Artificial Intelligence

The artificial intelligence (AI) hype cycle may be coming to an end. Technology giants and investors alike are enthusiastic about AI’s potential to drive productivity gains and transform the economy.

But certain resource constraints could prevent AI growth rates from meeting lofty expectations. Indeed, investors in recent months have begun to question how long it will take for the multibillion dollar investments in AI to translate to profit growth. But the bottlenecks might not be where you expect.

“One of the ironies of producing an advanced technology like AI is that it requires vast physical resources, and you might not think of such advanced technology as being physically constrained,” says U.S. economist Jared Franz.

Not all resource constraints will make the news like shortages of advanced semiconductors made by NVIDIA and other chipmakers. Here are four resource constraints that could slow the growth of AI — and present opportunities for old economy companies.

1. AI sparks a 21st century copper rush

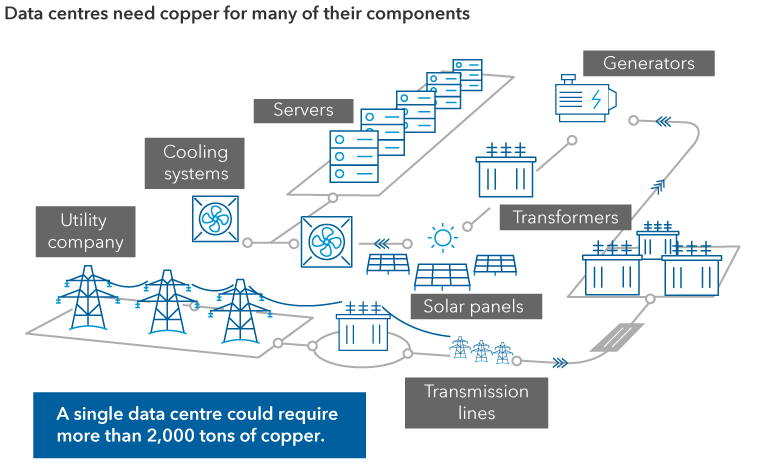

Generative AI tools like ChatGPT run on large language models hosted on thousands of servers in massive data centres. These data centres require cooling systems to help the servers run more efficiently, as well as a power infrastructure consisting of transformers, generators and transmission lines. Most of these elements require copper. The construction of a US$500 million Microsoft data centre near Chicago required 2,177 tons of copper, for example.

Anatomy of a data centre: Servers, power and cooling systems

Source: Capital Group.

“If the projections by the hyperscalers are right, data centres constructed over the next eight years will require one million tons of copper in the U.S. alone,” Franz says. “And you’re going to have to think globally about this build-out.”

Demand for copper in electric vehicles, clean energy technology and the modernization of the U.S. electric grid is already expected to create growing deficits. The planned construction of AI data centres will push those deficits to more than six million tons by 2030, according to JPMorgan. “The question is, can miners extract enough copper out of the earth quickly enough to meet expectations for the AI build-out?” Franz asks.

Anticipating shortfalls, global mining companies are focusing on acquiring and expanding copper operations. Grupo México, a conglomerate that operates some of the lowest cost copper mines, restarted work in south Peru this past July to boost production. Similarly, the fourth largest copper producer, Glencore, is turning to operations in Argentina to double its output in the coming years.

2. Power demand is going nuclear

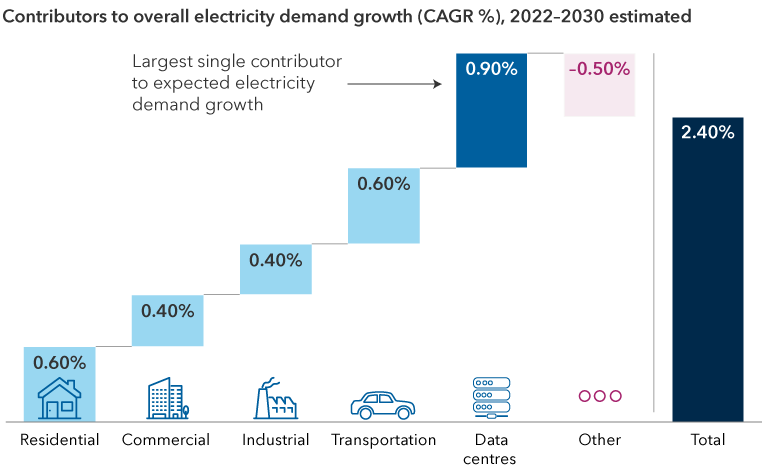

AI, like just about any advanced technology, needs power. A lot of power. Data centres could consume as much as 9% of total U.S. electricity output by 2030, more than double current usage, according to the Electric Power Research Institute. “The demands on the grid from both data centres and electric vehicles are going to drive an increase in consumption we haven’t seen in about 20 years,” says equity portfolio manager Cheryl Frank.

Data centres jolt demand for electricity

Sources: Goldman Sachs, U.S. Energy Information Administration (EIA). Estimates from Goldman Sachs as of April 28, 2024. CAGR is the compound annual growth rate. “Other” includes the impact of energy efficiency improvements and the change from categories not listed.

The question is, can U.S. utilities meet the soaring demand in the near term? Probably, but there are complications, according to Franz. First, supply and demand dynamics vary by state. “You could have mismatches in specific states, but if the current trajectory is right, there should be enough power. But if the trajectory doubles, bringing on new capacity very quickly would be very challenging.”

What’s more, many of the tech giants have committed to net zero carbon emissions by 2030. “It will be challenging to meet these commitments and power demand in the short term,” Franz adds. “You’ll need a lot more wind, a lot more solar, natural gas — and you may need to slow the pace of decommissioning coal plants. All energy sources may need to be on the table.”

In some high-demand areas, available connections are scarce. “Companies are being told they can’t get a connection into the system and will need to go on a waiting list,” Frank says. To help meet its growing needs, Microsoft in September reached an agreement with nuclear power provider Constellation Energy to restart the Three Mile Island nuclear plant in Pennsylvania.

3. Capital equipment needs are surging

Substantial capital equipment needs to build out data centres and increase power generation globally are driving demand for a range of industrial companies, in some cases leading to shortages. For example, energy equipment maker GE Vernova expects its US$6.4 billion backlog of gas turbines needed for backup generators and other electrical equipment to triple by the end of 2024.

Because AI chips generate a great deal of heat, data centres require advanced liquid cooling systems to prevent equipment failure and improve energy efficiency. Industrial manufacturers such as Modine and Vertiv have seen triple-digit increases in their stock prices this year as demand for their offerings has surged.

Need for cooling technology has bolstered industrial companies

Sources: Capital Group, FactSet. Figures reflect cumulative total returns between January 1, 2024, and September 30, 2024. Returns are in USD.

4. AI needs more humans

News headlines will focus on the potential for AI to eliminate jobs. But the rollout of AI faces a potential human resources shortage. “We're starting to hear companies say there is an actual shortage of AI engineers who can build foundational models, as well as a shortage of people able to implement AI systems at the enterprise level,” Franz says.

According to a recent Salesforce survey, 60% of public sector IT professionals identified a shortage of AI skills as their top challenge to implementing AI.

Without experienced people leading the rollout, adoption will likely be slower and take more time to generate the efficiencies the technology can provide. “I think professional services companies like Accenture and Oracle will play an important role in helping enterprises determine their AI strategies,” Frank adds. “There will be a lot of people in this chain.”

The bottom line

To be sure, AI technology has great potential to drive productivity and transform the economy over the long term, but build-out and adoption of the technology will likely take time because of the potential bottlenecks identified here, in addition to other factors. Technological advances could mitigate some of these constraints. For example, future advances in semiconductor design could reduce the amount of power needed in data centres, or at least minimize current requirements.

“I expect two AI cycles,” Frank concludes. “The one we are in the middle of, which is an advertising-driven consumer AI cycle, and later, an enterprise AI cycle that will be more manageable but a much longer and slower build. That pattern is normal when it comes to innovation.”

Hyperscalers are large-scale cloud service providers that offer computing power and storage to organizations and individuals globally.

S&P 500 Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks. The index is unmanaged and, therefore, has no expenses. Investors cannot invest directly in an index.

Our latest insights

-

-

Currencies

-

Market Volatility

-

Market Volatility

-

Markets & Economy

RELATED INSIGHTS

-

Emerging Markets

-

Global Equities

-

Commissions, trailing commissions, management fees and expenses all may be associated with investments in investment funds. Please read the prospectus before investing. Investment funds are not guaranteed or covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. For investment funds other than money market funds, their values change frequently. For money market funds, there can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capital Group‘s Canadian investment funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capital Group. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. Capital Group funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2025 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2025. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com)

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capital Group trademarks are owned by The Capital Group Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capital Group funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capital Group, a global investment management firm originating in Los Angeles, California in 1931. Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capital Group funds offered on this website are available only to Canadian residents.

Jared Franz

Jared Franz

Cheryl Frank

Cheryl Frank

Brad Olalde

Brad Olalde