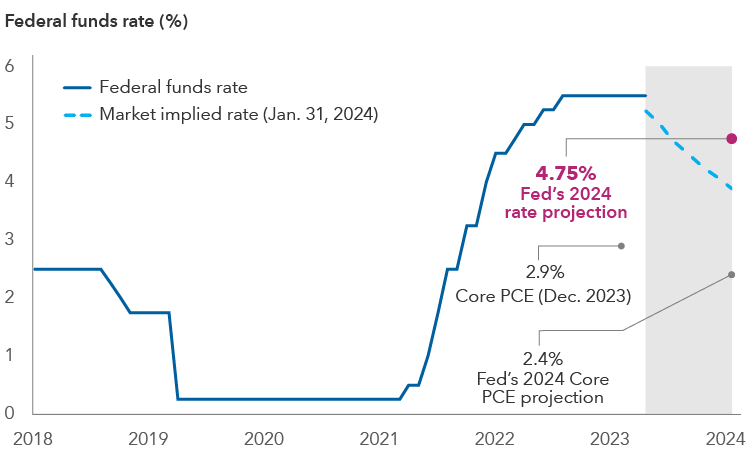

Market pricing after the January 31 meeting showed investors appear to believe the Fed will cut rates by around 140 basis points (bps) by the end of the year. This is higher than the Fed’s most recent dot-plot projections of 75 bps and reflects a view that the central bank is likely to deploy “maintenance cuts” as inflation continues to slow, even if growth stays positive.

Market valuations are reflecting a Goldilocks economic scenario of slowing inflation and resilient growth, supported by easier monetary policy. While a recession is not the base case, there are signs that markets could be overly optimistic about the economy. The risk is that markets are underestimating the potential impact of one of the sharpest tightening cycles in decades. Even if one has a baseline expectation for a soft landing, the margin of error reflected in current bond pricing seems very thin.

Valuations across fixed income sectors suggest it may be prudent to consider adding some defensive positioning. Since the Fed’s pivot at its December meeting, there have been strong excess returns across various bond sectors. Investment-grade (BBB/Baa and above) credit spreads are nearing their tightest levels since before the global financial crisis. A bias for higher quality securities may be appropriate as the current pricing of lower rated credits does not appear to reflect the potential downside risk.

The core Personal Consumption Expenditures (PCE) Index (the Fed’s preferred gauge of inflation) dipped below 3% year over year in 2023 and is now below 2% on three-month and six-month bases. As a result, the central bank is likely to begin rate cuts even as the economy continues to expand. Maintenance cuts may be greater than the Fed's projection (e.g., if inflation falls below 2.5% by the end of 2024 and the Fed wants to bring the real monetary policy rate down to 1%, this would imply the federal funds target rate should fall to 3.5%, entailing 200 bps of cuts by the end of 2024).

According to both Governor Christopher Waller and Chair Powell, the Fed will be closely watching the Bureau of Labor Statistics’ revised Consumer Price Index (CPI) data released on February 9. The Fed will be looking for confirmation that the near-term inflation trend is sustainable, particularly as revisions to CPI this time last year surprised to the upside.

Should a recession materialize, additional cuts would likely be implemented. Given the recent decline in interest rates, positioning for a steeper yield curve may offer more attractive risk-reward than an overweight to duration.

Labor market strength remains a key variable to achieving a soft landing. So far, the labor market appears to be reaching balance without significant loss of jobs — but there are areas to watch such as aggregate employment measures and revisions to nonfarm payrolls, which have been negative in 11 out of the last 12 months. Additionally, the larger-than-expected fiscal stimulus and liquidity from the decline in usage of the Fed’s Reverse Repurchase (RRP) facility were both supportive of strong economic growth in 2023. Both factors are expected to be weaker this year.