Defined Contribution

Annual plan reviews play a critical role in maintaining the health of a retirement plan. But this year’s plan review may take on a different dynamic than in recent years. Given declines in both stocks and fixed income, participants may be seeing something they haven’t in a while — or ever, depending on their age — negative investment returns in their 401(k) accounts.

Put yourself in the shoes of plan sponsors

While market declines may be first and foremost in the minds of many plan sponsors, successful plan reviews start with thinking about a client’s point of view and the plan’s objectives. Use this time to reconnect with your clients and take a temperature check on how they, and their business, have fared over the past year or more.

Did they thrive during this period of time or were they challenged? Did higher costs cause struggles in the business or was keeping good people top of mind? Has their company returned to in-person work or are they still maintaining a virtual environment, or a combination of the two? While you may not be able to control where you will meet, you can control how clients will be met.

Revisiting roles and responsibilities

The role of the financial professional (FP) has always been an integral part of running a 401(k) plan. But in a rapidly changing environment, that role is shifting to become an extension of the plan sponsor. As a result, many FPs are spending more time and resources to help sponsors monitor plan health and ensure it is operating effectively.

With all the changes happening in the retirement industry, FPs should be proactively educating their clients about them. FPs can’t afford to be reactive: A recent survey of plan sponsors found that nearly half (47%) are considering changing their FP, marking an all-time high.* FPs should control the narrative before it is dictated by someone else. Now might be a good time to remind clients of all you do to help provide the best retirement plan possible.

That’s why determining how well your client’s retirement plan operates — including who provides each service — matters. Service providers should work in tandem to meet the plan’s goals, and the annual review is an ideal time to revisit their roles and responsibilities. The graphic below illustrates some of the common service providers involved with running a plan. You can also share our handout on how to evaluate service providers.

Working together to meet plan goals

Don’t be afraid to review the investment menu

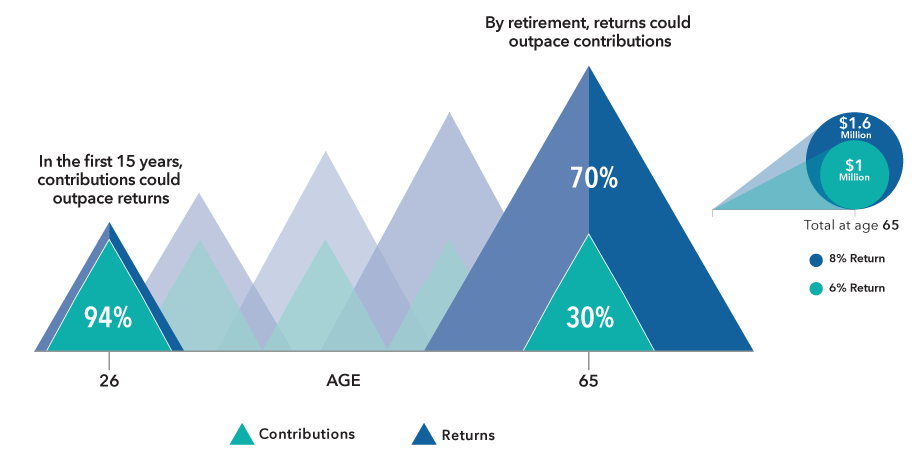

While the investment lineup doesn’t fall under the category of service provider, it plays a critical role in the success of the plan. As the chart below shows, investment returns — not participant contributions — are the primary engine that drives participant outcomes over the long term. You can watch the returns story unfold through this video illustration.

So returns matter, especially when measured by rolling returns, which may be a more in-depth gauge of long-term returns as opposed to trailing returns. The most critical factor bridging the gap between what participants save and what they’ll need in retirement lies in the quality of the returns their plan’s investments can generate.

Returns matter more than you think

By the time participants retire, as much as 70% of their account value could come from returns, not contributions.

The demographic assumptions, returns, and ending balance are hypothetical and provided for illustrative purposes only, and are not intended to provide any assurance or promise of actual returns and outcomes. Returns will be affected by the management of the investments and any adjustments to the assumed contribution rates, salary, or other participant demographic information. Actual results may be higher or lower than those shown. Past results are not predictive of results in future periods. Based on the exhibit by CBS Moneywatch. Assumptions for 70/30 rule of thumb: This hypothetical example assumes a participant started investing 10% of their $40,000 income at age 26. And then continues to contribute 10% each year throughout their career, as salary increases by 3% a year.

The majority of plan sponsors say their financial professional demonstrates the greatest value by evaluating fund performance, according to proprietary research conducted by Chatham Partners on behalf of Capital Group. Now, with U.S. stocks and bonds officially in bear market territory, it may be more important than ever to reevaluate the funds in the plan’s lineup.

According to the Plan Sponsor Council of America (PSCA), the average number of funds on the menu reached 21 in the 2020 plan year, the first increase in over 10 years. But is that too many? When it comes to the investment menu, simplicity is better. For each fund on the menu, consider some of the following questions:

- Why was it chosen in the first place?

- Is it meeting its objectives?

- Have the results been challenged? If so, can they be deemed reasonable? Or was it a major surprise?

- Have they been resilient the times following the periods they've lagged in previous downturns?

When discussing investment results, consider looking at rolling returns. Trailing returns can vary greatly from month to month, especially during periods of volatility. This variation can cause funds to be evaluated differently depending on the particular month the review takes place. Rolling returns, however, can provide a better measure of consistency, as they average multiple periods.

While plan sponsors and financial professionals cannot control the market, they do have control over choosing funds for their plan menus that have potential to withstand market volatility.

Spotlight on participants

While it’s important for you to reconnect with your clients, it’s just as important for you and the plan sponsor to check in with their employees. After all, the employees are the ultimate beneficiaries of the retirement plan.

Since the great financial crisis, financial wellness has become a hot topic in the financial industry. It might be easy to talk about financial wellness when markets are steadily rising as they have for more than a decade. But consider that many participants may be experiencing sustained volatility and losses for the first time. For example, many participants started working around the time of the 2008 financial crisis and perhaps didn’t have much in retirement savings.

Now, those same participants have likely built up their retirement balances and may be worried about losses. With all major U.S. stock indexes finishing down for 2022, it's important to speak to those people that have never experienced it before and guide them. This may help you stand out as a leader – especially in the eyes of plan sponsor clients.

Our recent article on selecting 401(k) plan funds to weather a bear market may help in the discussion. And more insight is only a phone call away to your Capital Group representative.

Related resources:

- Deliver effective retirement plan reviews: Use this comprehensive list of resources to help plan sponsors assess and improve their plans.

- Retirement Planalyzer®: Find, price, compare and present retirement plan options for plan sponsors.

- Target Date ProView: Use Morningstar data to compare specific target date series based on Department of Labor (DOL) guidance.

- RecordkeeperDirect® Plan Review Sample Report: This report compiles plan, participant and investment data to help you assess and improve retirement plans.

* “Nearly Half of Plan Sponsors Considering Changing Advisors, Recordkeepers,”401K Specialist, 401kspecialistmag.com, August 23, 2022.

Our latest insights

-

-

Defined Benefit

-

Regulation & Legislation

-

Retirement Planning

-

RELATED INSIGHTS

Never miss an insight

The Capital Ideas newsletter delivers weekly insights straight to your inbox.

Andy Laskowski

Andy Laskowski