Chart in Focus

Emerging Markets

When Facebook paid $5.7 billion for a 10% stake in Jio Platforms, the digital technology arm of Indian conglomerate Reliance Industries, it signaled Silicon Valley’s growing enthusiasm for India’s consumer market. Facebook’s main interest in the deal with India’s largest mobile network was to process payments for millions of local retailers via its WhatsApp messaging service, which already has more than 400 million users in India. Google soon followed, with a $4.5 billion investment in Jio. Meanwhile, Walmart spent $16 billion for a majority stake in e-commerce unicorn Flipkart, and Amazon invested around $6.5 billion to become a major player in Indian e-commerce.

These companies are hardly alone. India’s entrepreneurial culture and vast pool of technology talent has given birth to a host of domestic competitors, some with significant private equity funding. Now, as they extend their scale, many are lining up in the initial public offering queue. If successful, these deals could help support the digital ecosystem and diversify India’s equity markets. Among the most active in e-commerce are Flipkart, food delivery services Zomato and Swiggy, online insurer Policybazaar, logistics firm Delhivery, and cosmetics retailer Nykaa.

New public companies are part of the further diversification of India’s equity market away from state-owned enterprises to private-sector banks, technology companies, consumer stocks and energy businesses. Health care is a fast-growing area of the economy, dominated by manufacturers of generic drugs. A significant pool of new foreign portfolio investments is helping drive the market well above the broad emerging markets benchmark.

Indian stocks have outpaced emerging markets

Sources: MSCI, RIMES. As of January 31, 2021.

India could be poised for double-digit growth

The last decade has been challenging for India’s manufacturing, construction and infrastructure sectors as the investment cycle slowed down. That weighed on gross domestic product growth, which reached a decade-low 4.2% in 2019. Consumer demand driven by easy finance, runaway credit growth for an aspirational population, and government spending have been key supports for economic growth. So what are the prospects for India’s market and economy?

In our view, industrial firms’ aggressive cost-cutting during the past few years has laid the foundation for change. Companies have slashed capital expenditures and reduced leverage. The Indian government has implemented needed labor reforms. Meanwhile, bank balance sheets are healthier and interest rates are low. Against this backdrop, Indian manufacturing is probably entering a multiyear growth period with recovery in margins, profits and ROCE (return on capital employed). This should drive the new investment cycle.

At the same time, the COVID-19 vaccine rollout is restoring consumer confidence. India has navigated the pandemic well despite dire forecasts. After what has been dubbed the harshest lockdown in the world, the economy has bounced back more quickly than expected.

In our many conversations with companies, we sense a buoyancy in corporate and entrepreneurial sentiment that has been missing for the past few years. Various sectors of the economy have begun to normalize. Manufacturing activity, export orders and property and vehicle sales have all improved.

The government’s approach also appears to be shifting. Rather than trying to clean up the system, as it has done with significant success over the last six years, it now seems to be targeting growth and wants to work with the private sector to spur the economy. Case in point: India recently unveiled a production-linked incentive program to encourage foreign manufacturers of mobile phones, pharmaceuticals and medical devices to set up shop in the country and for domestic producers to expand. The just-released central government budget for the 2022 fiscal year, with its focus on infrastructure spending and growth, has further buoyed sentiment.

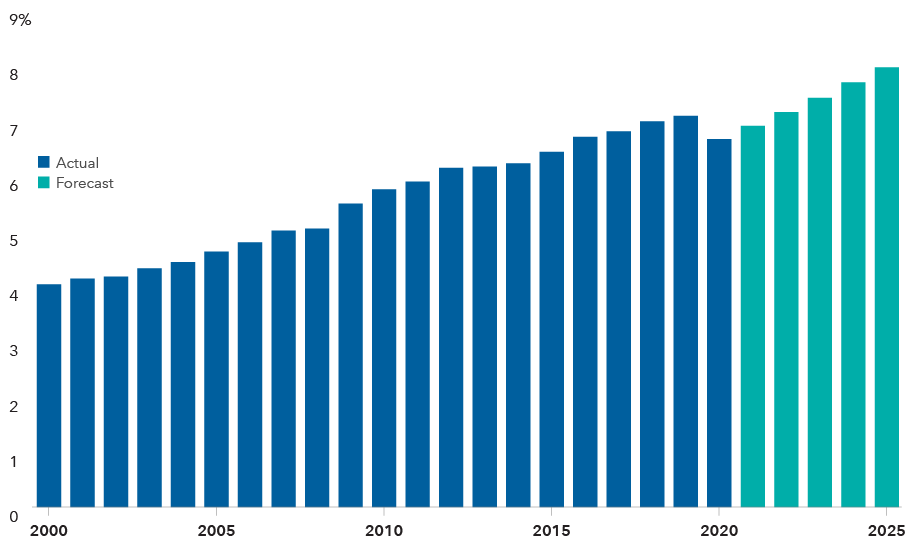

The nascent recovery, coupled with low interest rates, could start a virtuous cycle for the Indian economy. We believe GDP could reach double-digit growth in the 2022 fiscal year and could stabilize in the 6% to 8% range in later years.

A rising economic power

India GDP as % of global GDP

Source: International Monetary Fund, World Economic Outlook Database, October 2020. GDP figures on a purchasing power parity basis. Actual figures as of 2020; forecast through 2025.

Corporate earnings may drive stocks higher

Already, we have started to see a sharp recovery in corporate profits and profit margins in recent quarterly earnings reports. Low interest rates and government support for domestic manufacturing are helping. Global geopolitical developments — including Western countries aiming to diversify manufacturing away from China — will likely boost Indian exports. The conditions are also ripe for residential real estate growth, which should drive demand for materials and create jobs for a lower-skilled segment of the population where job creation has been challenging.

Financial markets in India, as elsewhere in the world, have been strong through the pandemic since the lows of last March, and are certainly not cheap. The MSCI India Investable Market Index (IMI) sports a forward price-to-earnings multiple of 24, compared with 15 for the benchmark MSCI Emerging Markets IMI (as of December 31, 2020). Strong foreign inflows and low interest rates have supported high multiples and rich valuations. The high valuations also reflect depressed earnings. Consequently, it may be earnings upgrades rather than multiple expansion that lead to the next phase of stock price appreciation.

Key areas to watch

Some key sectors will be critical to watch for signs of progress — and investment opportunities — as India’s economy continues to mend.

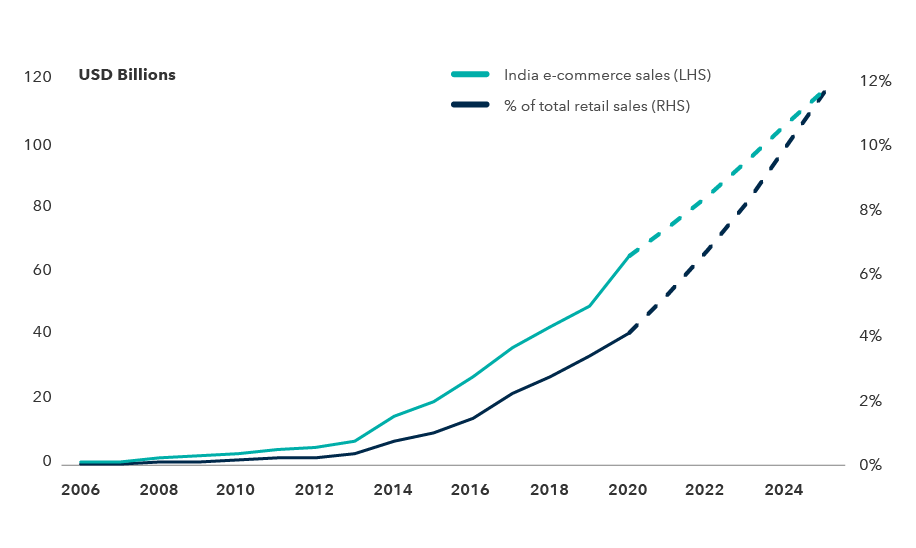

E-commerce: A hotly contested battleground. India’s digital transformation is moving at a brisk pace, pitting domestic technology companies against multinationals looking for a piece of the country’s large and youthful consumer market. Reliance Industries is at the center of the fray. Its Jio mobile service launched in 2016 and recently surpassed 400 million subscribers. Growing from its roots as India’s largest oil and gas company, Reliance has transformed into a domestic technology powerhouse. But rather than go it alone, the company has teamed up with global multinationals looking for a gateway into India. Its broader vision is to connect manufacturers, retailers and consumers on the Jio platform. That’s what drove its strategic partnership with Facebook. Jio is also collaborating with Google to develop a low-priced Android smartphone.

Room to run

E-commerce takes a growing share of Indian retail sales

Source: Euromonitor International. Actual figures as of 2020; forecast through 2025.

India’s banking system: A tale of two worlds. India’s banks have strong growth potential owing to relatively low market penetration and the rapid growth of mobile banking. But there is a sharp split between public and private banks. State-owned banks carry some of the highest ratios of bad loans in the world, a problem that the pandemic is likely to make worse. While a new bankruptcy law forced banks to recognize bad loans more quickly, it will take further reforms to get more credit flowing to stimulate growth and innovation. To that end, the government recently announced plans to create a “bad bank” to manage distressed loans.

In contrast, the larger private banks have been growing profits and gaining market share. They are well-positioned to scoop up some of the country’s weaker lenders.

Residential real estate: Less fragmented. In recent years, new laws have both formalized and legitimized the industry, leaving a few large, organized regional homebuilders including Godrej Properties, Sobha Ltd., and Brigade Enterprises as survivors. A speedy economic recovery in India could drive new demand for homes in urban areas. Besides the homebuilders themselves, opportunities could arise for companies that provide cement, paint, tiles or household appliances.

Consumer market: Dominated by multinationals. India’s consumer market has been dominated by subsidiaries of multinationals such as Hindustan Lever, a unit of Unilever. Pepsi, Nestlé, Mondelez and Coca-Cola are pursuing greater market share through a host of innovative strategies targeted at hypermarkets. This is a high-growth area that will likely see the emergence of new domestic players and the entry of a larger group of multinationals.

Further progress on reforms will be key

To realize its full potential and keep markets humming, India will have to implement deep-seated structural reforms. Since taking power in 2014, Prime Minister Narendra Modi has implemented a series of reforms aimed at modernizing the economy, increasing the ease of doing business, rooting out corruption and raising living standards. His government has seen the pandemic as an opportunity to push long-pending measures affecting agriculture, labor and domestic manufacturing. However, major reforms can be challenging, as we’ve recently seen with widespread protests by farmers over new agricultural laws.

From a portfolio perspective, exposure to Indian equities can come from a range of investment approaches. At Capital, we have invested in Indian equities across a host of strategies ranging from large-cap global and international equities to global small cap and dedicated emerging markets equities portfolios. In our experience, we have found the quality of management of India’s private-sector companies to be on par with the best in the world. Should structural reforms unleash a higher domestic growth rate, many of these companies would be well-positioned to grow both top line and bottom line at a faster pace than many of their global and emerging markets peers. At a market capitalization of about $872 billion, based on the MSCI India IMI as of December 31, 2020, India’s equity market is still relatively small compared with the size of the economy and its potential growth. That could mean an expanding opportunity set in India over the coming years.

MSCI has not approved, reviewed or produced this report, makes no express or implied warranties or representations and is not liable whatsoever for any data in the report. You may not redistribute the MSCI data or use it as a basis for other indices or investment products.

The MSCI Emerging Markets Investable Market Index (IMI) captures large, mid- and small-cap representation across 27 emerging markets (EM) countries.

The MSCI India Investable Market Index (IMI) is designed to measure the performance of the large, mid- and small-cap segments of the Indian market.

Anirudha Dutta

Anirudha Dutta

Brad Freer

Brad Freer