing practices, board composition, and executive compensation, among others, is also conducted. The Investment Adviser also engages in regular dialogue with companies on corporate governance issues and exercises its proxy voting rights for the entities in which the Fund invests.

If a previously eligible company held in a Fund subsequently fails the Investment Adviser’s assessment of good governance practices, the company will generally be sold within six months from the date of such determination, subject to the best interests of investors in the Fund.

Capital Group’s ESG Policy Statement provides additional detail on Capital Group’s ESG philosophy, integration, governance, support and processes, including proxy voting procedures and principles, as well as views on specific ESG issues, including ethical conduct, disclosures and corporate governance. Information on Capital Group’s corporate governance principles can be found in its Proxy Voting Procedures and Principles as well as in the ESG Policy Statement.

Information on Capital Group’s corporate governance principles can be also found in its Proxy Voting Procedures and Principles, available on:

https://www.capitalgroup.com/content/dam/cgc/tenants/europe/documents/responsible-investing/global_proxy_voting_guidelines(en).pdf.

The ESG Policy Statement provides additional detail on Capital Group’s views on specific ESG issues, including ethical conduct, disclosures and corporate governance, available on:

http://www.capitalgroup.com/content/dam/cgc/tenants/eacg/esg/files/esg-policy-statement(en).pdf

Proportion of investments

At least 90% of the Fund's investments are in category “#1 Aligned with E/S characteristics” and so are used to attain the environmental or social characteristics promoted by the Fund (being subject to the Investment Adviser’s binding Negative Screening Policy). A maximum of 10% of the Fund’s investments including investments non-aligned with the E/S characteristics promoted and/or derivatives are in category “#2 Other”.

The Fund does not commit to make any sustainable investments.

Cash and/or cash equivalents are excluded from the asset allocation. Cash and cash-equivalents may be held for liquidity purposes to support the Fund’s overall investment objective.

Monitoring of environmental or social characteristics

The sustainability indicators used by this Fund to measure the attainment of each of the environmental or social characteristics it promotes are as follows.

The Investment Adviser applies ESG and norms-based exclusions to implement a Negative Screening Policy to the Fund’s investments. The Fund will monitor:

percentage of sovereign issuers failing the Investment Adviser’s process for assessing sovereigns; and

percentage of corporate issuers failing a screen under the Negative Screening Policy.

The Fund applies investment restrictions rules at the time of purchase on a pre-trade basis in portfolio management systems to restrain investment in companies or issuers based on the exclusion criteria. The portfolio also undergoes regular/systematic post-trade compliance checks. The methodology applied to sovereign and corporate issuers respectively in support of this screening is described in detail under the section “Investment Strategy” of this document.

In the event that exclusions cannot be verified through the third-party provider(s) or if the Investment Adviser believes that third party data and/or assessment is incomplete or inaccurate, the Investment Adviser will aim to identify business involvement activities through its own assessment (including third-party data sources). Please refer to Fund’s Negative Screening Policy for further details.

Methodologies

The Fund implements one binding ESG-related criteria: sector- and norms-based screens in the form of exclusions, with the methodology applied to this commitment having already been presented in detail in the previous sections.

The SFDR classification is related to the European Union’s regulation and is not equivalent to approval or recognition as an ESG Fund by regulators in Asia Pacific.

Data sources and processing

Data sources

The Investment Adviser uses a combination of internal research and third-party data providers to gather ESG-related data.

Third-party providers are used to calculate the carbon footprint of the Fund and for identifying corporate issuers' involvement in activities inconsistent with ESG and norms-based screens. In the event that exclusions cannot be verified through third-party data or if the Investment Adviser believes that third-party data and/or assessment is incomplete or inaccurate, the Investment Adviser reserves the right to identify business involvement activities through its own assessment (including by using other third-party data sources).

Exclusions for sovereign issuers are identified through the Investment Adviser’s proprietary research. The Investment Adviser leverages data from third-party institutions such as the United Nations and the World Bank to calculate ESG scores across the sovereign universe. Sovereign issuers are evaluated on: (1) a gross national income-adjusted basis to better understand how well a country manages ESG risk relative to its wealth and available resources, as well as (2) on an absolute basis. If the Investment Advisor believes that the third-party data and/or assessment is incomplete or inaccurate, the Investment Adviser reserves the right to identify exclusions for sovereign issuers through its own assessment.

Data quality and processing

Capital Group periodically reviews the performance quality of provider organizations and conducts ongoing monitoring and due diligence activities commensurate with the significance of the services provided.

Data are regularly updated in Capital Group’s internal platforms and made available to relevant teams. When issues are identified in third-party data, they are reported back to the provider(s). The Investment Adviser also applies systematic data quality checks to catch discrepancies and validate with the provider when issues arise.

Proportion of data that is estimated

Third-party providers may estimate data. While reported data are prioritized, Capital Group uses estimated data when reported data are unavailable. The proportion of estimated data varies depending on the data point due to inconsistencies in reporting by investee companies.

Limitations to methodologies and data

The methodology and sources relating to the exclusions and the ESG integration approach as a whole have certain limitations. In order to identify all publicly traded companies globally which are involved in activities such as the production of controversial products and revenue derived from activities that are inconsistent with the ESG and norms-based screens, the Fund uses data from third-party provider(s). In the event that data cannot be obtained through third-party providers or if the Investment Adviser believes that third-party data and/or assessment is incomplete or inaccurate, the Investment Adviser will aim to identify business involvement activities through its own assessment (including by using other third-party data sources).

Due diligence

Members of Capital Group's compliance, risk management and internal audit staff conduct periodic assessments on the design and operating effectiveness of the firm’s ESG activities and key controls. This includes compliance with internal processes and procedures as well as with the regulatory landscape in the jurisdictions in which the company operates. Capital Group meets regularly with the third-party data providers to review the quality of the services provided.

Pre-trade and post-trade checks are also in place as further explained in section “Monitoring of environmental or social characteristics” above.

Engagement policies

Establishing dialogue with companies is an integral part of the Investment Adviser’s investment management service to clients. Capital Group’s investment teams meet on a regular basis with company management, including executive and non-executive directors, chairs and finance directors. This enables the company to engage and generate dialogue on any issues that could affect the company’s long-term prospects, including exposures to sustainability issues.

Where Capital Group's investment teams identify an issue material to the long-term value of a company or they are concerned about relative ESG performance, Capital Group's investment professionals and governance teams will engage with management. Management’s response and the steps they take to minimise any associated risks, forms an important part of Capital Group's assessment of management quality, which itself is a key factor in the stock selection decisions.

Designated reference benchmark

The Fund has not designated a reference benchmark to meet the environmental and/or social characteristics it promotes.

Where can more product-specific information be found?

More product-specific information can be found in the pre-contractual template:

https://docs.publifund.com/1_PROSP/LU1577354035/en_LU

More product-specific information can be found in the periodic reports:

https://docs.publifund.com/4_AR/LU1577354035/en_LU