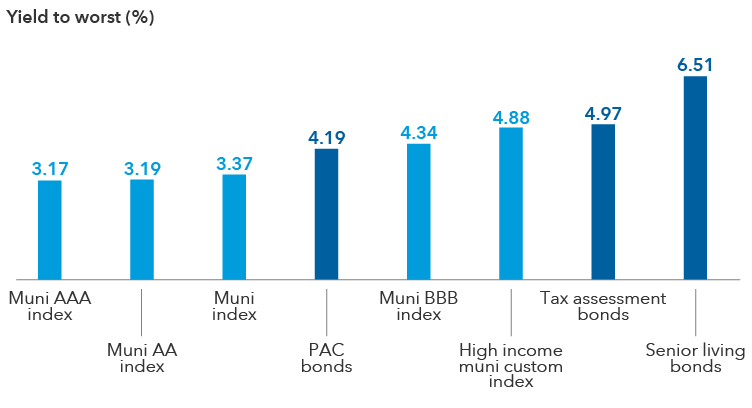

1 The high-income muni custom blend index is composed of 60% Bloomberg High Yield Municipal Bond Index (with 5% Tobacco Cap and 2% Issuer Cap), 20% Bloomberg Municipal Bond BBB Index and 20% Bloomberg Municipal Bond Index.

The value of fixed-income securities may be affected by changing interest rates and changes in credit ratings of the securities.

Lower rated bonds are subject to greater fluctuations in value and risk of loss of income and principal than higher rated bonds.

Bloomberg Municipal Bond Index is a market-value-weighted index designed to represent the long-term investment-grade tax-exempt bond market. This index is unmanaged, and its results include reinvested distributions but do not reflect the effect of sales charges, commissions, account fees, expenses or U.S. federal income taxes.

Bloomberg Municipal Bond AAA Index is a market-value-weighted index representing the AAA-rated portion of the Bloomberg Municipal Bond Index. This index is unmanaged, and its results include reinvested distributions but do not reflect the effect of sales charges, commissions, account fees, expenses or U.S. federal income taxes.

Bloomberg Municipal Bond AA Index is a market-value-weighted index representing the AA-rated portion of the Bloomberg Municipal Bond Index. This index is unmanaged, and its results include reinvested distributions but do not reflect the effect of sales charges, commissions, account fees, expenses or U.S. federal income taxes.

Bloomberg Municipal Bond BAA Index is a market-value-weighted index representing the BAA-rated portion of the Bloomberg Municipal Bond Index. This index is unmanaged, and its results include reinvested distributions but do not reflect the effect of sales charges, commissions, account fees, expenses or U.S. federal income taxes.

Bloomberg U.S. Aggregate Index represents the U.S. investment-grade fixed-rate bond market. This index is unmanaged, and its results include reinvested dividends and/or distributions but do not reflect the effect of sales charges, commissions, account fees, expenses or U.S. federal income taxes.

Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index covers the universe of fixed-rate, non-investment-grade debt. The index limits the maximum exposure of any one issuer to 2%. This index is unmanaged, and its results include reinvested distributions but do not reflect the effect of sales charges, commissions, account fees, expenses or U.S. federal income taxes.

Bloomberg High Yield Municipal Bond Index is a market-value-weighted index composed of municipal bonds rated below BBB/Baa. This index is unmanaged, and its results include reinvested distributions but do not reflect the effect of sales charges, commissions, account fees, expenses or U.S. federal income taxes.

© 2024 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

The after-tax (or tax-equivalent) yield of a municipal bond investment is the yield a taxable bond would have to offer to equal the same amount as the tax-exempt bond. Highest federal tax rate assumes the 3.8% Medicare tax and the top federal marginal tax rate for 2024 of 37%, for a total federal tax rate of 40.8%. Tax-equivalent yield calculation is yield to worst/(1-(federal tax rate)).

The Personal Consumption Expenditures (PCE) Price Index provides a measure of prices that people living in the United States, or those buying on their behalf, pay for goods and services. The core inflation figure strips out the volatile food and energy categories.

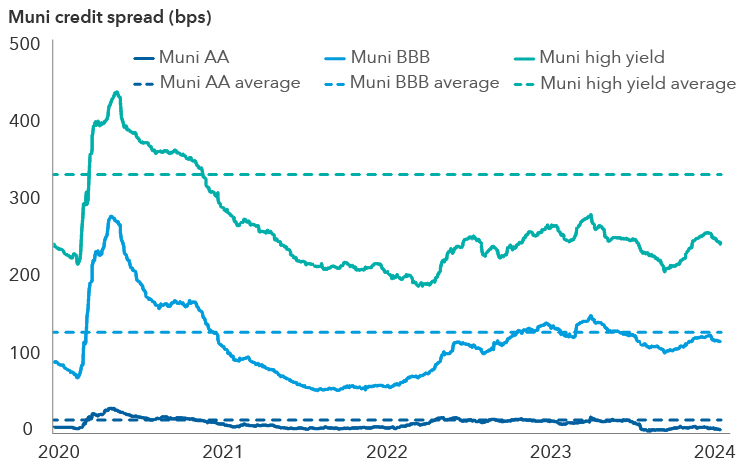

Credit spread - A credit spread is the difference in yield (the expected return on an investment over a particular period of time) between a government bond and another debt security of the same maturity but with different credit quality.

Duration measures a bond’s sensitivity to changes in interest rates. Generally speaking, a bond's price will go up 1% for every year of duration if interest rates fall by 1% or down 1% for every year of duration if interest rates rise by 1%.

Inflation – The rise in the prices of goods and services, as happens when spending increases relative to the supply of goods on the market – in other words, too much money chasing too few goods. Core inflation metrics strip out volatile items like food and energy.

Liquidity – Liquidity describes the degree to which an asset or security can be quickly converted into cash without a significant concession in price.

Yield to worst is the lowest yield that can be realized by either calling or putting on one of the available call/put dates or holding a bond to maturity.