Capital IdeasTM

Investment insights from Capital Group

Categories

株式

Electric vehicles in the fast lane: Who wins this race?

Walking the showroom floor of Germany's international auto show used to be a time to admire the latest and greatest gas-powered Mercedes-Benz, Volkswagen or even a Bentley. Not so much this year. One can sense the electric vehicle future coming. Two questions are at the forefront of people's minds: Will European consumers be interested in buying Chinese electric vehicles (EVs), and will China’s automakers slash prices to grab market share?

China has surpassed Japan as the top global automobile exporter so far this year, a feat that was unimaginable a decade ago. Several of China's leading EV makers are starting to charge into Europe's market, marking an early litmus test of demand in developed markets for Chinese EVs.

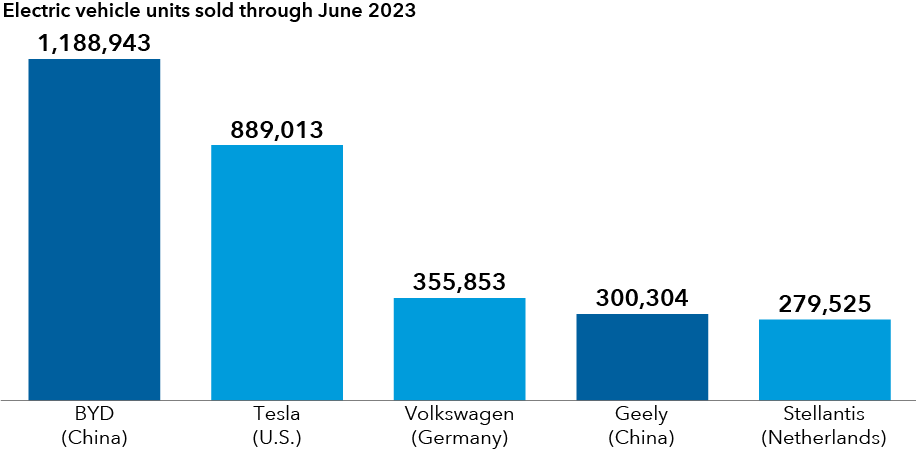

Chinese EV brands rank among the top in the world by sales

Data as at 30 June 2023. Source: Bloomberg

It's already having ripple effects in Europe, where regulators and politicians are grappling with how best to protect their traditionally strong auto industry. It's too early to know how the situation plays out, but it seems clear it will change the operating dynamic for Europe's automakers and how investors value their businesses moving forward.

Despite the initial headway China has made, many of its domestic auto manufacturers are losing money. The rush to drive down costs and prices may force lesser-capitalised EV makers out of business, and we could see a wave of consolidation.

Until then, we believe it would be a mistake to write off European automakers. Low valuations and technology advancements could provide attractive entry points for investors. They have a long and glorious legacy to build upon. They've been here before, staving off competition from Japanese car makers.

European consumers are discerning and historically chose to stay with European manufacturers even at slightly higher price points. But the global dominance of European brands, especially at the luxury end, may not last as EVs gradually replace traditional combustion engine or hybrid technology cars and other automobiles.

過去の実績は将来の成果を保証するものではありません。投資の価値および投資収益は減少することも増加することもあり、当初投資額の一部または全部を失うことがあります。本情報は投資、税務もしくはその他の助言の提供、または証券の売買の勧誘を意図するものではありません。

個人に帰属する記述は、その個人の出版日現在の意見を述べたものであり、必ずしもキャピタル・グループまたはその関連会社の意見を反映したものではありません。特に明記がない限り、すべての情報は記載された日付現在のものです。一部の情報は第三者から取得したものであり、そのため、かかる情報の信頼性については保証いたしません。

Michael Cohen

Michael Cohen

Talha Khan

Talha Khan