Tax & Estate Planning

International Equities

For pure edge-of-your-seat theatrics, it’s hard to top the U.S. election — rife as it is with political dysfunction and general unpredictability. But the political and economic drama playing out in France makes for a worthy double feature.

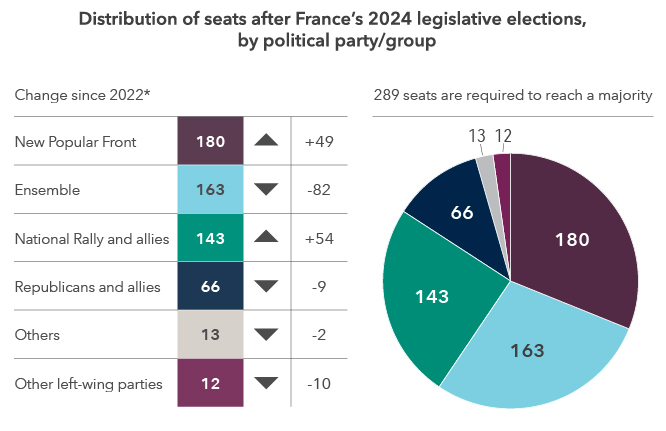

When he called snap parliamentary elections in June, President Emmanuel Macron and his centrist party appeared vulnerable to the once-unlikely prospect of a takeover by Marine Le Pen’s far-right National Rally. Indeed, the hard right sailed to a resounding victory in the first round of voting. But the decisive second round, just weeks later, flipped the script. The left-wing New Popular Front surged unexpectedly, besting Macron’s centrist bloc and pushing the National Rally into third place.

Far from clarifying the outlook, however, the outcome raised more questions. With no party securing a majority, the government is mired in gridlock at an inopportune time. Economic growth remains soft, the budget deficit is well above expectations and Parliament's ability to pass a budget is in doubt. Beyond that, the political convulsions in the eurozone's second-largest economy are casting a shadow over the whole body as Germany, which has long been the continent’s main economic piston, grapples with its own burdens.

No group has a mandate after recent French elections

Source: Capital Group. Positions within the business cycle are forward-looking estimates by Capital Group economists as of December 2023 (2024 bubble) and September 2024 (2025 bubble). The views of individual portfolio managers and analysts may differ.

To be sure, France has important factors going its way. Inflation and unemployment have eased from their peaks and the economy is insulated from some of the more vexing problems bedeviling its European neighbors. Notably, France is much less reliant on imports of natural gas and exports to China than Germany, a big advantage given the volatility of the fossil fuel's price and the Asian giant’s recent stumbles. And though it has no lasting economic significance, successfully hosting the Olympic games in Paris gave the country a collective morale boost.

The biggest unknown is the fate of the structural reforms and industrial policy measures that Macron has championed during his seven years in power. His efforts to make France more business friendly have yielded clear results, including a surge in foreign investment and a flowering of technology start-ups.

Put it all together, and the French economy is at a critical juncture. In the short term, the government must resolve a severe budgetary shortfall that’s forbidding in its own right, a task that looks increasingly more challenging amid divisions in Parliament. Beyond that, France must decide if it’s going to continue on the path of economic reform that may hold the key to long-term success.

Macron has sought to reshape the economy.

Macron swept into the presidency seven years ago as a change agent, pledging to enhance global competitiveness and reverse the perception of France as inhospitable to businesses and investors. He took aim at a host of regulations, slashing corporate taxes, overhauling vocational training and revamping the labor code to make it easier for companies to hire and fire employees.

He encouraged entrepreneurship in an effort to recast France as a destination for startups, particularly in tech. That included the launch of Station F, a colossal tech incubator in central Paris. Initiatives like this helped bring a surge in foreign direct investment as unemployment dropped to its lowest point in 15 years.

However, Macron’s policies sparked fierce resistance among a citizenry shaken by rapid technological change, rising costs and fear of diminished living standards. Powerful unions mobilized public opposition to labor code reforms, resulting in strikes that disrupted economic activity and dampened market sentiment. Despite their dueling priorities, the far left and far right found common ground in opposing Macron’s highly controversial push to raise the retirement age from 62 to 64. Macron ultimately invoked executive power to pass the measure last year after failing to move the bill through Parliament.

The move only added to an image problem for Macron, with the technocratic leader increasingly seen as elitist and out of touch with ordinary citizens. The anxieties of working-class citizens burst into prominence in the “Yellow Vest” protests that erupted in opposition to a proposed gas-tax increase in 2018. Macron later abandoned the plan. Similarly, this year, farmers waged a series of demonstrations over numerous grievances, at one point parking tractors to block traffic in and out of Paris.

The French economy has its strengths.

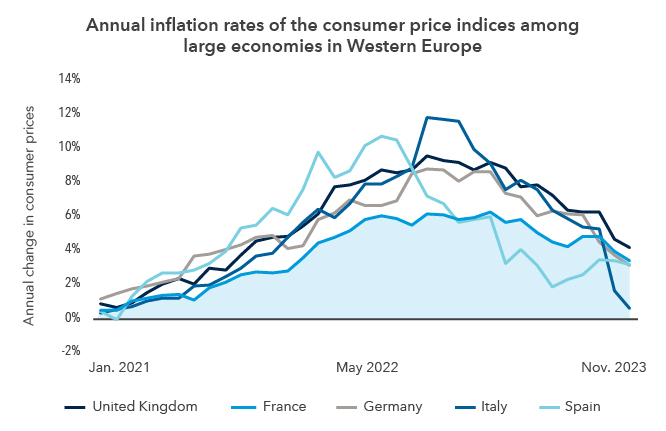

Despite its challenges, the French economy has clear positives. It has high-quality infrastructure and its labor productivity compares favorably to the U.S. and Germany. The country has experienced less inflationary pressure than Germany and the U.K., in part because of interventions that shielded consumers from the full impact of rising energy prices amid the war in Ukraine. Employment has trended upward post-pandemic, thanks partly to earlier Macron reforms that focused on reducing unemployment and fostering job creation.

Additionally, France’s limited exposure to China has become an advantage in the current economic climate. Although certain sectors, such as luxury goods, are significantly affected by Chinese consumer demand, France’s overall exposure remains comparatively low.

The country continues to benefit from its diverse manufacturing industry. Sectors like aerospace, luxury goods, consumer staples and energy are major revenue drivers and remain well-positioned. Efforts to promote reindustrialization have also shown promise with targeted investments and incentives aimed at reviving certain sectors and reducing reliance on imported goods.

Inflation was less pronounced in France

Source: Europe; France; Germany; Italy; Spain; United Kingdom; OECD; January 2010 to November 2023.

France has become more critical to the eurozone's fortunes.

The outlook for France matters more than ever for the 20-nation eurozone as Germany, long the region's economic powerhouse, contends with its own issues. The export-driven country has been particularly affected by the double whammy of the war in Ukraine and the economic downshifting in China.

Historically, Germany relied heavily on cheap Russian gas. But the war in Ukraine caused a sharp spike in energy prices beginning in 2022. Although prices have largely decreased since then, the initial surge badly squeezed households and businesses. France also experienced an energy-induced inflation spike, but the government's capping of retail energy prices helped limit the damage.

German manufacturers have also been stung by their dependence on exports to China, the nation’s biggest trading partner, as the Asian giant undergoes its own economic troubles. Conversely, China is also becoming a greater rival in key industries such as automobiles as the country steps up its manufacturing prowess and export ambitions.

Germany is also facing domestic hurdles from the related issues of an aging population and a shortage of skilled workers. These problems are slowing its productivity and economic growth, compounding other challenges.

The budget deficit is taking center stage.

The most immediate concern is France’s ballooning budget deficit and national debt. Despite Macron’s efforts to stimulate growth through tax cuts and public investment, the budget deficit and public debt have swelled in recent years, exacerbated by pandemic-related subsidies and support to households and companies during the energy shock. While these measures were necessary during the crisis, they left the country with a substantial fiscal hole.

France’s deficit is now around 6% of GDP. Additionally, its debt load now tops 100% of GDP, its highest ratio since World War II; while lower than Japan‘s or Italy‘s, it far exceeds Germany‘s. The fiscal situation prompted Standard & Poor’s to cut France’s sovereign debt rating in May. The European Union issued a rare rebuke in June.

The debt problems have raised concerns about fiscal sustainability. A failure to adequately address the strained public finances could erode confidence among investors, further increasing the cost of borrowing for the French government.

It’s unclear if substantive economic reforms will endure.

Although Macron’s reforms have laid a foundation for growth, there is a risk that the new political regime could unravel his progress.

Michel Barnier, a center-right politician whom Macron named as the new prime minister in September, has been vocal about the need for strong action to redress the government’s fiscal imbalances. He has signaled his intent to impose higher taxes on corporations and the wealthy, which would mark a sharp reversal from Macron’s tax-slashing formula.

By their very nature, economic reform and industrial policy changes are long-gestating measures that can often spark outcry in their early stages. The path forward will require balancing fiscal discipline against political and social requirements. How France navigates this balancing act will determine whether it can emerge from this period of uncertainty stronger and more competitive on the global stage.

Related Insights

Related Insights

-

-

Philanthropy

-

Wealth Planning

Robert Lind

Robert Lind