Chart in Focus

Asset Allocation

Christopher Kiesel manages money in Hilton Head, South Carolina, a tranquil resort and retirement community. His firm, Oak Advisors, gets its name from the region’s stately oak trees, blanketed in Spanish moss. It’s the type of place that moves at a slower, more relaxed pace.

Except, that is, for Kiesel. Because Oak Advisors serves a client base primarily made up of wealthy retirees, protection is the guiding principle. And it’s his job to play defense.

“I try to watch out for ‘land mines,’” says Kiesel, a CFA® charterholder. “I don’t want to buy into something that gives our portfolios a risk I didn’t know about and have it blow up on us.”

It was this concern that led Oak Advisors to our Portfolio Consulting and Analytics Team in 2018. After performing one of the portfolio analysis reviews we offer to financial advisors, we found a potential issue hiding in — of all places — the firm’s bond allocations. “We were already using several mutual funds with credit risk,” Kiesel explains. “And we were finding the funds we considered core fixed income might be too exposed to credit risk in general, and wouldn’t be appropriate as an equity hedge.”

While it’s not always easy to see the risks in fixed income, and harder still to convince investors that they exist, our work reviewing countless portfolios each year helps us point out blind spots. Lately we are finding a good deal of risk hidden in core bond allocations. After years of reaching for yield in lower quality issues, many core strategies have shifted away from the roles bonds are designed to play, including diversification from equities, capital preservation and inflation protection.

Underscoring this issue, Morningstar recently split the once “big tent” intermediate term bond category in two, separating core bond funds from core-plus strategies that take more credit risks. As a result, some big name bond funds received lower ratings in their new categories.

To help you spot hidden risks in your bond allocations, this portfolio makeover tackles three common fixed income issues and serves as a case study for ways to add stability to your portfolios.

Issue 1: Not enough diversification from equities

A primary role of fixed income allocations is to offer counterbalance or stability when equities are volatile. You want your bonds to hold up when stocks go down. The best way to test this is to measure the correlation between stocks and bonds in your portfolio. Lower is generally better and means you have more diversification.

Some investors overlook this important correlation metric and screen bond funds in the same way they screen equities, based on performance rather than how they pair with the overall portfolio. The result is bonds that act like stocks in some ways, leaving the portfolio vulnerable during a market downturn.

Action: Go back to basics with government bonds.

From a diversification perspective, it’s hard to beat U.S. Treasuries. They are negatively correlated with equities and tend to offer downside protection when stock prices fall. Municipal bonds also provide a low correlation to equities and historically low default rates. And recent changes to tax law make muni bonds potentially even more appealing.

In Kiesel’s portfolio, corporate issues went from representing almost half of the fixed income portfolio to a more balanced 37.6%. Those proceeds were used to increase the allocation of government bonds from 14.7% to 22.8%. Municipal bonds in the portfolio increased from 5.9% to 9.0%. More importantly, the portfolio’s three-year correlation compared to the Standard & Poor’s 500 Composite Index went from .57 to just .18.

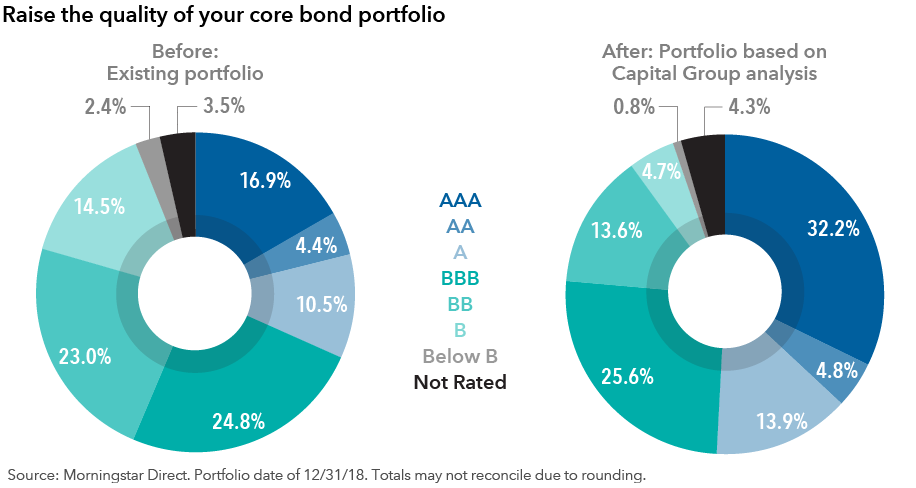

Issue 2: Too much credit risk in the portfolio

In a protracted low-yield environment, it’s natural to want to trade some credit risk for potentially higher returns. That’s why high-yield debt has been so enticing in recent years. But when non-investment grade debt starts to pervade the portfolio, investors may lose the diversification and stability that bonds are meant to provide. In a late-cycle economy, overexposure to lower quality credit can be particularly risky.

Action: Focus on quality at the core.

Since Morningstar split the intermediate term bond category, most investors might realize they have too much allocated to core-plus and not enough to core. Investors should evaluate whether there’s a need to rebalance those positions and separate quality fixed income positions from riskier or more speculative ones. Investing in a true core bond fund can help provide stability without surprises, leaving investors better situated to weather market conditions.

Even in core-plus positions, it’s important to keep an eye on quality. One compelling example is emerging markets debt, a surprisingly compelling alternative to high-yield bonds. This asset class is not as risky as it once was, but you can still get relatively high income from it. Emerging markets debt also has a lower correlation to equities compared to high-yield bonds, although some of the diversification comes from currencies and other regional idiosyncrasies that can add some risk.

“Having a fund that’s positioned to do what we expect it to do in various scenarios is a good core fixed income position for us,” Kiesel says. Implementing a true core fund reduced the firm’s positions in high-yield, floating-rate and strategic income opportunity funds to make room for less risky debt. The overall credit quality of the portfolio improved, with the highest quality bonds representing more than 32% of fixed income, up from just under 17%. Issues rated BB were brought down from 23% to a more reasonable 13.6%. Similarly, B rated holdings went from representing 14.5% of the portfolio to 4.7%.

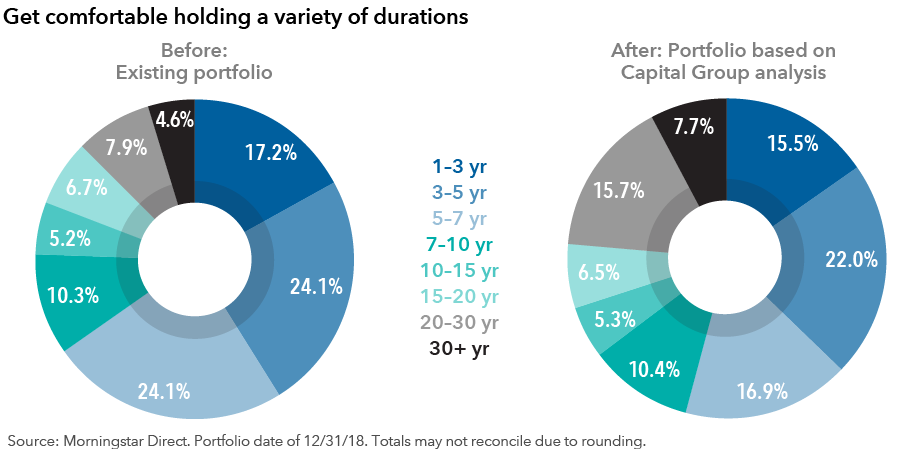

Issue 3: Not enough variety in duration

“What gets us into trouble is not what we don’t know, but what we know for sure that just ain’t so.” This quote is sometimes attributed to Mark Twain, but it could easily describe fixed income investors who take large positions on specific durations in an effort to reduce interest rate risk, only to be exposed to more volatility as the yield curve shifts.

It’s also possible to successfully hedge against one type of risk only to trade it for another. When the Federal Reserve seemed poised to raise rates in 2018, for example, many investors attempted to mitigate interest rate risk through the use of floating-rate bank loans. The non-investment grade loans are issued by banks and made up of loans made to companies in need of funding, and are not as sensitive to interest rate changes. But rates did not rise, leading investors to reconsider this exposure in early 2019.

Action: Let your objectives guide duration.

Rather than try to guess which way the yield curve will move next, investors should focus on the goals they are trying to meet. Quality investment opportunities can be found across the duration spectrum. Your bond strategies should have the flexibility to take advantage of them.

In Kiesel’s portfolio, we recommended a reduction in holdings with maturities between five to seven years from 24.1% to 16.9%. Meanwhile, holdings with 20- to 30-year maturities increased from 7.9% to 15.7%. And holdings with maturities of 30 or more years increased from 4.6% to 7.7%. Overall the average duration of the portfolio went from 2.37 years to 4.15.

With these risks uncovered and remedied, Kiesel is feeling almost as relaxed as his client base. “I have confidence that we aren’t going to have any surprises,” he concludes. “Everything should operate as we expect.”

The return of principal for bond funds and for funds with significant underlying bond holdings is not guaranteed. Fund shares are subject to the same interest rate, inflation and credit risks associated with the underlying bond holdings. Lower rated bonds are subject to greater fluctuations in value and risk of loss of income and principal than higher rated bonds. Income from municipal bonds may be subject to state or local income taxes and/or the federal alternative minimum tax. Certain other income, as well as capital gain distributions, may be taxable. Bond ratings, which typically range from AAA/Aaa (highest) to D (lowest), are assigned by credit rating agencies such as Standard & Poor's, Moody's and/or Fitch, as an indication of an issuer's creditworthiness. If agency ratings differ, the security will be considered to have received the highest of those ratings, consistent with the fund's investment policies. Securities in the unrated category have not been rated by a rating agency; however, the investment adviser performs its own credit analysis and assigns comparable ratings that are used for compliance with fund investment policies.

Investing outside the United States involves risks, such as currency fluctuations, periods of illiquidity and price volatility, as more fully described in the prospectus. These risks may be heightened in connection with investments in developing countries.

Standard & Poor’s 500 Composite Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks. Standard & Poor’s 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2019 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part is prohibited without written permission of S&P Dow Jones Indices LLC.

Our latest insights

-

-

Economic Indicators

-

Demographics & Culture

-

Emerging Markets

-

Never miss an insight

The Capital Ideas newsletter delivers weekly insights straight to your inbox.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.

Casey Dregits

Casey Dregits

Alex Rokowski

Alex Rokowski