Capital IdeasTM

Investment insights from Capital Group

Categories

債券

Three reasons why we prefer investment grade credit to US Treasuries

Given the generous level of yield currently offered by US Treasuries (UST) and the relatively tight spreads within investment grade corporate credit, would it not be better to just buy UST?

For some investors, this might be the right choice. Specifically, we think investing in UST makes sense if you have a strong view the economy is heading into a deep recession. However, 2023 has taught us that recession in the US is far from a done deal, and, in fact, there is still a meaningful probability of the economy remaining resilient and continuing to avoid a recession in 2024.

In this scenario, we think IG credit provides the better opportunity. This paper outlines three reasons why we believe this is the case:

- Historical analysis shows that during most periods, global IG corporate bonds have delivered better results than UST.

- Credit spreads are close to their historical average, but dispersion remains elevated.

- Global corporate bonds can provide the strategic core fixed income allocation of a portfolio as they provide income, capital preservation, and diversification from equities.

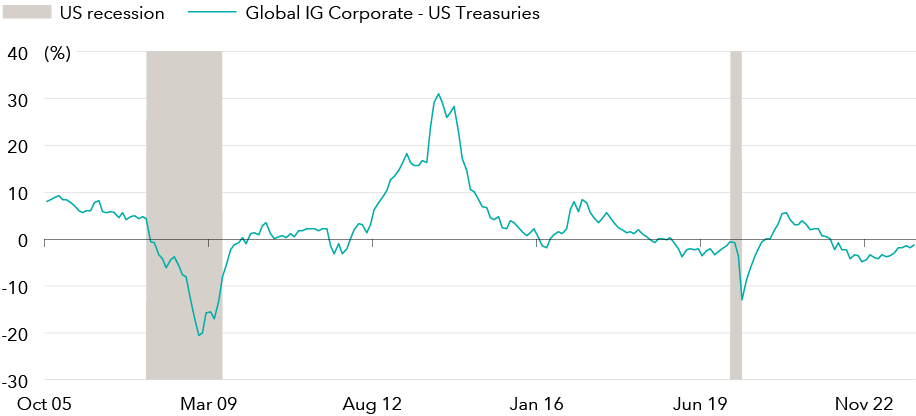

Five year rolling results of corporate bonds and US Treasuries

Source: Bloomberg. US Treasuries represented by Bloomberg US Treasuries. Global IG Corporates represented by Bloomberg Global Aggregate – Corporates USD hedged. Based on five-year rolling returns using monthly values. Data as at 22 October 2023

過去の実績は将来の成果を保証するものではありません。投資の価値および投資収益は減少することも増加することもあり、当初投資額の一部または全部を失うことがあります。本情報は投資、税務もしくはその他の助言の提供、または証券の売買の勧誘を意図するものではありません。

個人に帰属する記述は、その個人の出版日現在の意見を述べたものであり、必ずしもキャピタル・グループまたはその関連会社の意見を反映したものではありません。特に明記がない限り、すべての情報は記載された日付現在のものです。一部の情報は第三者から取得したものであり、そのため、かかる情報の信頼性については保証いたしません。

Flavio Carpenzano

Flavio Carpenzano