Capital IdeasTM

Investment insights from Capital Group

エマージング市場

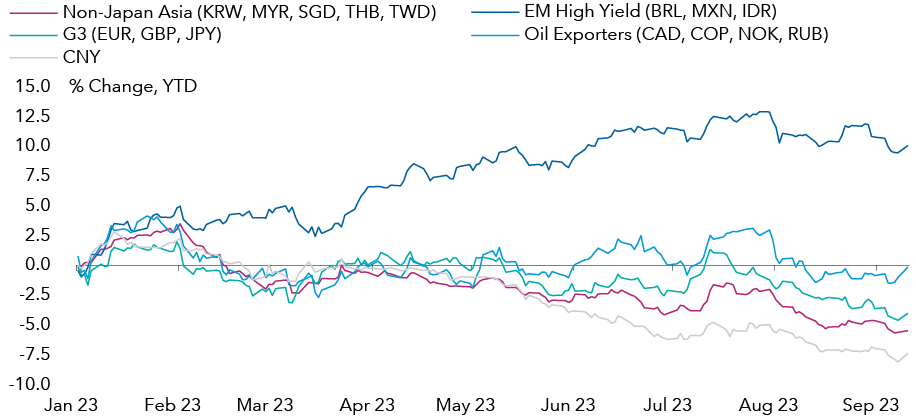

The EM carry trade1 has been a successful strategy so far this year, as many EM countries, particularly those in Latin America, have been able to offer investors high real interest rates, diminishing policy risks and attractive valuations.

Chart 1: High carry currencies have been strong year-to-date

Past results are not a guarantee of future results.

As at 11 September 2023. KRW: South Korean won, MYR: Malaysian ringgit, SGD: Singapore dollar, THB: Thai baht, TWD: Taiwan dollar, BRL: Brazilian real, MXN: Mexican peso, IDR: Indonesian rupiah, EUR: Euro, GBP: Pound sterling, JPY: Japanese yen, CAD: Canadian dollar, COP: Colombian peso, NOK: Norwegian krone, RUB: Russian rouble. Source: Macrobond

The strength of the EM carry trade now looks to be fading as EM central banks start to cut rates. This reduction in interest rate differentials between EM and developed market (DM) countries could weaken some EM currencies, as was the case in Chile earlier this year. Crowded investor positioning within EM carry trades, meanwhile, has the potential to amplify any reversal in positioning.

That said, given the high starting interest rate for many EM countries, real rates may continue to look attractive even as central banks cut rates. Moreover, in many cases, investors are guided by risk sentiment and fundamentals as well as the real rate differential. We look into both those factors in this paper.

1. An exchange rate “carry trade” goes against the uncovered interest rate parity theory (UIP). According to UIP, the expected change in an exchange rate should be equal to the interest rate differential for the two currencies for the same period. If this does not happen, in theory, there is an opportunity to make an abnormal return, using the carry trade, by borrowing a low interest-rate currency and investing in a higher interest rate currency.

過去の実績は将来の成果を保証するものではありません。投資の価値および投資収益は減少することも増加することもあり、当初投資額の一部または全部を失うことがあります。本情報は投資、税務もしくはその他の助言の提供、または証券の売買の勧誘を意図するものではありません。

個人に帰属する記述は、その個人の出版日現在の意見を述べたものであり、必ずしもキャピタル・グループまたはその関連会社の意見を反映したものではありません。特に明記がない限り、すべての情報は記載された日付現在のものです。一部の情報は第三者から取得したものであり、そのため、かかる情報の信頼性については保証いたしません。

Jens Søndergaard

Jens Søndergaard