Capital IdeasTM

Investment insights from Capital Group

Categories

株式

Emerging markets: Positive signs even as China slows

The post COVID-19 era has seen a reset in financial markets on many levels – interest rates, geopolitics and growth paradigms. It's also led to a redrawing of the landscape for emerging markets (EM).

We believe the next phase of growth for EM will be different than the past 20 years. China's economy has matured and is going through a difficult patch of reforms. Geopolitical tensions and the world's energy transition are driving foreign investment into a broader mix of developing countries for manufacturing and natural resource needs. And government-led reforms are changing the trajectory of some developing countries, such as India and Indonesia.

Many asset managers, including us, have increased their capital market assumptions for both EM equities and debt. We believe the outlook for EM is constructive over the medium-term and will expand to markets that have not been front-and-centre for investors.

Here we discuss the macro variables as well as some of the trends and opportunities we are seeing across markets and industries.

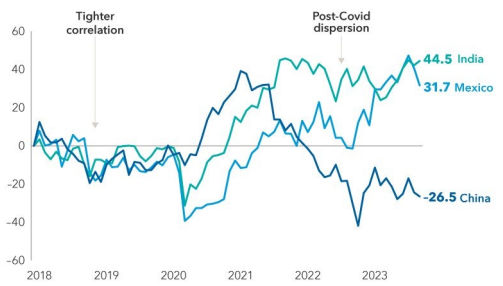

Returns among large EMs have diverged post-COVID

Data as at 30 September 2023. Returns reflect MSCI India Index, MSCI Mexico Index, and MSCI China Index. Five-year time period shown to reflect returns pre and post-COVID. Sources: MSCI, RIMES

過去の実績は将来の成果を保証するものではありません。投資の価値および投資収益は減少することも増加することもあり、当初投資額の一部または全部を失うことがあります。本情報は投資、税務もしくはその他の助言の提供、または証券の売買の勧誘を意図するものではありません。

個人に帰属する記述は、その個人の出版日現在の意見を述べたものであり、必ずしもキャピタル・グループまたはその関連会社の意見を反映したものではありません。特に明記がない限り、すべての情報は記載された日付現在のものです。一部の情報は第三者から取得したものであり、そのため、かかる情報の信頼性については保証いたしません。

F. Chapman Taylor

F. Chapman Taylor

Lisa Thompson

Lisa Thompson

Brad Freer

Brad Freer

Kent Chan

Kent Chan