A target date fund (TDF) is arguably the most important investment on a retirement plan menu. It allows all investors regardless of their level of sophistication to have a diversified investment that’s appropriate for their age and career timeline. Furthermore, a TDF takes a complex investment challenge and presents it in a simple solution that plan participants can more easily understand.

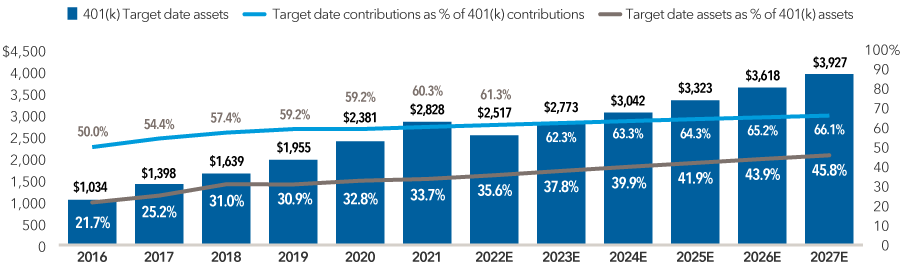

As a result, TDFs have become the dominant investment trend in 401(k) and other defined contribution plans. However, they may still be underutilized by participants. According to Sway Research and Callan, TDFs comprised only 32% of total 401(k) assets, as of September 2022.