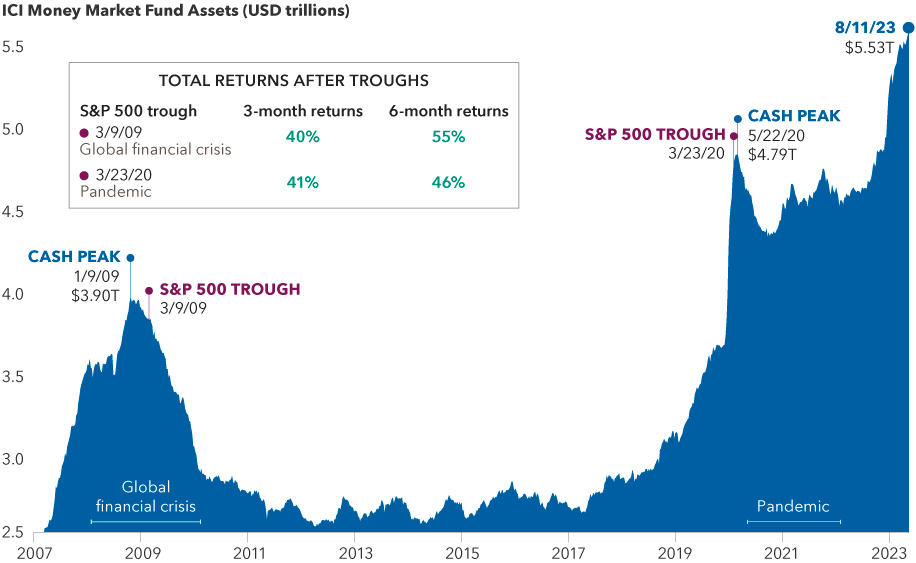

Cash is a proxy for uncertainty. And when investors leave cash on the sidelines, they could be missing out on future opportunities and potentially putting long-term goals at risk.

“Some of the most uncertain times — Fed hikes, inflation, disappointing earnings — have been inflection points. In hindsight, these events were opportune times to reallocate cash in client portfolios and align them to their objectives,” says Mike Gitlin, head of fixed income at Capital Group.

With a record amount of assets sitting in money market funds and a high-yielding cash environment, your clients may be unsure if the time is right to reinvest that cash — or how to deploy it. Cash can play an important role for unexpected emergencies, such as a job loss or unplanned expenses, but excess cash can be a headwind for long-term goals.

"One of the most difficult aspects of an advisor's job is managing clients through challenging times, keeping them from acting on fears that may get in the way of their long-term success," says Chris Jenkins, a wealth management consultant at Capital Group. "Your clients may need a nudge to help them deploy cash into investments better aligned with their long-term goals, and the conversation offers a great opportunity to demonstrate your value and deepen relationships."

When these conversations come up, it helps to have a systematic and repeatable approach. For example: There are four steps to any effective client conversation, each with a distinct goal. "First, acknowledge where the client stands. Second, provide your perspective. Third, build confidence. And fourth, share any potential opportunities," explains Max McQuiston, an advisor practice management consultant at Capital Group. “This framework can be used in any discussion but is particularly useful in times of risk aversion or market volatility.”