While variable annuities are commonly associated with generating protected lifetime income, they can also prove valuable to investors seeking to accumulate assets by offering tax advantages, growth potential with professional management, and legacy planning benefits.

October 14, 2024

KEY TAKEAWAYS

- For investors seeking to accumulate assets, variable annuities can provide a powerful platform for investments to grow and compound over time.

- Variable annuities can serve as a practical tool for legacy planning, allowing for the designation of beneficiaries and the ability to pass on assets efficiently.

- Professional asset management within variable annuities can enhance the accumulation process through active management designed to maximize returns.

Now, let’s delve into these key points to understand how variable annuities can be a valuable tool for asset accumulation.

Long-term, tax deferred investment growth has its advantages: Investments that combine the compound growth of earnings with the benefits of tax deferral can substantially add to a person’s wealth over time. Many investors experience this in their IRAs and/or employer sponsored retirement plans, where compounding can gradually make an impactful difference to an investor’s overall retirement portfolio. Variable annuities are also tax-deferred – delaying the recognition of investment earnings for income tax purposes and providing the potential for substantial tax-deferred growth over time; even after the extra costs of these vehicles are considered.

With variable annuities, investors can also have more control over the timing of their withdrawals. This can benefit those with higher current tax liabilities and/or higher returns. Typically, the longer a person’s money can be invested, the greater the benefit can be from tax deferral and compounding.

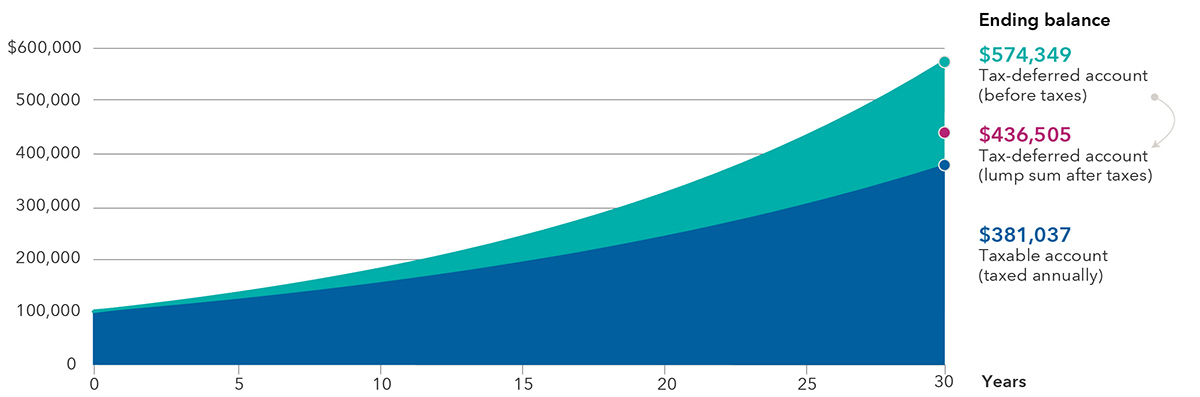

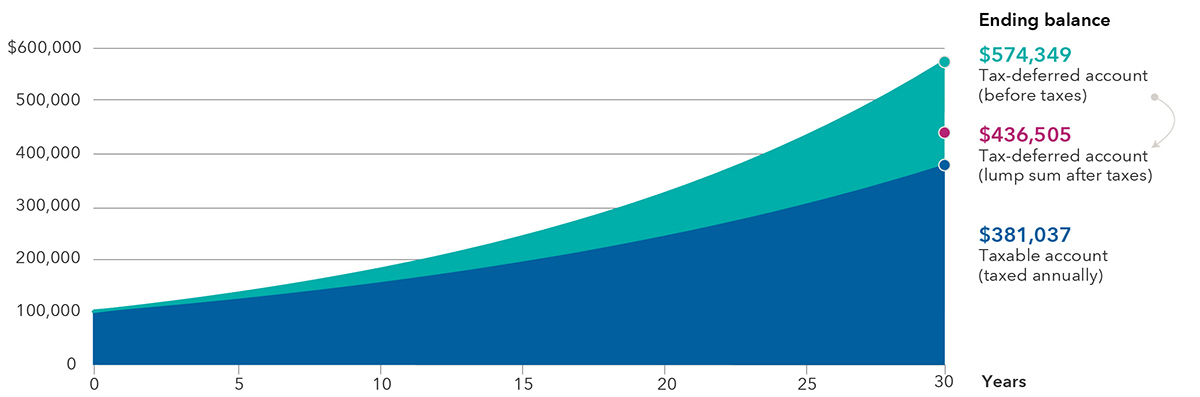

Taxable vs. tax-deferred investing over a 30-year time frame

Hypothetical growth of $100,000

Hypothetical results are for illustrative purposes only and in no way represent the actual results of a specific investment.

Source: Dinkytown.net, accessed 8/21/24.

This hypothetical compares the growth of two investments of $100,000, with no subsequent contributions, over 30 years at a 6% annual rate of return. The taxable account investment is assumed to have been made with after-tax dollars and taxed annually on short-term gains at 24% (long-term capital gains and qualified dividends are not considered in this analysis). The tax-deferred account investment is assumed to have been made pre-tax, with tax applied to the lump sum value upon distribution at a flat 24% tax rate.

An investor’s personal investment horizon and income tax bracket, both current and anticipated, may further impact the comparison. Withdrawals prior to age 59½ from certain tax-deferred investment vehicles like IRAs, employer sponsored retirement plans or variable annuities may be subject to a 10% federal penalty.

The power of legacy protection: The combination of growth and tax deferral can be a beneficial strategy for the gradual accumulation of a substantial legacy. But how do you protect that legacy? Many variable annuities offer a variety of death benefit options, some for an additional cost. These options not only allow for investors to remain invested for growth opportunities but can also provide an additional layer of legacy protection. Annuity death benefits can often bypass the probate process, allowing proceeds to pass directly to designated beneficiaries. This streamlined transfer of wealth can help investors avoid delays and potential estate expenses.

The power of professional management: Many variable annuities offer professional asset management that provides investors with access to a team of experienced portfolio managers who can craft well-informed strategies and help optimize asset allocation. This experience can potentially boost returns and bolster risk management. Additionally, many variable annuities offer diversification across a spectrum of asset classes to allow portfolio customization that aligns with their risk tolerance and financial goals.

Unlike many other investment vehicles, variable annuities permit switching between investment options within the annuity without triggering immediate tax consequences. This access and flexibility can be a powerful tool for many investors seeking wealth accumulation and preservation.

Consider the American Funds Insurance Series® as a part of your accumulation strategy

Since 1984, the American Funds Insurance Series has remained dedicated to enhancing investor outcomes and to helping them achieve their objectives. Our funds offer a proven track record for investments with a variety of objectives and are available at an insurer near you.

For over 90 years, Capital Group, home of American Funds, has applied a consistent philosophy and consistent approach to generate consistent outcomes. With more than $2.5 trillion in assets under management,1 it is one of the asset managers trusted by financial professionals.2

Our funds employ The Capital SystemTM, combining independent, high-conviction decision-making with the diversity that comes from multiple perspectives. In combination with our consistent approach, the system pursues superior outcomes. It seeks to deliver long-term results that help clients pursue their goals.

In summary, while variable annuities are commonly associated with generating protected lifetime income, they can also prove valuable while an investor is seeking to accumulate assets, especially when other retirement accounts are maxed out. Variable annuities can enhance an investor’s ability to accumulate wealth by offering tax advantages, growth potential, legacy planning benefits and professional asset management.

Who might benefit from the compounded advantages of tax-deferred earnings:

- Individuals with higher marginal income tax rates

- Investors with a longer time frame to retirement (10+ years)

- Investors who have maxed out their employer-sponsored retirement plan and/or IRA contributions

- Those who expect lower marginal tax rates in retirement

Kate Beattie is a senior retirement income strategist with 18 years of investment industry experience (as of December 31, 2024). She holds a bachelor’s degree in economics with a business administration minor from Colorado State University and holds the Certified Financial Planner™ and Retirement Income Certified Professional® designations.