Economic Indicators

U.S. Equities

If you had to name a cutting-edge sector with high growth potential, I doubt that utilities would instantly spring to mind. After all, the sector has historically been known for its relative stability and reliable dividend payers rather than for any inherent dynamism.

But this slow-rolling sector has begun an unprecedented shift — utilities today are behaving more like growth stocks.

After nearly 15 years of relative stagnation, several powerful forces are causing electricity demand to soar: the electrification of vehicles, the reshoring of manufacturing and, perhaps most notably, the construction of massive artificial intelligence (AI) data centers. Data center energy needs are projected to double between 2022 and 2026, with AI facilities expected to comprise a large part of that growth.

To meet that projected demand, utilities will have to spend huge sums to retrofit and upgrade long-outdated grid systems. In the heavily regulated economics of the utility business, capital expenditures can be a profit driver as regulators allow companies to recoup their investments through rate increases over time.

The underlying trends are expected to continue, which I believe will position leading companies for continued growth. As of September 30, the S&P 500 was up 22.08% this year, while the S&P 500 Utilities Index as up 30.63%. Although this confluence of factors has introduced some volatility to a traditionally predictable sector, I believe that U.S. utilities could enjoy a tailwind over the coming decade.

The aging electric grid needs an overhaul.

With segments of the U.S. electric grid dating back to the 1950s and 1960s, upgrades and expansions are underway with more on the horizon. This presents a welcome opportunity for additional profits and revenue streams within the strict regulations that govern how utilities can charge consumers. Costs of upgrades will be passed on to customers, and government incentives and subsidies for energy efficiency, renewable energy adoption and grid modernizations similarly enhance the bottom line.

A big portion of these investments involves renewables. President Joe Biden signed the Inflation Reduction Act in 2021, which earmarked billions of dollars over decades to promote the use of green energy. This will provide crucial support for utilities seeking to transition to such power sources. Certain parts of the law could be changed by a new administration, but I don’t see a future where companies stop investing in renewables.

Wildfires and floods also require fortifying systems. For example, Pacific Gas & Electric and Southern California Edison have had to harden their networks against disasters, in addition to procuring clean energy sources to meet emission standards.

Utilities are powering the AI boom.

It is no secret that AI consumes a great deal of electricity. One query to ChatGPT uses the same amount of energy as keeping a single light bulb lit for 20 minutes, according to the research firm Allen Institute.

Some tech companies are taking their energy needs into their own hands. Amazon purchased a 960-megawatt data center campus from Talen Energy earlier this year for $650 million, with plans to buy power from Talen’s neighboring nuclear power plant. Stocks have soared for companies with exposure to unregulated nuclear energy.

It is likely that regulators will incentivize companies to build new power plants because the increase in data center demand will likely tighten electricity supply across the country. Concerns have already surfaced about potential grid reliability as critical infrastructure is used more often when electricity demand peaks.

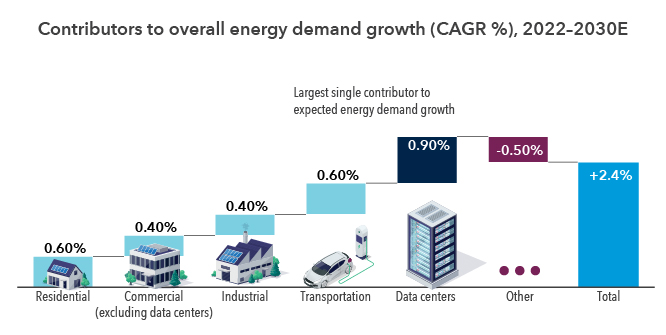

Data centers projected to lead growing energy demand

Sources: Goldman Sachs, U.S. Energy Information Administration (EIA). Estimates from Goldman Sachs as of April 28, 2024. CAGR is the compound annual growth rate. “Other” includes the impact of energy efficiency improvements and the change from categories not listed.

Reshoring has added to the energy demand.

Companies have embraced reshoring, or moving manufacturing back to the United States, to protect against the possibility of geopolitical problems and supply chain disruptions, and there remains a general desire to avoid manufacturing in countries with import tariffs, such as China.

Industries that have large energy requirements, such as semiconductors, pharmaceuticals and automobiles, are part of the reshoring wave. Within semiconductors, Intel plans to roll out a foundry in the U.S. with funds from the so-called CHIPS Act. While energy transition subsidies may slow under a Republican-led government, reshoring resonates with both parties.

Consumer behavior is also driving up electricity use.

Commercial and industrial shifts are projected to account for much of the electricity demand spike, but consumer behavior is having an impact, too. For one, electric vehicle (EV) use is on the rise. Consumers are concerned about climate change, love the newer models and federal incentive programs help make EVs more affordable. One-fifth of new cars sold in California in 2023 were electric, according to California Energy Commission, and officials predict that EVs in the state could account for 10% of power use by 2035 during peak hours.

I am constructive on utilities broadly, but believe we need to be selective. There seems to be a split in the utility sector: those in areas that have strong data center demand and those that do not. Geography is also a differentiator. I am interested in utilities in regions where demand growth is the strongest, such as the southeast arc from Texas to the Carolinas. West Coast utilities are promising with the combination of high EV penetration and low valuations.

Overall, the long-term prospects for the U.S. utilities sector appear favorable for investors. Despite potential policy changes after the November election, demand for electricity is expected to remain strong and the need for infrastructure improvements will not go away. By capitalizing on the growth for demand for electricity and current environmental initiatives, I am optimistic that utilities have the potential to benefit from these conditions in the years to come.

Related Insights

Related Insights

-

-

International Equities

-

International Equities

Andre Meade

Andre Meade