Capital Ideas™

Investment insights from Capital Group

Categories

退休年齡

退休后投資解決方案:可擴展的定製建議框架

KEY TAKEAWAYS

- Unprecedented levels of economic uncertainty mean there has never been a greater need for high quality, affordable advice.

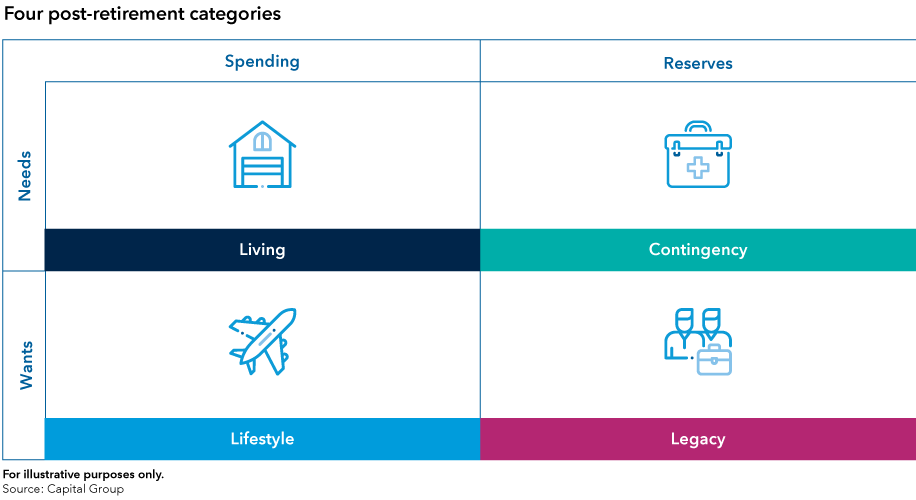

- Categorising post-retirement needs - living, lifestyle, legacy and contingency – creates a framework that helps align client goals with appropriate investments.

- Using this framework allows advisers to provide tailored advice, but also facilitates a scalable solution that can be applied across a range of client segments.

Post-retirement: A changing landscape – a new and growing opportunity

The global landscape for retirement investing is changing. Previously the focus was on investing for retirement – accumulating assets for future use – but as Western and Asian populations age, post-retirement investing is becoming more important. This area is experiencing considerable growth; in the UK, the drawdown market is expected to grow over the next decade at more than 10% per annum to £467bn1, while in the US, investible assets of baby boomers are set to hit more than US$40 trillion by 20272.

However, the economic backdrop has shifted considerably in a short space of time. The huge demand shock to the world economy from the COVID-19 outbreak means that interest rates are likely to stay even lower for longer, sources of income previously seen as reliable, such as dividend income from banks and property rentals have turned out to be vulnerable.

In the UK, dividend cuts have impacted income funds, while some property funds have been gated, leaving investors unable to access their money. These factors could have a significant impact on the willingness of retirees to invest in assets such as equities, which offer the potential growth in capital and income needed for the sustainability of withdrawals over increasingly long retirements. Amidst such uncertainties, there has never been a greater need for high quality, affordable investment advice to support investors and guide them to suitable portfolios.

How does post-retirement investing differ from pre-retirement?

Client needs in the post-retirement phase are quite different from the accumulation stage - where investors have more homogenous requirements. The table below highlights several considerations that are significantly different between these two life phases.

The differences outlined above highlight the difficulty in addressing the postretirement market. Waning interest in annuities and greater freedom to construct personal post-retirement arrangements has meant that individually-tailored retirement accounts are becoming more important. From an adviser’s perspective, addressing the diverse needs of individual clients in retirement will almost certainly consume significantly more time and resources compared with the pre-retirement cohort. As a result, finding an effective, scalable solution to address this market need may seem out of reach for many adviser firms.

A framework to tackle the challenge

In untangling the complexities of individual client needs, it can help to classify post-retirement needs into four categories – living, lifestyle, legacy and contingency. These could be thought of as building blocks in the post-retirement solution process.

Given the range of investments that are available to retirees in their postretirement arsenal and the extent of needs and wants to meet in their new stage of life, using the four categories above can be helpful in identifying the types of expenses likely to be incurred and how they will be funded. This exercise can help develop an effective solution that ensures the retiree’s needs are satisfied with the resources they have.

The advantage of using this approach for advisers is that they can:

- efficiently extract the most relevant information from their clients;

- effectively educate them in what they might need; and

- provide them with an appropriate and scalable solution.

1. Broadridge Navigator 2019. Projections over 2018-2028 for the retirement income pensions assets market.

2. Tiburon Strategic Advisors, September 2018.

Risk factors you should consider before investing:

- This material is not intended to provide investment advice or be considered a personal recommendation.

- The value of investments and income from them can go down as well as up and you may lose some or all of your initial investment.

- Past results are not a guide to future results.

- If the currency in which you invest strengthens against the currency in which the underlying investments of the fund are made, the value of your investment will decrease.

- Depending on the strategy, risks may be associated with investing in fixed income, emerging markets and/or high-yield securities; emerging markets are volatile and may suffer from liquidity problems.

我們的最新見解

相關見解

Hear from our investment team.

Subscribe to the Capital Ideas weekly newsletter to get industry-leading insights delivered straight to your inbox.

過往業績並非將來業績的保證。本基金的價值及來自基金的收入可升亦可跌,閣下可能損失部分或全部原投資額。本信息不擬提供投資、稅務或其他意見,亦不擬招攬任何人士購買或出售任何證券。

本信息所包含的陳述是已識別身份的個別人士的意見及所信,不一定反映資本集團或其聯屬公司的觀點。除非另有說明,所有信息截至所示日期。某些資料可能從第三方取得,因此概不保證該資料的可靠性。