Reviewed onSeptember 25, 2024

5 MIN ARTICLE

Your value proposition statement articulates your core principles as a financial professional. Here are the steps to producing a statement that speaks to clients.

KEY TAKEAWAYS

- Create powerful, customized value proposition statements

- Convey your core principles as a financial professional

- Reach three types of retirement plan clients

- Underscore your commitment to superior outcomes

For retirement plan sponsors: Use the value proposition tool for employer-sponsored retirement plans. The tool includes a variety of sample statements to choose from. They focus on:

- Overall plan servicing philosophy

- Plan sponsor support

- Commitment to participant education and ongoing services

Sample statement for retirement plan sponsors

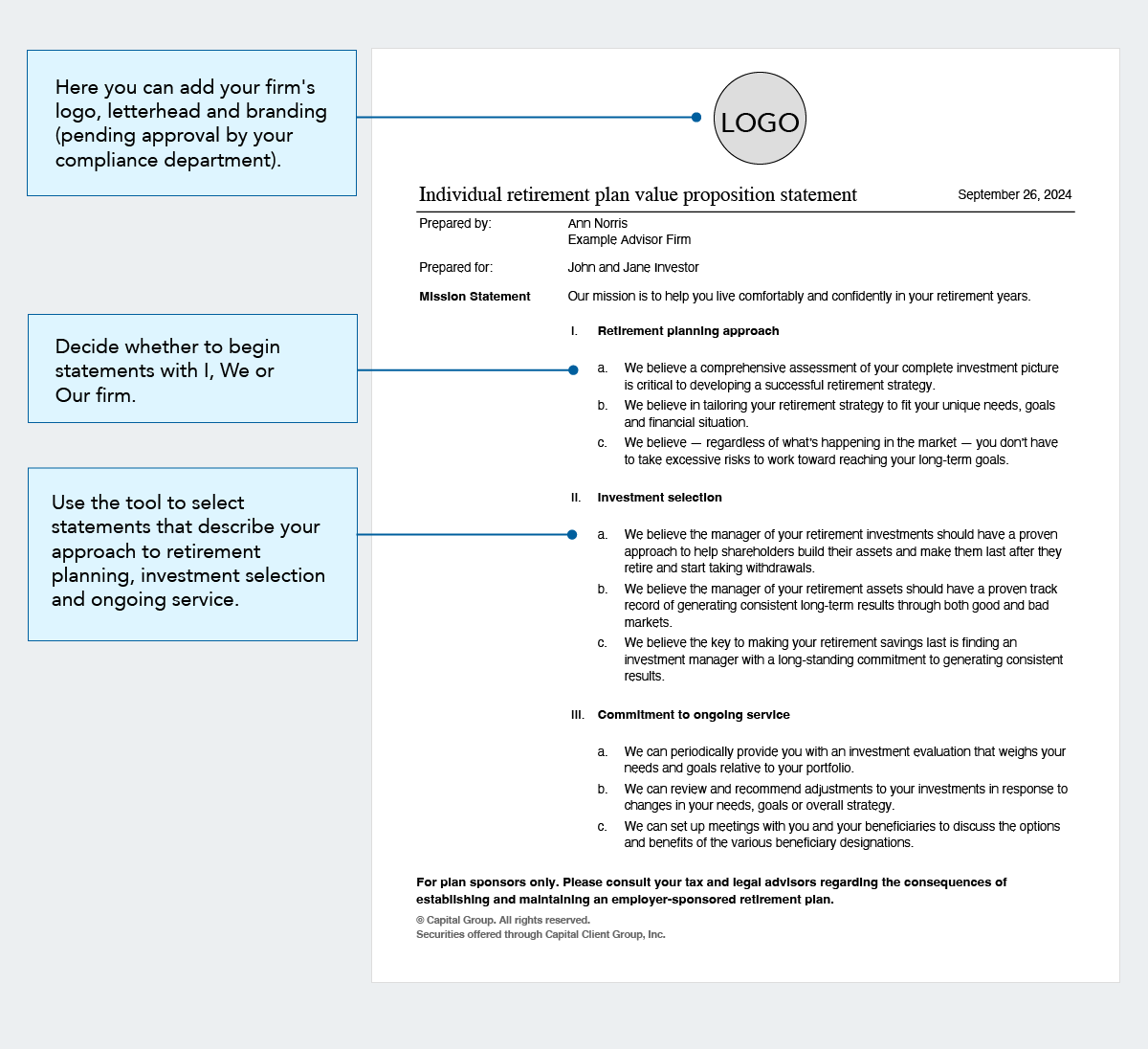

For IRA clients: Use the value proposition tool for individual retirement plans. The tool includes a variety of sample statements to choose from. They focus on:

- Retirement planning

- Investment selection

- Customer service

Sample statement for IRA clients

For retirement income clients: Use the value proposition tool for retirement income. The tool includes a variety of sample statements to choose from. They focus on:

- Retirement income planning

- Investment selection

- Ongoing customer service

Step 2: Print copies of the value proposition documents on your letterhead

How to do it:

- Each of the tools will generate a one-page VPS document in PDF format.

- Save the file on your local desktop and print copies on your letterhead to further customize your statement.

- Remember to have your compliance department review and approve your VPS (if required by your firm) before sharing it with clients.

Step 3: Put your value proposition statement to work

How to do it:

For prospecting:

- Distribute your individual retirement account (IRA) VPS to prospective clients at seminars or presentations as your calling card to show that you’re committed to helping them live comfortably and confidently in retirement.

- Provide your employer-sponsored retirement plan VPS to interested plan sponsors to highlight your ability to provide superior ongoing service and summarize what you can do for them.

- Use the retirement income VPS with clients or prospects who are close to retirement or who are concerned about having enough income in retirement.

- A VPS is also a useful tool for networking with other professionals (e.g., CPAs or tax advisors) who can refer clients to you for their retirement needs.

With existing clients:

- Present your VPS to existing IRA clients during an annual review, along with the personalized investment program you created for them.

- Your VPS can be a great icebreaker to begin a discussion with plan sponsors about their plans. Customize your VPS to reflect the concerns that are most important to individual plan sponsors and use it as a way to reintroduce yourself to your existing clients.