Capital IdeasTM

Investment insights from Capital Group

Categories

債券

How global corporate bonds can improve outcomes for UK investors

Investment-grade corporate bonds play a central role in a well-diversified fixed income portfolio, with the potential to generate attractive risk-adjusted returns. Many investors continue to maintain a preference for their domestic market when considering investment options.

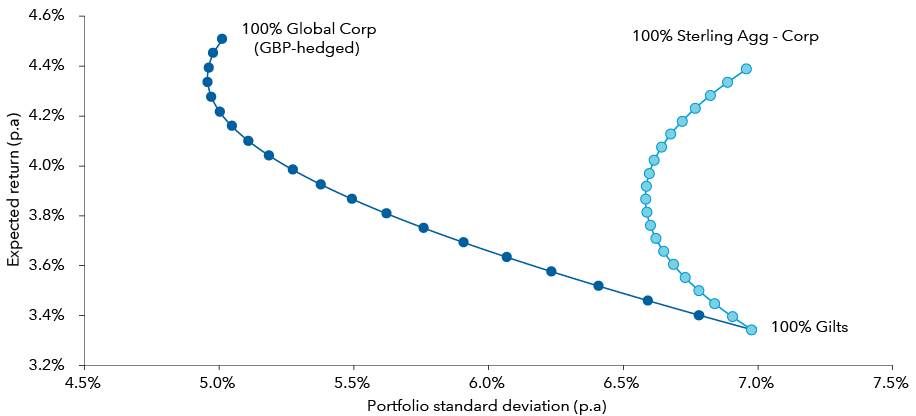

However, investment strategies focused solely on one’s own domestic market may not be able to spread risk effectively. The potential diversification benefits of adding more markets and issuers to a portfolio are intuitive to most, highlighting the advantages of a global portfolio over regional strategies. This is illustrated in the efficient frontier analysis chart below. As can be seen, diversifying UK gilts exposure using global corporates rather than UK corporates not only increases potential expected returns, but also reduces volatility. This is due to the diversified nature of the global corporate market.

Efficient frontier analysis

Comparing hypothetical fixed income portfolios

Past results are not a guarantee of future results

Selected assets include Sterling Aggregate – Corporates, UK Gilts, Global Aggregate – Corporates (GBP-hedged).

Monthly returns from January 2001 to 31 August 2023. Source: Bloomberg

テーマごとに見る

過去の実績は将来の成果を保証するものではありません。投資の価値および投資収益は減少することも増加することもあり、当初投資額の一部または全部を失うことがあります。本情報は投資、税務もしくはその他の助言の提供、または証券の売買の勧誘を意図するものではありません。

個人に帰属する記述は、その個人の出版日現在の意見を述べたものであり、必ずしもキャピタル・グループまたはその関連会社の意見を反映したものではありません。特に明記がない限り、すべての情報は記載された日付現在のものです。一部の情報は第三者から取得したものであり、そのため、かかる情報の信頼性については保証いたしません。

Peter Becker

Peter Becker

Flavio Carpenzano

Flavio Carpenzano