Capital IdeasTM

Investment insights from Capital Group

債券

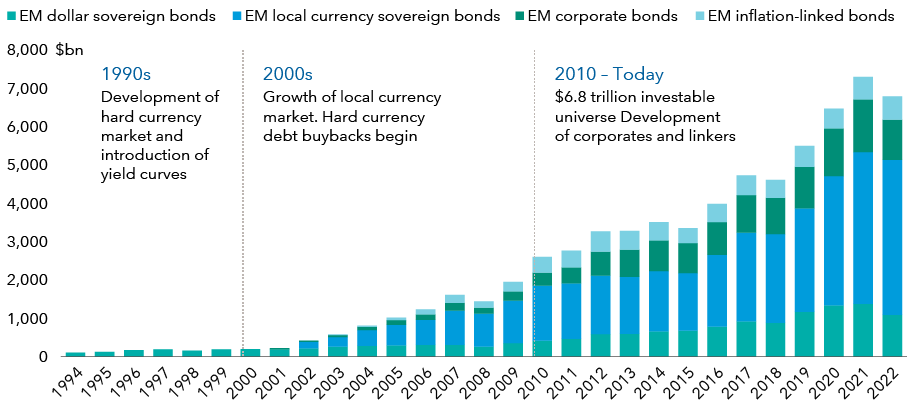

The fast-paced evolution of EMD as an asset class necessitates an investment approach that can adapt swiftly. At its inception in the mid-1990s, EMD was a relatively narrow asset class consisting of just 12-15 countries issuing hard currency debt. This was often in response to crises in those countries. As illustrated in the chart below, little changed until the early 2000s when local currency debt bonds and corporate bonds were introduced. Since then, the asset class has gradually expanded to encompass almost 70 countries1, issuing a broader range of debt instruments. In addition, some countries have made significant progress in establishing local yield curves, reducing their vulnerability to fluctuations in the US dollar and enhancing stability.

The market has developed into a mainstream asset class

Investors cannot invest directly in the index.

Data as at 31 December 2022, in US dollar terms. Indices: JPMorgan EMBI Global Index, JPMorgan GBI-EM Broad Index, JPMorgan CEMBI Broad Index, Bloomberg EMGIL Bond Index. Investable universe based on market value of indices used. Sources: JPMorgan, Bloomberg

In this Q&A, emerging market debt (EMD) portfolio manager Kirstie Spence discusses how to plan for the long-term success of managing the asset class.

1. As at September 2023. Based on JPMorgan EMBI Global Diversified Index.

Source: JPMorgan

過去の実績は将来の成果を保証するものではありません。投資の価値および投資収益は減少することも増加することもあり、当初投資額の一部または全部を失うことがあります。本情報は投資、税務もしくはその他の助言の提供、または証券の売買の勧誘を意図するものではありません。

個人に帰属する記述は、その個人の出版日現在の意見を述べたものであり、必ずしもキャピタル・グループまたはその関連会社の意見を反映したものではありません。特に明記がない限り、すべての情報は記載された日付現在のものです。一部の情報は第三者から取得したものであり、そのため、かかる情報の信頼性については保証いたしません。

Kirstie Spence

Kirstie Spence