U.S. Equities

- Expect a bumpy path for U.S. markets in 2020 as the economy comes back online, followed by a potentially more solid recovery in 2021

- Recoveries have been longer and stronger than downturns

- A great divide between winners and losers makes it a stock-picker’s market

- It’s better to consider staying invested than sit on the sidelines

The decade-long economic expansion did not end with a whimper. The coronavirus brought it to a screeching halt.

U.S. gross domestic product (GDP) fell 5% in the first quarter, and a steeper decline is likely in the second. Consumer spending, which accounts for about two-thirds of the U.S. economy, slid 13.6% in April, the steepest decline on record.

More bad news lies ahead in the short term, starting with the tragic human cost. Historic unemployment will likely have a lasting impact on the economy, and many businesses are failing. The path to economic recovery will depend on the course of the virus and public health response, and stock markets may bounce around for an extended period until the economy finds firmer footing.

“The U.S. stock market appears to be priced for a quick economic recovery,” says U.S. economist Jared Franz. “But I expect a more gradual U-shaped recovery with bumps along the way,” he explains.

When will near-term pain give way to long-term gain? “Over the next six months, we will see some challenges, and I expect consumer demand to remain sluggish for some time,” says portfolio manager Claudia Huntington. “That said, my three-year view is very optimistic. I am seeing a lot of long-term investment opportunities present themselves in this environment.”

Market recoveries have been longer and stronger than downturns

There will certainly be ups and downs, but veteran portfolio manager of the Capital Group Canadian Focused Equity Fund (Canada), Rob Lovelace believes it’s a matter of when, not if, we make it across this valley. “Because the slowdown was the result of government policy — not economic imbalances or rising rates ― we can see what recovery can look like when policies are relaxed,” Lovelace says. “And that to me is reassuring.”

Of course, when you’re in the middle of a downturn, it feels like it’s never going to end. But it’s important to remember that market recoveries have been longer and stronger than downturns. Over the past 70 years the average bear market has lasted 14 months and resulted in an average loss of 33% as measured by Standard & Poor’s 500 Composite Index. By contrast, the average bull market has run for 72 months — or more than five times longer — and the average gain has been 279%.

Moreover, returns have often been strongest right after the market bottoms. After the carnage of 2008, for example, U.S. stocks finished 2009 with a 23% gain. Missing a bounce back can cost you a lot, which is why it’s important to consider staying invested through even the most difficult periods.

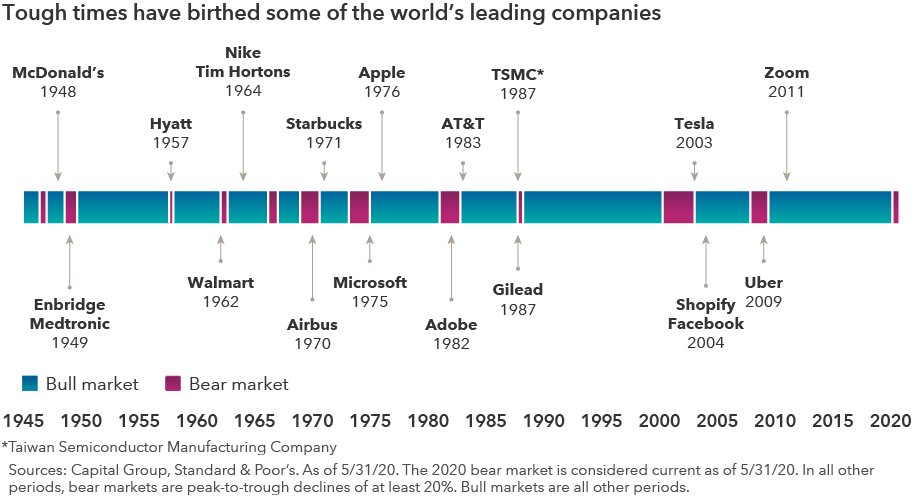

Long-term investors may take comfort in knowing that tough companies have often been born in tough times. Consider these examples: McDonald’s emerged in 1948 following a downturn caused by the U.S. government’s demobilization from a wartime economy. Walmart came along 14 years later, around the time of the “Flash Crash of 1962” — a period when the Standard & Poor’s 500 Composite Index declined more than 22%. Microsoft and Starbucks were founded during the stagflation era of the 1970s, a decade marked by two recessions and one of the worst bear markets in U.S. history.

Companies that can adapt and grow in tough times often present attractive long-term investment opportunities. Bottom-up, fundamental research is the key to separating these resilient companies from those likely to be left behind.

The post-COVID market presents opportunity for selective investors

While the pain of the current downturn has been widespread, its impact has not been universal. With stores shuttered and consumers mostly sheltered at home, U.S. retail sales slid an unprecedented 16.4% in April, according to the U.S. Commerce Department. But that’s not the whole story.

A look beneath the surface of the U.S. stock market shows there has been a stark divide between winners and losers in this era of limited mobility. Not surprisingly, online retailers and grocers have enjoyed strong sales growth as consumers eat in and do their shopping in front of a screen. Providers of broadband, health care, home improvement materials and educational services have also benefited from healthy demand. Conversely, restaurants, travel and leisure companies, and aerospace companies have seen sales evaporate.

“We are witnessing a number of exciting themes emerge during this crisis,” says Huntington. “Within health care, for example, we are seeing telemedicine come to the forefront, as elements of the national health system go online, improving efficiency for many patients.” To be sure, not all companies will equally tap into rising opportunity, so selective investing will be critical going forward, Huntington adds.

Digitization of daily life is here to stay

Some of the recent demand activity reflects an amplification of already established trends. Cloud demand, for example, was sky-high before the COVID-19 outbreak. But the events of 2020 have kicked that theme into overdrive. In the stay-at-home era, e-commerce, mobile payments and video streaming services have soared in popularity, occasionally pushing the limits of technology. While the levels of online activity are likely to moderate, the pandemic could be a catalyst for even stronger e-commerce growth in the years ahead.

“The response to the COVID-19 crisis — keeping everyone at home — has accelerated this powerful trend of digitizing the world,” explains Capital Group portfolio manager Mark Casey. “Services that were already useful have in some cases become almost essential. Many people felt compelled to try grocery delivery for the first time, for example, and subscriptions to Netflix skyrocketed.”

There’s also room to advance, Casey adds. While e-commerce has grown in popularity, it still represents only about 11% of U.S. retail sales last year, and mobile payments stood at similarly low levels. “Given where we are now in the consumer-technology space, the growth potential is truly exciting.”

Don’t forget: A U.S. presidential election is looming

In an odd twist of political and economic fate, the event that everyone thought was going to be the biggest story of the year has been relegated to an afterthought. And maybe that’s the best way for investors to think about it.

That’s because, historically speaking, presidential elections have essentially made no difference when it comes to long-term investment returns. The U.S. stock market has powered through every election since 1933, reaching new highs over time regardless of whether a Republican or a Democrat won the White House.

What has mattered most is staying invested. Getting out of the market during election season has rarely paid off. It’s time, not timing, that makes the difference.

By design, elections have winners and losers, but the real winners have been investors who avoided the temptation to time the market and stayed in it for the long haul.

Commissions, trailing commissions, management fees and expenses all may be associated with investments in investment funds. Please read the prospectus before investing. Investment funds are not guaranteed or covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. For investment funds other than money market funds, their values change frequently. For money market funds, there can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capital Group‘s Canadian investment funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capital Group. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. Capital Group funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2025 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2025. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

MSCI does not approve, review or produce reports published on this site, makes no express or implied warranties or representations and is not liable whatsoever for any data represented. You may not redistribute MSCI data or use it as a basis for other indices or investment products.

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capital Group trademarks are owned by The Capital Group Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capital Group funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capital Group, a global investment management firm originating in Los Angeles, California in 1931. Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capital Group funds offered on this website are available only to Canadian residents.

Mark Casey

Mark Casey

Jared Franz

Jared Franz

Claudia Huntington

Claudia Huntington