Global Equities

Global Equities

- Major shifts in globalization and technology are changing the way investors approach international investing.

- Global investors should consider moving beyond strict boundaries defined by borders as companies find revenues outside their own region.

- Fundamental research can help identify global companies that are best positioned to find opportunity in a restructured world economy.

The notion of global investing is not what it used to be just 10 years ago.

Rapid advancements in technology, free trade agreements and the rise of multinationals in emerging markets have transformed the structure of the economic world today, allowing companies to compete for customers, labor and capital on a global basis. These profound shifts have changed the way to think about global investing, not only in terms of opportunities but also portfolio allocation decisions.

Rather than dividing portfolios in regional slices, I believe global flexibility is crucial in efforts to design a “future-proof” portfolio amid the changing dynamics of business and trade.

Download our white paper containing research on how global flexibility can enhance portfolios.

Welcome to the new geography

Globalization and an increase in open trade is having a significant impact on the universe of investment opportunities, meaning that companies headquartered in Europe, Japan and the U.S. don’t necessarily generate most of their revenue in their home country like they once used to.

Furthermore, the rise of economies in China, India and other emerging markets is having a profound effect on the global economy and major implications for companies in the developed world.

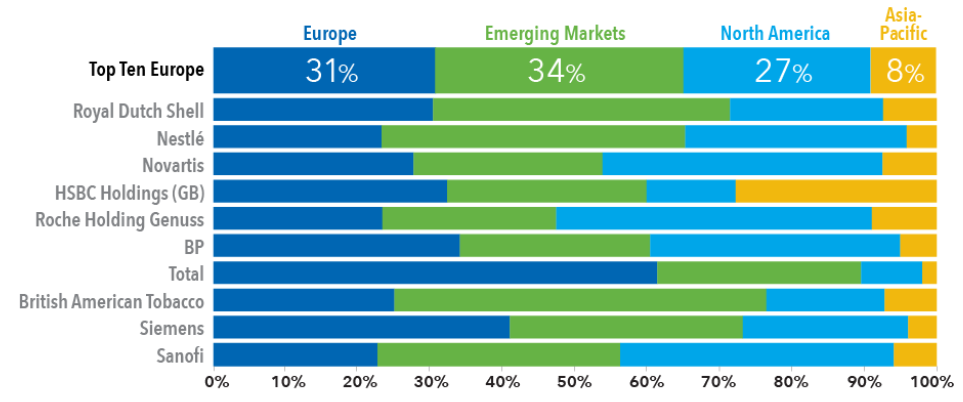

For instance, a review of S&P 500 company revenues shows that about 37% is derived from outside the U.S. Meanwhile, the 10 largest companies in the MSCI Europe Index get approximately 69% of revenues from outside Europe, in part due to slower growth in their region and better opportunities abroad.

Investing in Europe means investing globally

Revenue exposure of top 10 companies in the MSCI Europe Index

Sources: MSCI, RIMES. Revenue exposure of the top 10 companies in the MSCI Europe Index by market cap, as of December 31, 2016.

So when considering how much of your portfolio is exposed to the global economy, I’ve found that digging into where a company generates its revenue is a much more practical and transparent yardstick, rather than relying on an index structured around domicile or country.

As a bottom-up investor, I use this approach to broaden the opportunity set of investment choices. It gives me the flexibility to look across a global industry and select the companies that I believe are best positioned for growth, regardless of their location.

From goods to gigabytes

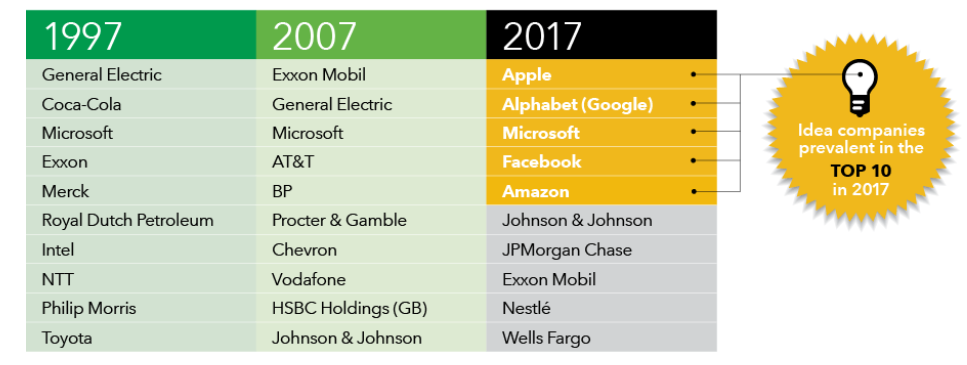

Investors often used to think of multinational companies as powerhouses in commodities or heavy industries, but a host of new global companies is rapidly emerging. If the 20th century was defined by a phenomenal rise in the transfer of goods and industrial commodities, the 21st century is being characterized by the rapid digitization of services and the increasing automation of manufacturing.

The knowledge economy, or digital trade, is gaining momentum, and this is giving rise to a new breed of global giants that are “idea” companies — think Amazon or Alphabet (Google’s parent). These companies are creative, nimble and networked, leveraging technology to their advantage.

Top 10 largest companies in the MSCI ACWI by market cap

Source: MSCI and RIMES. The top 10 companies for 1997 and 2007 are as of December 31 for each year; for 2017, they are as of 8/29/17.

With the internet, there are no real borders, which creates paradigm shifts in the way companies are organized and in how products are consumed. Product adoption can be swift and distribution costs limited — the smartphone or tablet is the delivery mechanism.

It’s no wonder that the composition of the world’s most valuable companies by market value has changed dramatically since 2007, with tech-related firms dominating the index rather than old-line behemoths in the oil, finance and industrials sectors.

Globalization is here to stay

As borders blur, the flexibility to invest in companies anywhere in the world has become important as investors seek to benefit from globalization. The growth of the FTSE Multinationals Index is a reflection of the rise in global commerce since the 1990s. Index members, which must derive more than 30% of their revenue from outside their domestic region, has expanded to 715 from 427 in 1994.

Despite recent protectionist rhetoric, it’s hard to see globalization reversing: It’s embedded in the way many companies do business, supply chains are set up and products are manufactured. Apple is an obvious example: Its supply chain spans 30 countries, and it is a master of using geography to its advantage, sourcing suppliers that can churn out cost-effective parts that adhere to its quality requirements.

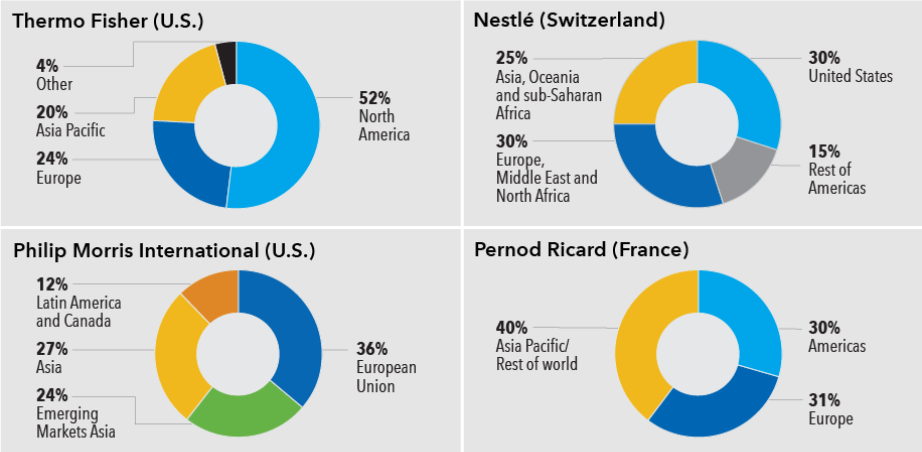

Moreover, many established multinationals like Unilever, Nestlé and Coca-Cola have been moving closer to end-markets over the years. They have decentralized their operations to be much more local to gain a deeper understanding of local markets and compete with a rising number of domestic companies.

Global companies scour the world for customers

Where a company does business can be more important than where it’s located

Sources: Capital Group, company reports. 2016 revenues shown for Thermo Fisher, Nestlé, and Philip Morris International. Fiscal year 2017 revenues shown for Pernod Ricard. Numbers may not add to 100% due to rounding.

Moving forward, we are likely to see global trade patterns evolve with the increasing digitization of commerce and the likelihood of new trade, tariff and tax structures in many parts of the world.

Of course, not all global companies will thrive in this environment. Fundamental research will be key to identifying potential winners.

Having invested in global companies for nearly three decades, I have found that successful multinational companies typically have innovative management teams, diverse sources of revenue and resilient balance sheets. These are the attributes I will be looking for as globalization enters a new era.

The Standard and Poor’s 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2017 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

MSCI has not approved, reviewed or produced this report, makes no express or implied warranties or representations and is not liable whatsoever for any data in the report. You may not redistribute the MSCI data or use it as a basis for other indices or investment products.

The Capital Group companies manage equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

Investing outside the United States involves risks, such as currency fluctuations, periods of illiquidity and price volatility. These risks may be heightened in connection with investments in developing countries.

Use of this website is intended for U.S. residents only.

Jody Jonsson

Jody Jonsson