Capital IdeasTM

Investment insights from Capital Group

Categories

株式

Where next for equity valuations? The AI effect

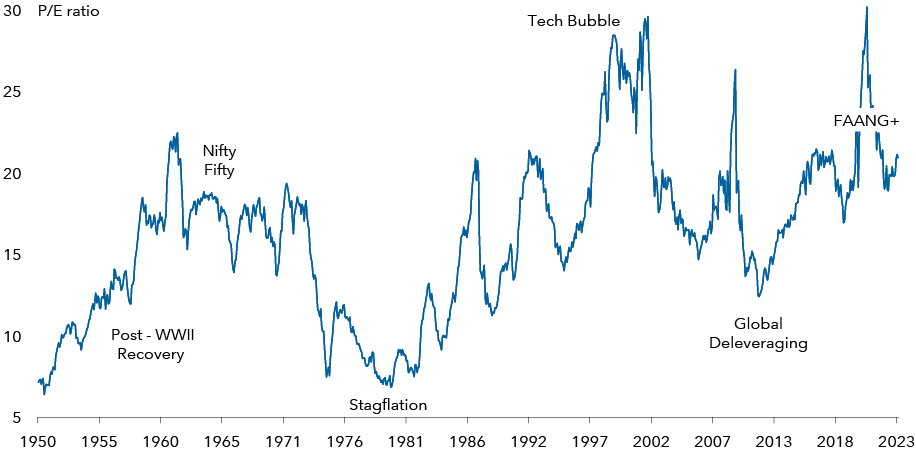

Distinct valuation ‘eras’ can be seen in stock markets across the decades, typically driven by broader macro trends. These can have a significant influence on individual company valuations, even when bottom-up analysis points to different conclusions.

Valuation eras in the US over time

S&P 500 Price/Earnings Ratio (Using trailing four-quarter operating earnings per share)

Past results are not a guarantee of future results. Investors cannot invest directly in an index.

Data to 31 August 2023. Source: Macrobond, Capital Group

How valuations evolve over the coming years will ultimately depend on where growth and interest rates settle. To explore this, we have looked at four potential scenarios based on two questions currently dominating markets: how disruptive Artificial Intelligence might prove to be and whether inflation returns to central banks’ 2% target on a sustained basis.

With AI, we have considered whether the disruption it brings could be benign or destructive. Benign implies that new technologies are easily absorbed into existing structures of capital and labour, creating new job opportunities and boosting output. Destructive suggests tech replaces labour and capital faster than they can be redeployed elsewhere, generating unemployment.

This is scenario planning, not prediction. Still, given the scale and pace of innovation in the AI space, and enormous range of its potential impact, work of this kind will be critical as we look to shape our portfolios for the future.

過去の実績は将来の成果を保証するものではありません。投資の価値および投資収益は減少することも増加することもあり、当初投資額の一部または全部を失うことがあります。本情報は投資、税務もしくはその他の助言の提供、または証券の売買の勧誘を意図するものではありません。

個人に帰属する記述は、その個人の出版日現在の意見を述べたものであり、必ずしもキャピタル・グループまたはその関連会社の意見を反映したものではありません。特に明記がない限り、すべての情報は記載された日付現在のものです。一部の情報は第三者から取得したものであり、そのため、かかる情報の信頼性については保証いたしません。

Beth Beckett

Beth Beckett