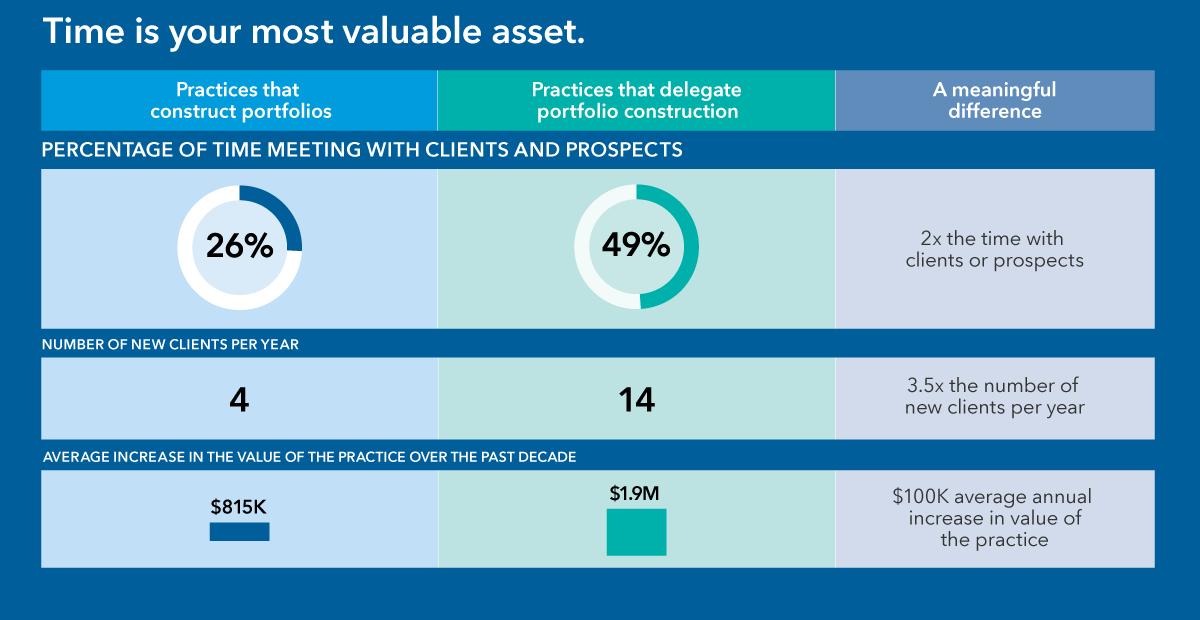

1. Show investors how they can benefit from models

To incorporate model portfolios into your practice, the first order of business is to clearly articulate the benefits to clients. This may seem like a major change for many of them. For years, many advisors honed the message that they were highly skilled in creating investment portfolios tailored for clients’ specific needs. And now, they’re extolling the virtues of model portfolios, which at first blush can sound closer to a paint-by-number approach than a personalized investment mix.

Some advisors worry that they spent years preaching one concept to clients. Now, in order to promote models, they’ll need to reverse course, says Jan Gundersen, senior vice president, portfolio solutions and services at Capital Group. “They think, ‘I can’t shift midstream.’” But with a well-crafted message and a deft hand, he says, they can. That’s because model portfolios can offer what clients want most: more time to talk to their advisors about their needs and investments suited to them.

That’s precisely been the appeal for Blaire Greenwood, CEO of Greenwood Financial Group. In 2015, in the early days of the Department of Labor fiduciary rule, her practice started a conversion to fee business. That change entailed a move to model portfolios, which took close to two years. And even now, there are some “straggler accounts,” Greenwood says. But by and large, clients embraced the idea of models.

Models helped the practice focus on financial planning, which resonates with clients. Clients also like the transparency involved with any changes to the investment mix. As for the benefits to the practice? “Models make growth more feasible, while not giving up that level of service for clients,” Greenwood says.