In observance of the Christmas Day federal holiday, the New York Stock Exchange and Capital Group’s U.S. offices will close early on Tuesday, December 24 and will be closed on Wednesday, December 25. On December 24, the New York Stock Exchange (NYSE) will close at 1 p.m. (ET) and our service centers will close at 2 p.m. (ET)

Test your investment's endurance

Use our comparison tool to dive deeper and explore how your investment stacks up, even in periods of market instability.

While the current crisis represents a new challenge, there is nothing new about market volatility. Markets have survived viral outbreaks, natural disasters, and other economic, financial and geopolitical crises in the past. We believe that looking past such periods of market instability and staying the course can benefit investors over the long term and help them reach their financial goals.

To see how your investment has held up, use our new comparison tool, which includes:

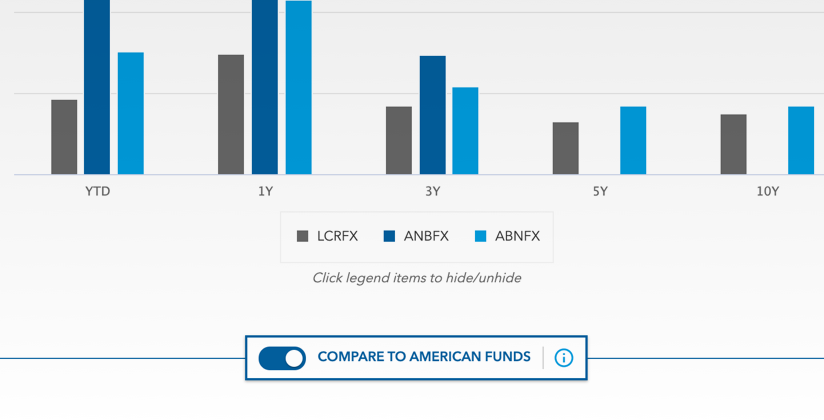

Results

Analyze your investment's results against its Morningstar category index and American Funds peers over short- and long-term periods.

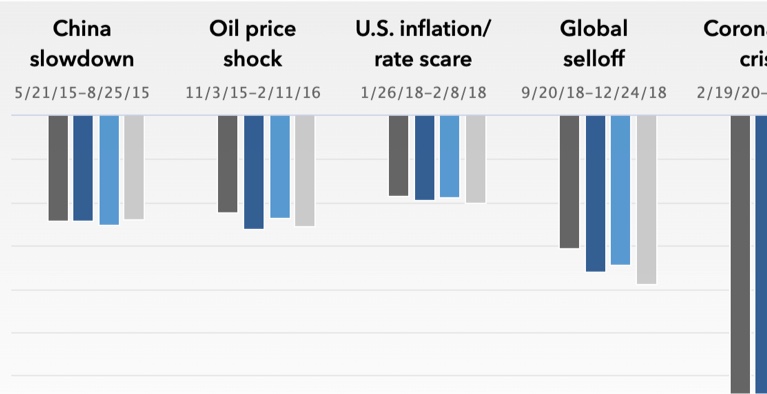

Market corrections

See how your investment has fared against its American Funds peers during recent market corrections, including the current crisis.

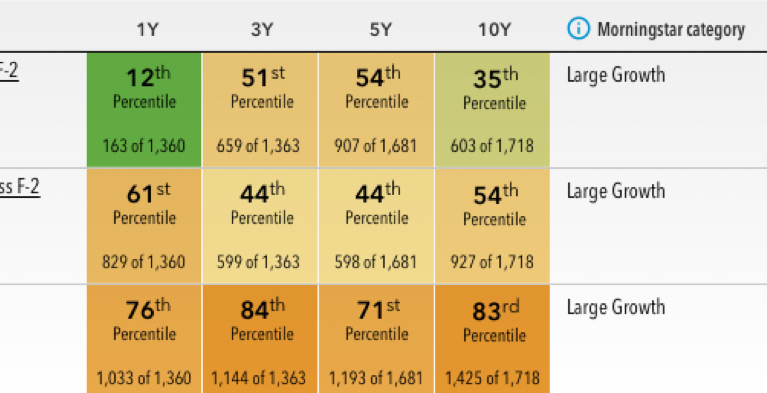

Rankings

Compare your investment's Morningstar category ranking to similar American Funds and see how it stacks up.

Stay in the know

Visit Capital Ideas™ to see our latest insights

Figures shown are past results and are not predictive of results in future periods. Current and future results may be lower or higher than those shown. Prices and returns will vary, so investors may lose money. Investing for short periods makes losses more likely. Market price returns are determined using the official closing price of the fund's shares and do not represent the returns you would receive if you traded shares at other times. View mutual fund expense ratios and returns. View ETF expense ratios and returns.

Investments are not FDIC-insured, nor are they deposits of or guaranteed by a bank or any other entity, so they may lose value.

Capital Group Exchange traded funds (ETFs) are actively managed and do not seek to replicate a specific index. ETFs are bought and sold through an exchange at the then market price (not NAV), and are not individually redeemed from the fund. Shares may trade at a premium or discount to their NAV when traded on an exchange. Brokerage commissions will reduce returns. There can be no guarantee that an active market for ETFs will develop or be maintained, or that the ETF's listing will continue or remain unchanged.

ETF market price returns since inception are calculated using NAV for the period until market price became available (generally a few days after inception).

As nondiversified funds, Capital Group ETFs have the ability to invest a larger percentage of assets in securities of individual issuers than a diversified fund. As a result, a single issuer could adversely affect a fund’s results more than if the fund invested a smaller percentage of assets in securities of that issuer. See the applicable prospectus for details.

Investors should carefully consider investment objectives, risks, charges and expenses. This and other important information is contained in the fund prospectuses and summary prospectuses, which can be obtained from a financial professional and should be read carefully before investing.

Investing outside the United States involves risks, such as currency fluctuations, periods of illiquidity and price volatility. These risks may be heightened in connection with investments in developing countries.

The return of principal for bond funds and for funds with significant underlying bond holdings is not guaranteed. Fund shares are subject to the same interest rate, inflation and credit risks associated with the underlying bond holdings.

The fund’s use of forward currency contracts to hedge all or substantially all of the fund’s foreign currency exposure could result in losses to the fund if currencies do not perform as expected. Forward currency contracts are considered derivatives instruments and the use of derivatives involves a variety of risks, which may be different from, or greater than, the risks associated with investing in traditional securities, such as stocks and bonds.

Income from municipal bonds may be subject to state or local income taxes and/or the federal alternative minimum tax. Certain other income, as well as capital gain distributions, may be taxable.

Lower rated bonds are subject to greater fluctuations in value and risk of loss of income and principal than higher rated bonds.

All Capital Group trademarks mentioned are owned by The Capital Group Companies, Inc., an affiliated company or fund. All other company and product names mentioned are the property of their respective companies.

Effective July 1, 2024, American Funds Distributors, Inc. was renamed Capital Client Group, Inc.

Use of this website is intended for U.S. residents only.

This content, developed by Capital Group, home of American Funds, should not be used as a primary basis for investment decisions and is not intended to serve as impartial investment or fiduciary advice.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.

Standard & Poor's 500 Composite Index is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group.

Copyright © 2024 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

Bloomberg® is a trademark of Bloomberg Finance L.P. (collectively with its affiliates, "Bloomberg"). Barclays® is a trademark of Barclays Bank Plc (collectively with its affiliates, “Barclays”), used under license. Neither Bloomberg nor Barclays approves or endorses this material, guarantees the accuracy or completeness of any information herein and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

© 2024 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.