Greg Mendoza has always seen the opportunity in retirement plan consulting, even when he started in the business 24 years ago. “I was one of 107 people in my training class,” Mendoza says. “What differentiated me is everyone else went to the phone book; I went to business owners.”

His reason was simple: “I used to hate getting phone calls from telemarketers myself, so I didn’t want to call people at home,” he says. “I could talk to business owners at work.” Most of the people he spoke with either didn’t have a 401(k) plan or anything else in place. “But even if they did, I could extend myself as someone who could help them evaluate their plan, identify opportunities for improvement and implement these solutions.”

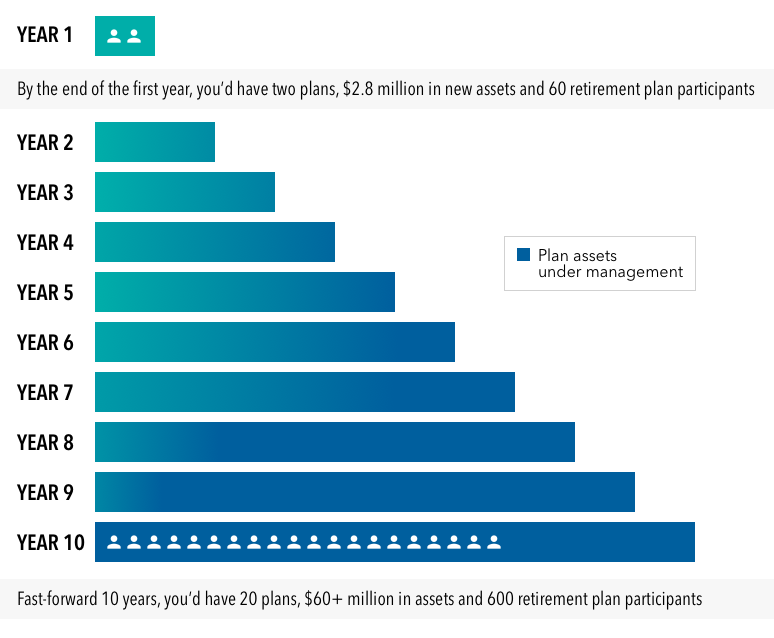

Today, Mendoza’s business, Integrated Wealth Management, in Hartford, CT, manages around 100 401(k) plans. He encourages other advisors to consider the retirement plan business. “No one thinks they can do it, but I assure you it’s possible — even in this day and age,” Mendoza says.

Getting serious about retirement plan consulting provides a way to scale your practice’s growth while leveraging what you know best — helping and educating investors in need. Successful retirement plan advisors say it helped them grow and retain assets under management, stabilize flows and increase ancillary sales — even during difficult times. If you’ve ever thought about getting started in the retirement plan business, consider these four reasons to add 401(k)s to your practice. Plus, see how to get started with a “one-meeting close.”