Chart in Focus

Municipal Bonds

- New regulations will lend additional transparency to retail municipal bond trading.

- The trend of advisors transitioning client assets from individual municipal bonds to more flexible muni strategies may accelerate.

- This could bring additional benefits, if advisors opt for managers with both scale and an emphasis on research-driven investing.

New rule for greater transparency

Do you allocate to municipals via individual bonds? If so, a new bond disclosure rule set by the Municipal Securities Rulemaking Board (MSRB) could be a game changer. Approved by the SEC last year and set to go into effect on May 14, this change will affect an estimated 8,000 retail investor muni bond transactions every day.

The new MSRB markup disclosure rule has two major parts. First, it will require retail bond brokerage firms to disclose the amount of their “markup,” or how much profit they are making on each trade. This is only the case for transactions that are bought and sold by the broker dealer on the same day, and only for retail clients.

Second, all client trade confirmations will feature a link to trade price data about the bond on the MSRB’s Electronic Municipal Market Access (EMMA®) website. With minimal effort, clients will be able to look at the price they paid (or received) versus the recent trading history for that same bond.

Why all the fuss?

First off, this rule will apply to most bonds traded with investment advisors, stock brokers or individual retail clients. But the new rule will have the greatest impact on municipal bonds, where a lack of transparency has historically led to relatively high transaction costs for individual buyers.

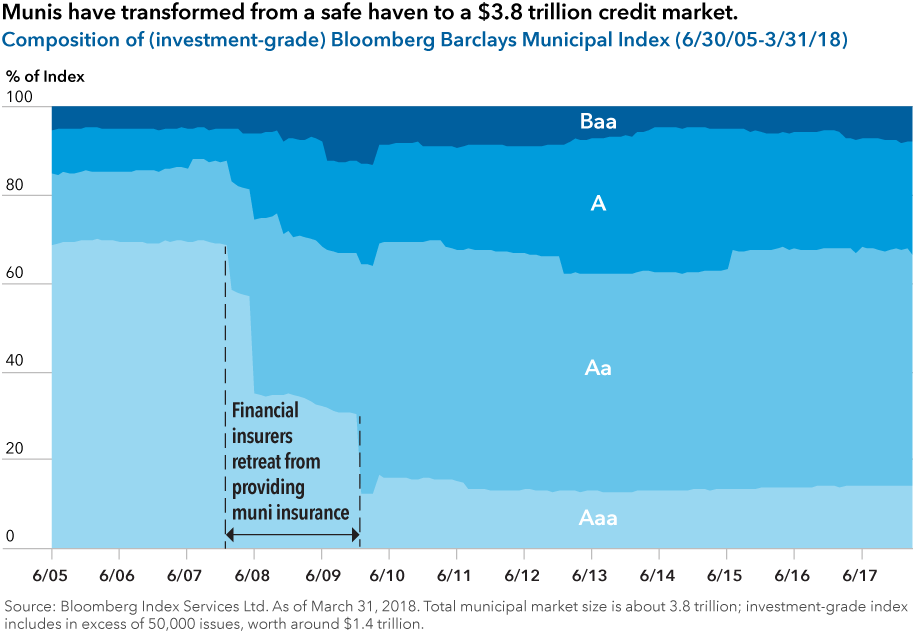

Overall, the municipal market is a very different place than it was a decade ago. Bond insurers have left the marketplace, creating the necessity for teams of experienced investment analysts to ascertain credit risk and relative value. The breadth of the market is extremely large as well: The Bloomberg Barclays Municipal Bond Index includes more than 50,000 separate issues.

It's safe to say that the new rule could potentially be a catalyst for some uncomfortable client conversations. Rather than letting the headlines dictate the discussion, we believe advisors should take a proactive approach and initiate the dialog with a solution already in place.

While not all clients need ot transition away from advisor-managed muni sleeves, there will likely be many cases when enlisting a third-party manager is prudent.

Flexible muni strategies can open the door to other benefits.

Tax-advantaged mutual funds and separately managed accounts (SMAs) can offer investors a relatively liquid and diversified way to invest in the asset class. For example, investors in Capital Group’s range of muni strategies can potentially benefit from:

- Deep research: With munis now much more of a credit-driven market, fundamental research is a crucial aspect of understanding risk-adjusted return potential.

- Institutional access: Managers with scale can access new issues, as well as competitive pricing in the secondary market.

- Liquidity: Funds and SMAs offer a relatively liquid investment option, compared to individual muni bonds.

- Duration and curve management: Strategies that manage interest rate exposure can potentially add value in different bond market environments.

The time for proactive client conversations is now.

The new disclosure rule is sure to spark many discussions about advisor-managed municipal bonds

Ultimately, greater transparency should benefit all by shedding light on costs. It should also provide greater context for those advisors who are considering transitioning client assets from individual municipal bonds to more flexible muni strategies such as The Tax-Exempt Bond Fund of America® or Capital Group Intermediate Municipal℠ SMA.

Bloomberg® is a trademark of Bloomberg Finance L.P. (collectively with its affiliates, “Bloomberg”). Barclays® is a trademark of Barclays Bank Plc (collectively with its affiliates, “Barclays”), used under license. Neither Bloomberg nor Barclays approves or endorses this material, guarantees the accuracy or completeness of any information herein and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

Our latest insights

-

-

Economic Indicators

-

Demographics & Culture

-

Emerging Markets

-

Never miss an insight

The Capital Ideas newsletter delivers weekly insights straight to your inbox.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.

Ajay Mittal

Ajay Mittal

Greg Ortman

Greg Ortman