DEFINED CONTRIBUTION SALES IDEA

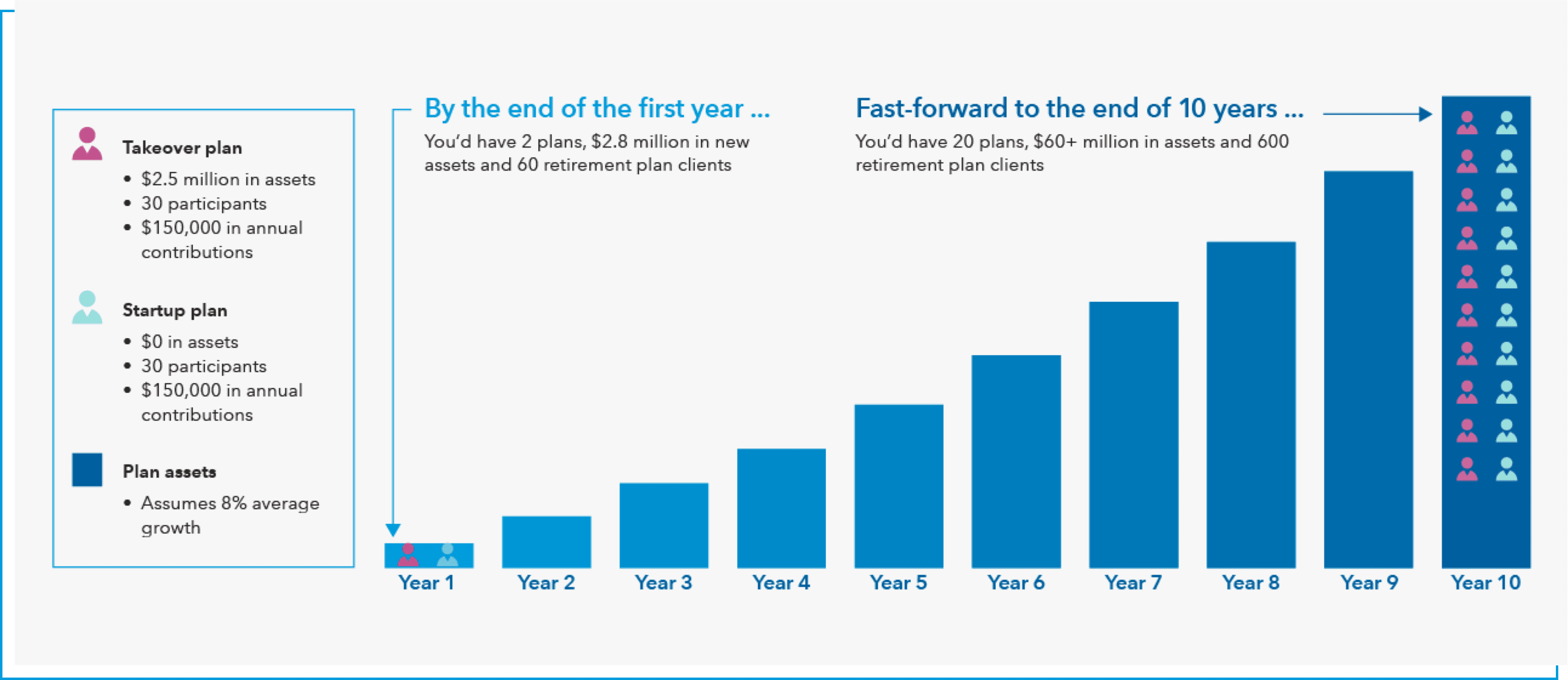

Winning just 2 plans a year can add up over time

Hypothetical example for illustrative purposes only; not intended to portray an actual investment. Example assumes (1) the addition of one startup and one takeover plan with $2.5 million in assets each year, (2) that each plan has 30 participants and adds $150,000 a year in new plan contributions, and (3) a hypothetical 8% annual growth rate on assets.

Get started with retirement plans

CONTACT US

Find your dedicated Capital Group representative

We’re committed to helping you win & retain more plans.

Contact Capital Group

No result for ZIP Code

There isn't a representative

assigned to this ZIP code. Please

enter another ZIP code or call us.

Your retirement plan counselor

We’re unable to display your retirement plan counselor's information at this time. Please try again later or

call us.

Find your retirement plan representative

Enter another ZIP Code

Investments are not FDIC-insured, nor are they deposits of or guaranteed by a bank or any other entity, so they may lose value.

Investors should carefully consider investment objectives, risks, charges and expenses.

This and other important information is contained in the mutual fund prospectuses and summary prospectuses, which can be obtained from a financial professional and should be read carefully before investing.

All Capital Group trademarks mentioned are owned by The Capital Group Companies, Inc., an affiliated company or fund. All other company and product names mentioned are the property of their respective companies.

Use of this website is intended for U.S. residents only. Use of this website and materials is also subject to approval by your home office.

Capital Client Group, Inc.

This content, developed by Capital Group, home of American Funds, should not be used as a primary basis for investment decisions and is not intended to serve as impartial investment or fiduciary advice.