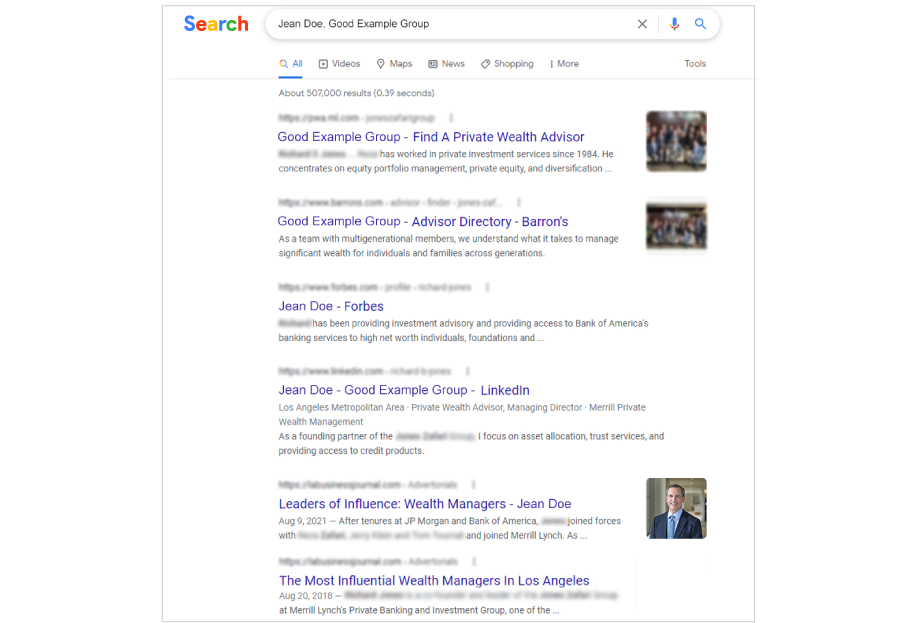

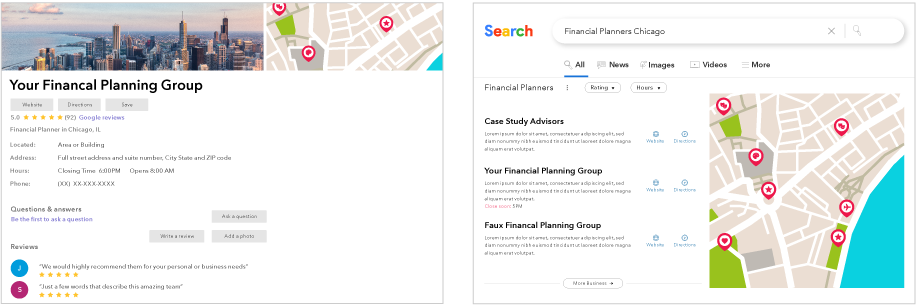

In a business powered by referrals, why bother with marketing? A decade or two ago, this may have been a fair question. Traditional marketing was primarily outbound – pushing sales messages towards prospects or clients, trying to gain awareness or consideration with a catchy or exciting pitch. In the digital age, much of marketing is inbound – pulling consumers in with information, validation or solutions at every step on their path to purchase. Even referrals are likely to use an internet search to investigate and validate the decision to work with you.

Digital marketing is so essential today, consumers engage without thinking about it as marketing. Indeed, many businesses participate without thinking about it as marketing. But advisors who take it seriously and invest time and resources into digital marketing have an edge. According to the research conducted for Capital Group’s Pathways to Growth: Advisor Benchmark Study, the highest growth advisors claimed two times greater confidence in their marketing skills than the average advisor and were more than twice as likely to use digital marketing strategies. (Of course, not all firms allow their financial professionals to make these types of digital connections. It’s important to review your firm’s policies and regulations before planning your strategy.)

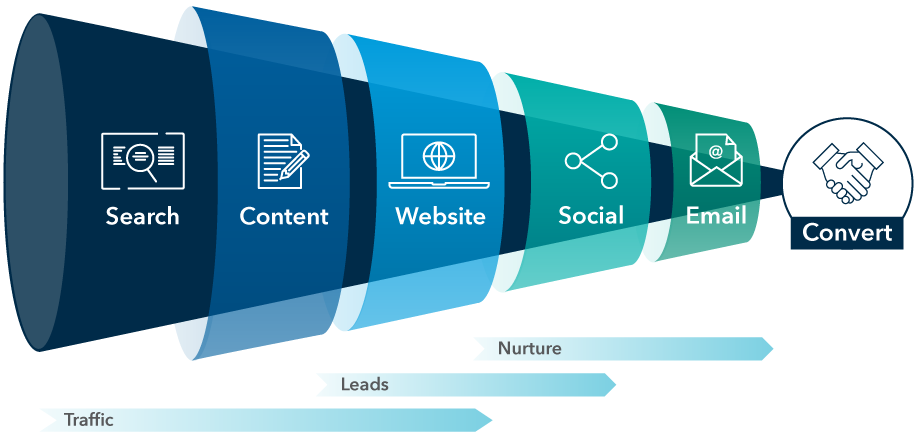

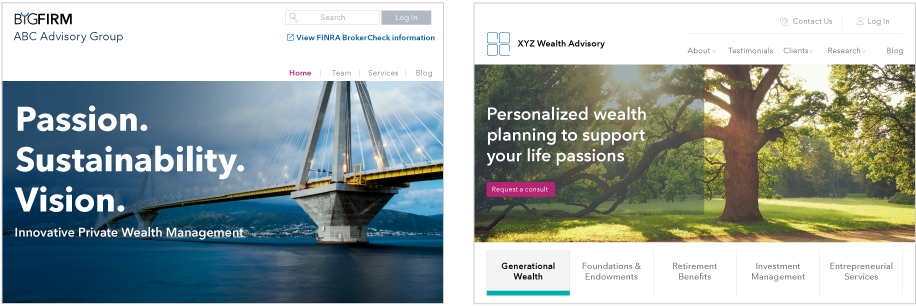

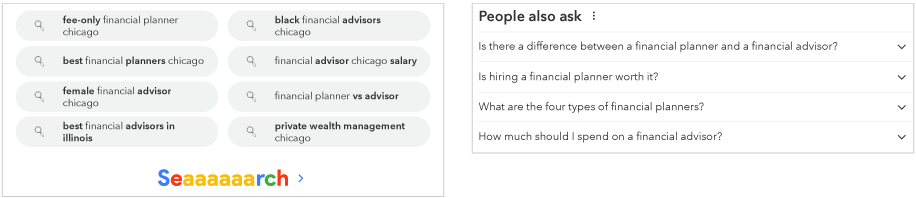

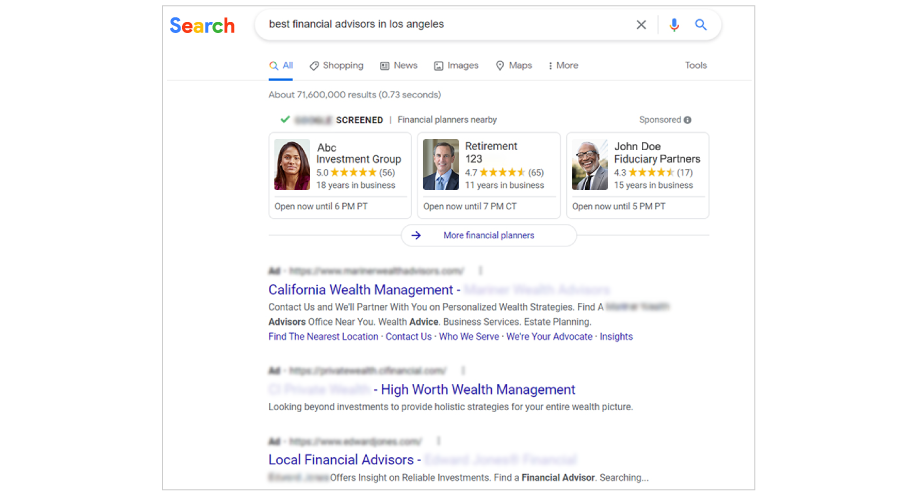

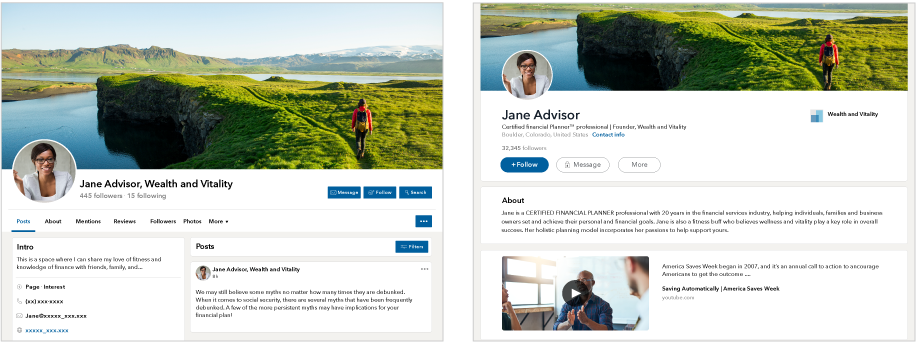

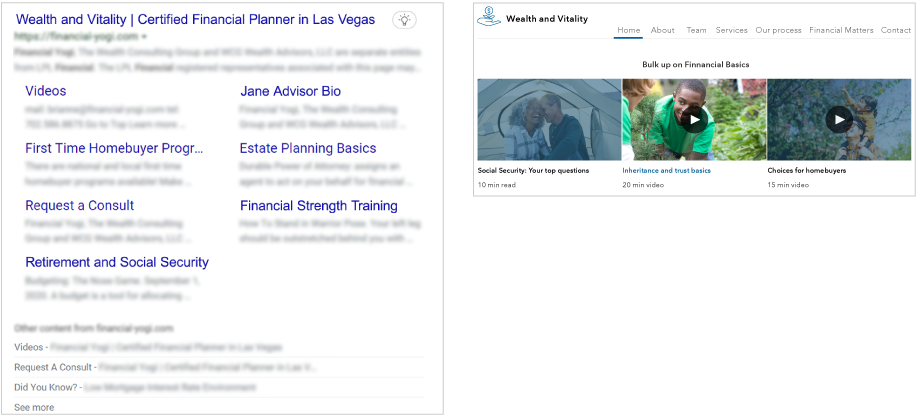

But where to start? Or, if you are doing digital marketing already, where do you focus or refine your efforts? The answer may depend on what you want clients or prospective clients to do. You can get different results depending on the point of access. Your website can help prospective clients determine whether your practice is a fit. Search engine optimization (SEO) can help them find you. Social media lets them see who you are, your motivations and what you care about personally and professionally. Content shows off your authority. And email can deepen engagement.