ESG

7 MIN ARTICLE

Maintaining dialogue with management teams can position us to positively influence their ESG strategies. While third-party ratings look to the past, our first-person interactions focus on future opportunities and potential challenges.

KEY TAKEAWAYS

- We believe engagement, rather than exclusion, can have a more positive impact.

- Our analysts advocate for policies that can benefit investors, organizations and the environment.

- Our deep research can uncover problems and find opportunities, and we are able to act on our findings.

At Capital Group, our approach to environmental, social and governance issues is central to our entire investment process. We look beyond any single issue and take a holistic view of every investment we make, seeking out companies with sustainable business models.

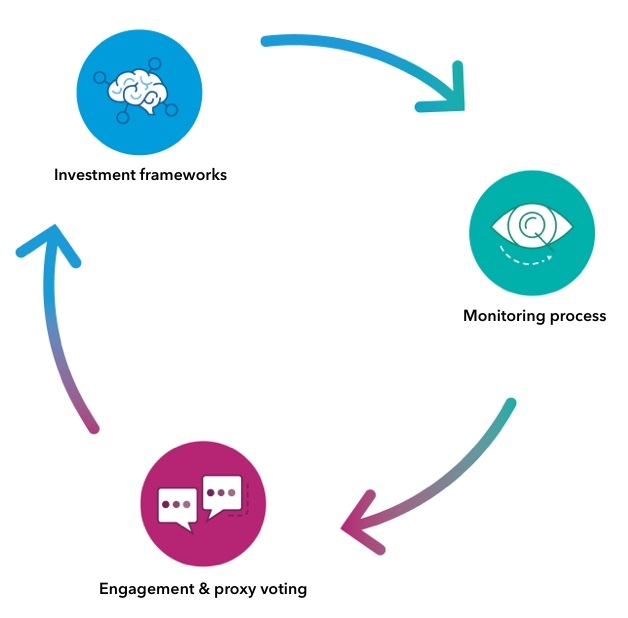

We incorporate ESG into our investment approach through a systematic process with three interrelated components. Our sector analysts define the material ESG issues for each industry. They also reference several third-party rating systems to flag problematic companies and issuers, and we continue to engage in ongoing discussions with management teams. Each of these three elements enhances the others to create an ongoing cycle of scrutiny.

The foundation for our investment decisions has always been deep, fundamental research, which includes engagement with management teams that can often span decades. Our intensive research and long-term holding periods naturally lead to productive relationships with companies and issuers, providing access and credibility. From this position, we have found that engagement can be a more effective catalyst for change than exclusion, as we can influence organizations to consider ESG issues in their strategy. We are typically viewed as a valued discussion partner who can support, advise and often challenge management’s approach to ESG issues. They recognize our seriousness of purpose and see engagement with Capital Group as mutually beneficial.

I’ve been covering the oil and gas industry, for instance, for more than 20 years. When a major oil company appointed a new CEO recently, I already knew him well. In the early stages of scoping out his ESG business strategy, he asked for my input. I, along with a couple of colleagues from Capital Group, had a great session at his office, covering a broad range of ESG topics, with climate issues as an obvious priority. The CEO appreciated that, like him, we have an investment timeline that spans far beyond the next quarter or year.

Our on-the-ground research has led to some far-flung locations, such as Azerbaijan in 2016.

When the company later presented a new approach to long-term strategy and ESG issues, including an increased emphasis on renewable energy, they acknowledged Capital Group as one of the important discussion partners that helped develop the new business model.

Our first priority is our investors, so we seek to invest in companies that can continue to grow and improve over the long term, maintaining their competitive advantages. We support sustainable business plans and forward-looking philosophies, which typically incorporate ESG. In the case of energy companies, for example, we are encouraging — and witnessing — a pivot toward renewables, which aligns with the market’s needs and would likely benefit investors, as well as the company and the environment. Of course, we continue to scrutinize the financial returns that companies can potentially earn on those investments.

The value of experience

Consider the fact that we have more than 200 investment analysts with an average experience of 14 years, and our more than 100 portfolio managers average 27 years.¹ Compare that to the median five-year tenure of a CEO.² Each engagement with management — whether a small start-up or global corporation — is shared with other analysts, documented and referenced for future discussions. We continue to build our deep knowledge of industries, companies, issuers, geographies and markets.

We avoid blanket judgments about entire industries, as we believe no company or sector is a single-issue choice. While some environmentally focused investors may avoid contributing capital to companies in fossil fuel sectors, for instance, we continue to invest in those oil and gas companies that are engaged on the issues and have a coherent approach to the “energy transition.” By engaging with those companies, we can help shape a future that is less dependent on fossil fuel but still meets the world’s energy needs. In another example, we may not exclude the entire tobacco industry, but we do encourage those companies that are developing less dangerous products.

Similarly, we don’t assume every climate-conscious company is free from societal or governance challenges. While environmental investors are understandably drawn to climate-conscious industries, like wind farms, solar energy or electric cars, we also examine how each of those companies treats its employees and shareholders, and invest accordingly.

There are other industries where a thorough consideration of ESG issues goes beyond a simple exclusionary approach — utilities, industrial manufacturers and mining companies are all good examples. In fact, we have worked with numerous companies to define the most problematic ESG concerns in specific industries as our analysts complete a framework for screening each sector. Simply walking away from an organization or industry does not enable us to influence change, but would only maintain the status quo.

In summary, our investing process involves layers of research and continuous engagement. We believe that working with management promotes a more positive impact in the long run.

In 2018, we traveled to Oman to take a close look at a potential investment.

Proxy voting

Our two-way engagement with management is also a factor in how we represent shareholders in proxy votes. In addition to our knowledge, there is our scale. Capital Group’s investment entities are often among a company’s largest shareholders, so our votes have an impact. With ownership comes responsibility — and a direct way of providing input.

We have robust policies on corporate governance and put substantial effort into developing and debating our views on key concerns, including environmental and ethical issues. In 2020, our portfolio managers and analysts held more than 20,000 meetings with management teams. Additionally, our investment professionals, 17 Governance Analysis & Proxy (GAP) specialists, and 14 ESG specialists engaged with more than 400 organizations specifically on ESG topics.

We find that these discussions — along with research visits and one-on-one meetings — can be more effective than the proxy vote itself. With continuous behind-the-scenes engagement, we are clear about our positions and can influence the content and wording of a proposal even before it is introduced for a vote.

The human touch

As a large and respected active asset manager, we not only have a seat at the table, we have leverage as well. Unlike passive index funds, we can invest or divest, based on our first-person learnings. We believe our detailed, case-by-case approach is especially important when so many passive investment vehicles remove human judgment from the equation. In cases where we see strategic, material commitment to ESG that can provide a sustainable competitive advantage, we can increase our investment. Conversely, we can avoid organizations where we don't find a meaningful commitment to ESG progress. That's one way that our investment approach can help our investors stay ahead of an index, which cannot shift asset allocation in response to new information about its predetermined holdings. We may discover problems before they are obvious to others, and we can find opportunities others miss.

Importantly, our views on issuers aren't static, and when we identify firms that, despite low ESG marks, may have increased their commitment to making meaningful improvement, we can invest in that upward trend to help benefit our investors if the changes get positively priced into a company's valuations. There are also organizations with high ESG ratings that we may not agree with.

We don't just visit management teams, we also spend time with their employees, competitors and suppliers. These interactions provide a deeper understanding of a company's inner workings and broader stakeholders.

In one recent example, we avoided investing in a well-known retail company when our on-the-ground research raised questions about supply chains and the sustainability of margins. Despite the company's high ratings by the third-party firms, subsequent news and claims regarding the supply chain vindicated our analyst's approach.

Conversely, sometimes an organization's past mistakes can lead to future potential as entire management teams are replaced. We can sit down with the new leaders and help influence their actions going forward, considering how a company can perform while it works to transform.

Will we catch every potential pitfall? Probably not. But without our dogged research we wouldn't uncover any. Have we missed opportunities? Perhaps. But we are confident that our expansive research efforts uncover other promising investments.

Since 1931, Capital Group has focused on long-term investing, which means finding organizations with forward-focused business models and a thoughtful approach to ESG. We seek to use our influence to encourage companies and issuers — and even whole industries — to continually improve. That entails nurturing ongoing relationships and staying engaged, actively working toward making a difference in the lives of our investors.

1 As of December 31, 2020.

2 Source: Strategy&, "2018 CEO Success study."