Fixed Income

Global Equities

Fast-growing digital and tech companies generated a lot of investor excitement over the past decade, not to mention an outsized share of market returns.

Since the start of 2022, however, many of these market darlings have taken a beating. Amid slowing economic growth, soaring inflation and the fear of rising interest rates, investors may be taking a second look at the high valuations many digital platform and software stocks command.

“This is one of the most complex environments for investing we have seen in years,” says equity portfolio manager Jonathan Knowles. “With questions lingering over the persistence of inflation and shifts in the geopolitical landscape, I am looking to invest in an ‘all weather portfolio’ with the potential to withstand a variety of potential risks.”

That’s why boring is beautiful according to Knowles. “I'm looking to invest in dull and dependable companies with the potential to generate solid cash flows and continue growing regardless of the direction of the economic cycle or macroeconomic developments.”

Here are some investment themes that cautious investors may want to consider.

Railroads are riding a commodities boom

You can’t build the new economy without old industries.

Long-term shifts toward a digital future, the rollout of electric vehicles and the transition to clean energy will likely continue to drive opportunity for innovators in those areas. But these trends are also providing tailwinds for old industries like mining and railroads.

Nickel, for example, is a key component in electric vehicle batteries. So is copper, which is necessary for updating the electric grid. And while software is becoming an increasingly essential player in the production of modern cars, steel remains a required component. Indeed, prices for select commodities have skyrocketed in recent months, a trend amplified by the war between Russia and Ukraine — major producers of nickel, copper and grains.

“People have underappreciated how much copper is needed to rewire and modernize the electric grid as demand rises,” says equity portfolio manager Andrew Suzman. “Businesses like Canadian metals and mining company First Quantum Minerals, which focuses on copper, and Brazil’s Vale, a producer of iron ore, could benefit.”

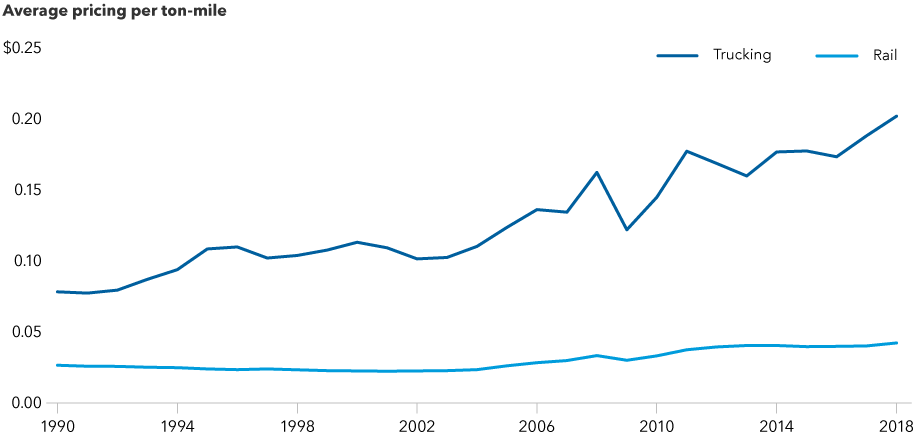

Rising demand for commodities and energy could also boost demand for North America’s railroads, which are the most cost-effective way to transport heavy materials. Railroads have pricing power potential as well, which is important in today’s inflationary environment. They typically base their pricing on the cost of the underlying commodities they are hauling, so revenues rise with commodity prices.

Rising fuel costs also prove beneficial, as the difference between the cost of trucking and rails is at its widest gap in years. “A railroad like Canadian Pacific, which has the only tri-coastal Canada-U.S.-Mexico network, could do well under a variety of economic circumstances,” Suzman adds.

Railroads have room to increase pricing amid a commodities boom

Sources: Capital Group, Association of American Railroads, U.S. Bureau of Transportation. Data shown from January 1990 through December 2018. The rail category refers to Class 1 rail, or carriers earning more than $505 million in annual revenue. Pricing per ton-mile refers to the pricing charged for transporting one ton of freight across one mile.

Industrials help power an energy-efficient future

The global push to reduce carbon emissions and improve energy efficiency is often associated with electric vehicles or utilities harnessing solar and wind power. At first blush, traditional industrial companies making machinery, chemicals and other construction materials might be construed as part of the problem, not the solution.

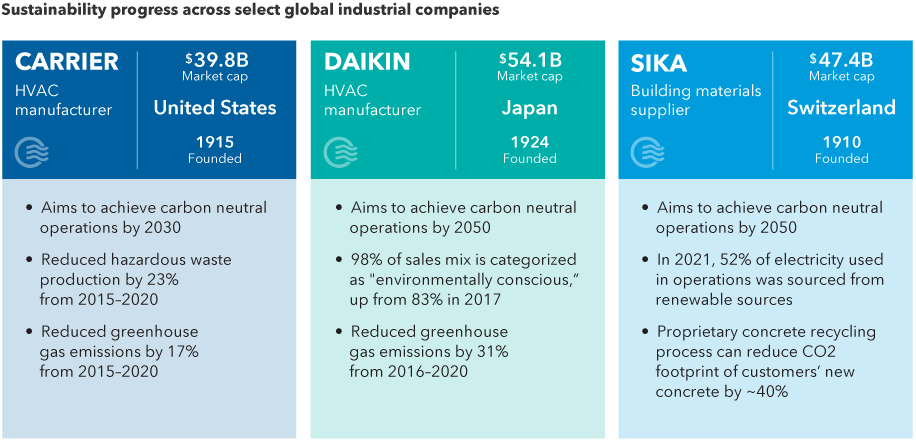

But HVAC companies like Carrier and Daikin are developing air conditioning and heating systems that could help reduce global greenhouse gas emissions. Regulations in Europe and elsewhere that require the replacement of older systems with more energy-efficient products could drive long-term opportunity for both companies.

Tighter carbon emissions regulations and infrastructure spending across major economies could also provide tailwinds for Swiss specialty chemical maker Sika, Knowles says. “The company makes cement additives that can reduce carbon emissions and increase durability,” Knowles says. “This may sound like a boring business, but its growth potential is pretty compelling as global emissions standards tighten.”

Tightening emissions regulations are generating opportunity for select industrials

Sources: Capital Group, company reports, Refinitiv Datastream. Company market capitalizations are in USD as of 3/31/22.

Bargain hunters find “treasure” at dollar stores

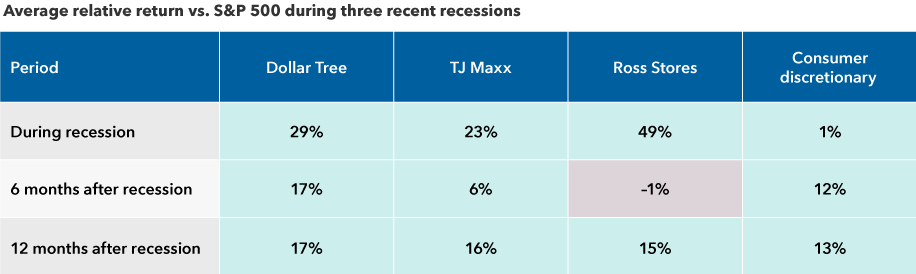

When economic conditions become challenging, consumers may naturally become more careful about spending. Many shoppers shift their spending to discount merchants known as treasure hunt retailers. These stores offer clothing, personal care items and household products at relatively low prices, as well as some higher quality products at bargain prices.

“In a slowing economic environment, many people will be trading down to dollar stores,” says portfolio manager Diana Wagner. “Such stores have held up well in past recessions.”

Treasure hunt retailers have outpaced the market in recessions

Source: Capital Group, National Bureau of Economic Research, Refinitiv Datastream, Standard & Poor’s. Reference periods for recessions are March 2001 to October 2001, December 2007 to May 2009, and February 2020 to March 2020. Consumer discretionary category refers to the S&P 500 Consumer Discretionary Index.

What might be less intuitive is that well-run treasure hunt retailers often have pricing power potential when inflation is rising.

For example, Dollar Tree, which offers a wide variety of items for $1, recently launched their “breaking the buck” strategy. The company initially offered a $5 category of goods, followed by a category for $1.25. “This same approach has helped other treasure hunt retailers generate multiple years of strong same-store sales growth and margin expansion,” Wagner says.

A change in senior management at the company could prove to be another tailwind. “Dollar Tree has been undermanaged relative to its competitor Dollar General,” Wagner observes. “But recently Rick Dreiling, the former CEO of Dollar General, was named chairman of Dollar Tree. I think this could be an important turning point for the company.

“In today’s environment, I look for companies that can improve their businesses and make their own growth happen regardless of what the economy does,” Wagner explains. “Dollar Tree could be one of those self-help stories.”

The bottom line

Investors may be wondering if the digital transformation has run its course. “Not at all,” Knowles says. “Leading digital platform companies, cloud software and autonomous vehicle technology continue to reshape the way we work, live and shop. But many of these companies may have gotten ahead of themselves.”

With inflation rising and the earnings potential for many of these companies still years away, valuations may be extended. “Leading technology companies continue to look promising over the long term,” Knowles says. “But in this environment, I am shifting my focus a bit toward companies that actually make stuff and tend to hold their ground during all types of market weather.”

Investing outside the United States involves risks, such as currency fluctuations, periods of illiquidity and price volatility, as more fully described in the prospectus. These risks may be heightened in connection with investments in developing countries.

S&P 500 Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks.

The S&P 500 Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2022 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part is prohibited without written permission of S&P Dow Jones Indices LLC.

Jonathan Knowles

Jonathan Knowles

Andrew Suzman

Andrew Suzman

Diana Wagner

Diana Wagner